Domestic and Indian Gold Price Rally Points to a Strong Second Half

Commodities / Gold and Silver 2014 Jul 19, 2014 - 12:43 PM GMTBy: Frank_Holmes

Earlier this week we reported that gold, defying expectations, is one of the best-performing commodities of the year so far.

Earlier this week we reported that gold, defying expectations, is one of the best-performing commodities of the year so far.

And now we've learned that gold bullion imports by India climbed a stunning 65 percent last month after the country's central bank allowed more investors to buy foreign bullion. Imports rose to $3.12 billion in June from $1.89 billion this time last year.

India is the world's second-largest consumer of gold after China, accounting for approximately 25 percent of all gold consumption. Gold is the country's second-largest import item after oil.

India is the world's second-largest consumer of gold after China, accounting for approximately 25 percent of all gold consumption. Gold is the country's second-largest import item after oil.

This news comes closely on the heels of the recent election of Prime Minister Narendra Modi, whose Bharatiya Janata Party (BJP) seeks to loosen import restrictions and other government regulations that tend to stifle economic growth. The rally also coincides with the Indian wedding season, which typically ends on July 7 and 8.

More importantly, what this news could portend is a stronger-than-normal second half of the year for the gold market. Data points going back 35 years confirm the probability of gold gaining strength in the second half, thanks largely to international celebrations such as Diwali, Ramadan and Christmas. This year in particular looks very promising indeed.

Keep your eyes on real interest rates

Recently I chatted with Daniela Cambone during my weekly Gold Game Film program on Kitco. I pointed out that, with the end of the Indian wedding season, we're historically due for a slight correction in the gold market. But whereas last year saw a huge contraction and liquidation of gold around this time, the gold bullion exchange-traded funds (ETFs) around the world this year actually expanded.

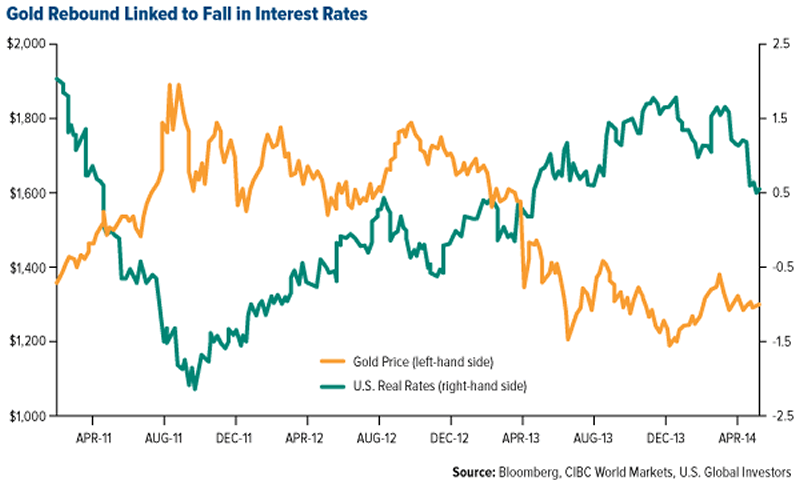

Daniela and I also looked ahead at the gold market in the coming months. One of the points I shared dealt with the strong correlation between gold performance and real interest rates, which you arrive at after subtracting inflation from the nominal interest rate.

If we go back to when gold was at $1,900 [in August 2011], the negative real interest rates were 200 basis points. Then by December of last year, it went to plus 50 basis points. Now it's gone negative again, and gold is rallying. And I think that that's a key factor when we look forward, and I think we're going to continue to have negative real interest rates. So when inflation starts to rise like it did in the '70s, [the Federal Reserve isn't] going to be able to lift rates as fast as the inflationary rate because it will stifle the economy dramatically.

One last point I want to emphasize is our perennial suggestion to investors: 5 percent exposure to gold bullion, 5 to gold stocks, and rebalance each year for an overall 10 percent weighting in your portfolio.

Last year the stock market boomed, whereas bullion disappointed and gold stocks dramatically underperformed. Had investors taken their profits in the stock market and rolled it into gold, they would have done exceptionally well this year.

That continues to be our discipline here at U.S. Global Investors, and the recent gold rally, domestically and in India, substantiates this position.

Want to receive more commentaries like this one? Sign up to receive email updates from Frank Holmes and the rest of the U.S. Global Investors team, follow us on Twitter or like us on Facebook.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.