Gold Investors Shouldn’t Fear Rising Interest Rates: Here’s Why

Commodities / Gold and Silver 2014 Aug 06, 2014 - 07:15 AM GMTBy: Jason_Hamlin

Investors commonly assume that rising interest rates adversely impact the gold price, and vise versa. They believe that a rising interest rate environment is indicative of a strong economy, which is supposed to drive investors out of gold and into the stock market. They further assume that investors will want to exchange their gold, which has no yield, for stocks and bonds, both of which have yields and generate income.

Investors commonly assume that rising interest rates adversely impact the gold price, and vise versa. They believe that a rising interest rate environment is indicative of a strong economy, which is supposed to drive investors out of gold and into the stock market. They further assume that investors will want to exchange their gold, which has no yield, for stocks and bonds, both of which have yields and generate income.

But this intuition is unfounded, at least when tracking the Fed Funds Rate since the Nixon abandoned the gold standard (i.e. after August 15th, 1971). Since then, a rising Fed Funds Rate has usually coincided with rising gold prices, and vise versa.

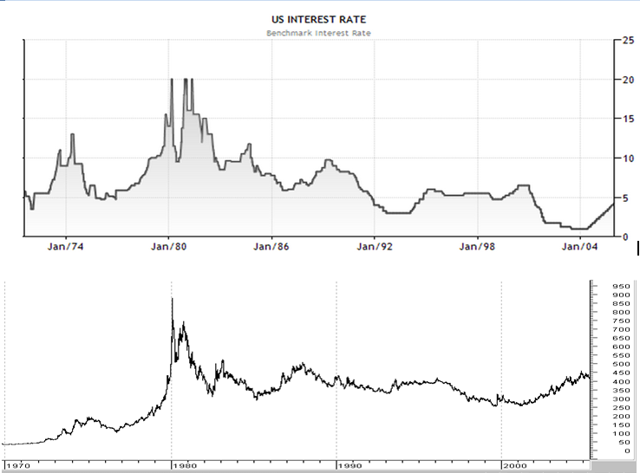

Consider the following data (gold price data is from Kitco, Fed Funds Rate data is from the St. Louis Fed):

- From August 1971 through December 1974 the gold price rose from $35 to $200 per ounce, while the effective Fed Funds Rate rose from 5.5% to 8.5%.

- From January 1975 through August 1976 the gold price dropped to just over $100/oz, while the Fed Funds Rate fell to 5.25%.

- In January of 1980 the gold price peaked at over $800/oz while the Fed Funds Rate rose to 14%.

- The gold price then fell to about $290/oz in late February, 1985, while the Fed Funds Rate fell to 8.6%.

- The pattern breaks here as the gold price rose to $500 in December, 1987 while the Fed Funds Rate continued to fall to 6.8%.

- However the trend continues as the gold price fell to $330 in March, 1993 while the Fed Funds Rate fell to 3%.

- The gold price then rose to $415 in February, 1996 while the Fed Funds Rate rose to 5.2%.

- The gold price then fell until hitting its September, 1999 bear market bottom at $255. This occurred just before the Washington Agreement on Gold was signed, while the Fed Funds Rate remained steady.

While the correlation is far from perfect, we can clearly see from the following charts that the Fed Funds Rate and the gold price move together more often than not and have similar trends over long time periods.

(Source: The Fed Funds Chart comes from TradingEconomics.com and the gold price chart comes from ChartsRUs.com)

What causes this strong correlation?

When the Fed Funds Rate falls this creates a carry trade that allows banks to borrow cheap money from the Fed in order to buy assets with higher yields. It follows that bonds and stocks–or assets that have value insofar as they have a yield–become more attractive by comparison. More generally, when interest rates fall, the yield on interest-bearing assets becomes more attractive. A corollary of this is that assets that do not have any yield (i.e. gold and other commodities) become less attractive from an investment standpoint.

Similarly, when the Fed Funds Rate rises this carry trade dissipates. Banks have to pay more in order to borrow, and so they are less willing to bid up the prices of income generating assets. As money comes out of these assets it finds a home in assets whose value is intrinsic.

So a bank can make money if it borrows money from the Fed at 5% to buy an asset yielding 5.5%. But if the Fed raises the Fed Funds Rate to 6%, that bank suddenly has to sell the asset yielding 5.5% or else it begins to lose money on the trade. Similarly, if the Fed Funds Rate drops to 4%, the bank has incentive to hold the asset even if it rises in value while its yield falls.

Ultimately we can conclude that a high interest rate should indicate to investors that they should sell their gold, but a rising interest rate is a tailwind that will drive the gold price higher. Similarly a low interest rate is an indication that investors should buy gold, whereas a declining interest rate acts as a headwind. It follows that the best time to buy gold is when rates are low, but set to move higher, and the best time to sell gold is when rates are high but set to move lower.

With the Fed Funds Rate at 0.1%, it is evident that gold is positioned to move substantially higher. Low interest rates are forcing investors into stocks and bonds for now as they reach for yield, but this is generating a bubble in paper assets and an “anti-bubble” in gold and other commodities. But interest rates cannot stay low forever. While the Fed’s low interest rate policy is pushing stock and bond prices higher, it is also infusing potential energy into the gold market.

Therefore, it is only a matter of “When?” and not “If?” this trend reverses and gold catapults higher.

By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $35/month by clicking here.

Copyright © 2014 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.