Gold and Silver - The 'Independent Fed' - Deutschland vs Brasilien

Commodities / Gold and Silver 2014 Jul 09, 2014 - 04:45 PM GMTBy: Jesse

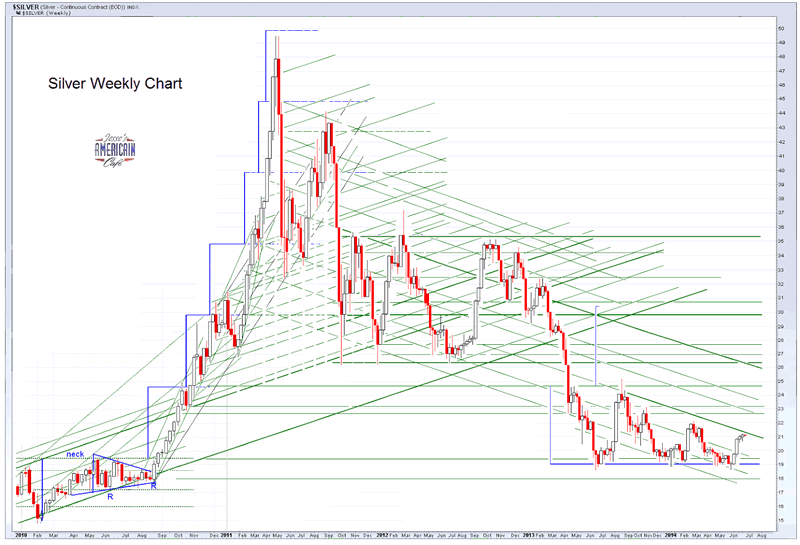

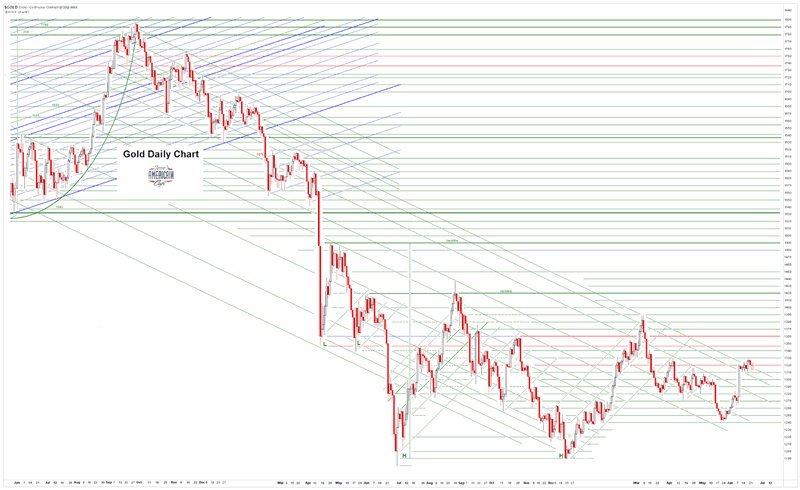

Gold and silver were hit by a trailing stop boogie woogie this morning, a half feeble effort to shake out the long who are running their stop loss orders a bit close. These sorts of things do not bother us because we have an intermediate to longer term investment horizon, right? lol.

Gold and silver were hit by a trailing stop boogie woogie this morning, a half feeble effort to shake out the long who are running their stop loss orders a bit close. These sorts of things do not bother us because we have an intermediate to longer term investment horizon, right? lol.

Otherwise gold and silver finished largely unchanged on the day.

Much more interesting than this lazy Summer trade is the World Cup game in progress, with Germany dominating Brazil, 5-0. The Germans unleashed a four goal torrent in a six minute period of the first half. I thought one of the goals was a replay. Brazil has not allowed five goals in an entire World Cup series since 1998.

Much more interesting than this lazy Summer trade is the World Cup game in progress, with Germany dominating Brazil, 5-0. The Germans unleashed a four goal torrent in a six minute period of the first half. I thought one of the goals was a replay. Brazil has not allowed five goals in an entire World Cup series since 1998.

Well you know what they say, lucky in the World Cup, unlucky in holding on to your gold reserves.

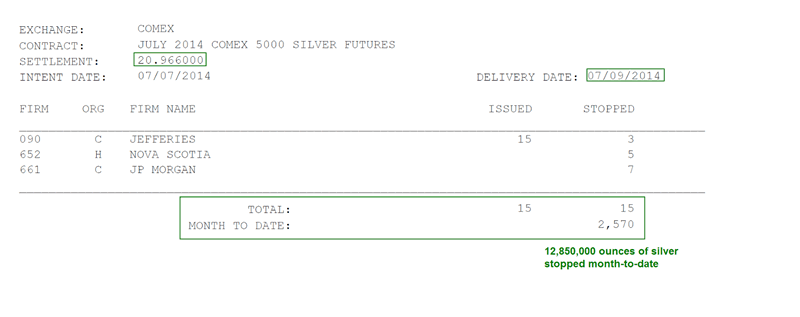

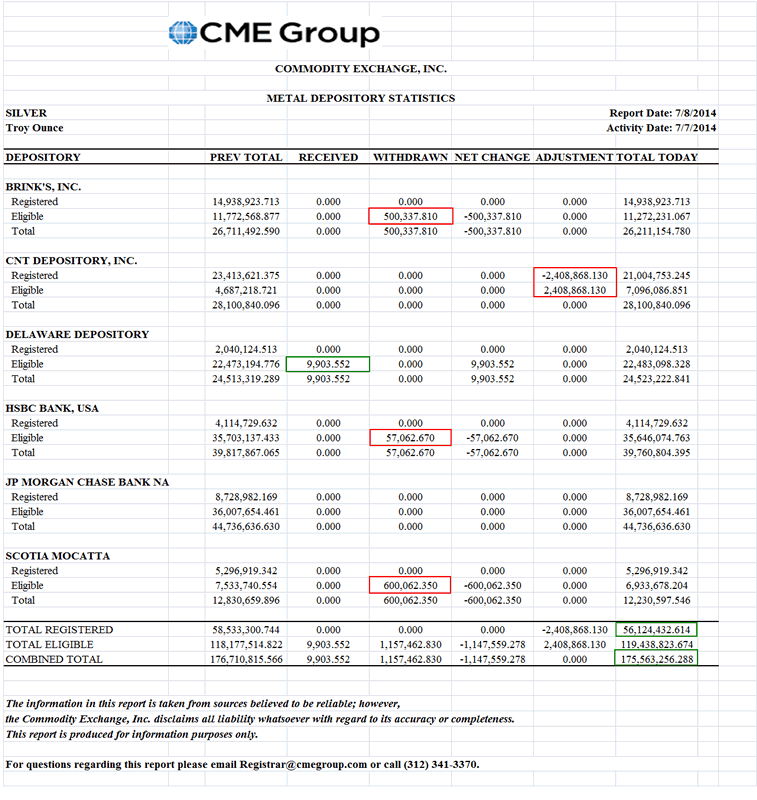

We *might* see some precious metals action in the latter part of July in the metals, based on some things the BRICs may be doing and some derivatives related events, but I am not overly excited about it yet. The Fed has the markets in hand it appears.

In response to a couple of emails I would like to take a minute to remind you all again that the Federal Reserve system is owned by their member banks, who receive a 6% dividend for their shares from the profits that the NY Fed makes on its market operations.

It is not a government entity. It operates under the license of the law passed in 1913. The Fed has not always existed, and the central bank in the US has an interesting and sometimes controversial history.

Although the government has some oversight, which the Fed peddles hard on their own websites, and can take measures if they have the will for it, the Fed is a private institution with a significant amount of its market power concentrated in New York. The Fed has its own level of 'opaqueness and independence.' One can debate whether this is a good thing or a bad thing, or just a thing. But I did want to reiterate that popular misconception.

For now this is the dog days of Summer, and a good time to do work outside, and to spend time with your family if you can.

We had a quick lesson in apartments for rent in Brooklyn, as our number one son will be starting graduate school in the NYC area this Fall. The rents and house prices in the NYC metro area, including Manhattan, Brooklyn, Queens, and the Jersey area around Hoboken and Jersey City, are in a barking mad real estate bubble related to the rebound in the financial sector jobs and profits.

I am hearing of many places being purchased and then left vacant as 'stores of wealth' by overseas investment money. And this is not even as intense as the things I am hearing from friends in London. House prices in the NYC are back to pre-financial collapse levels and beyond in many areas according to Zillow.

Have a pleasant evening.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2014 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.