Silver Price Forecast - Metal to Gain Ground in August on These Factors

Commodities / Gold and Silver 2014 Aug 06, 2014 - 12:40 PM GMTBy: Money_Morning

Jim Bach writes: Silver prices may have had an unremarkable July, trading down 3%, but if recent history is any indication, August could help steer prices in the right direction and draw in the bulls.

Jim Bach writes: Silver prices may have had an unremarkable July, trading down 3%, but if recent history is any indication, August could help steer prices in the right direction and draw in the bulls.

silver price forecast

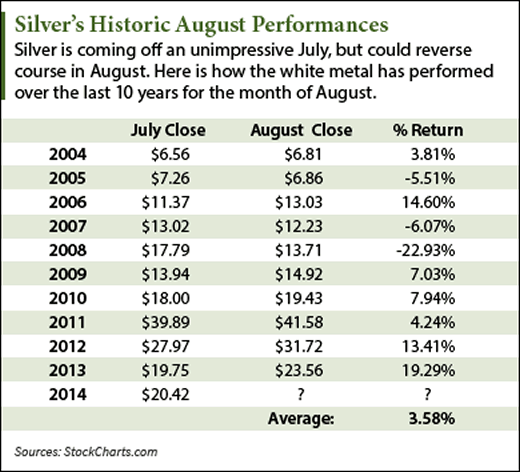

One reason for a rosy silver price forecast for August is that the white metal has finished up every year in this month for the last five years, averaging a return of 10.4%.

In the last 10 years, silver has finished up seven times and averaged a 3.6% month-long return. The last two years have been even better - silver tallied double-digit gains in August, with an astounding 19.3% surge in 2013.

July traded down this month, with silver slipping 3%. In 2010, when silver lost 3.8% in July, it rebounded with a strong August, netting 7.9% returns. Silver is also up about one dollar, or 5% this year, providing for a high ceiling and a lot of upside potential.

"With silver only up slightly year to date, I think odds are good we'll see it gain some ground in August," said Money Morning Resource Specialist Peter Krauth. "We could well see trading pick up this month."

Last year, trading volume increased by 65.1% in August and is most likely going to pick up significantly because July is historically a slow month as the markets settle into the summer doldrums.

Even though silver prices lost a little more than 3% in July, a month where silver has been up an average 4.2% over the last ten years, silver's decline shouldn't come as a big surprise given the peculiar June rally silver experienced and the unusual market factors undergirding June's 14% surge.

Record Speculation Leads to Unheard Of June Gains

This June was something of an outlier.

Over the last 20 years, June had never returned a double-digit percentage increase in silver prices until 2014's 11.9% figure. In fact, on average, the last 20 years have seen 1.4% declines in silver prices on the month. And in June last year, silver plunged 12%.

But the beginning of June 2014 saw speculators betting against silver in numbers that haven't been seen before.

On June 3, data from the U.S. Commodity Futures Trading Commission's Commitments of Traders report showed that non-commercial traders - also known as speculators - had staked out about 49,000 short positions on silver. This was the third record-setting week in a row.

But at the same time, silver was experiencing a punishing bear cycle. After topping out in late February with closing prices above $22, silver plummeted 15% and prices were dipping below $19 an ounce. As traders saw silver bottoming out, they rushed out of their short positions and renewed long purchases, giving silver a sustained lift.

It also helped that U.S. Federal Reserve Chairwoman Janet Yellen, following a Federal Market Open Committee (FOMC) meeting, maintained her stance that interest rates would remain low for a "considerable" period. When interest rates stay low for too long, and stimulative central bank policy continues to flood the economy with money, investors begin fearing inflation and will flock to precious metals as a hedge against the potential of a weakening dollar.

On the day of the Fed meeting, silver prices shot up 4.3%.

Unexpectedly Hot June Sets Path for Slow July

It's no surprise that this unprecedented rally had traders looking to lock in profits at three-month highs, making the 3% decline mostly a function of natural market processes.

"I have to say that I do think this is simply the market's healthy process of profit taking," Krauth said, "In the grand scheme, not a very big deal, as that's less than 5%."

And the sell-off was also felt in funds linked to the price of physical silver.

Over the last 12 months, silver ETFs had added 13.7 million ounces to their total holdings for a 2.2% increase, according to analyst data from Thomson Reuters GFMS. This was a reversal from the first half of 2013, when these ETFs shed 5.2 million ounces for a 0.8% decrease.

But despite silver getting a strong endorsement from ETFs going into 2014, July saw a slight trimming in holdings of about 10,000 ounces. This was after ETFs boosted their physical silver portfolios by about 7 million ounces in the first six months of the year.

For silver to begin to catch steam, Krauth said it's important that it hits $22, which it briefly brushed up against in February before languishing in the three months to follow. That will serve as an important bullish indicator that could attract more investment and lift prices even higher.

The price of silver will need to advance about 8% in August to reach this important benchmark. Last year it gained 19.3% on the month, and in 2012 it shot up 13.4%. Krauth isn't certain that silver will get there just yet.

"I'm not sure silver will be able to break through the critical $22 level in August, but I think odds are good it will do so this fall," Krauth said.

And the momentum built from that could carry prices to the $24 level not long after, Krauth added.

The London Silver Fix is shutting down this month after 117 years, unencumbering the white metal from the artificially low price fixes set by a small coterie of banks. With demand for physical silver hitting all-time highs, and market forces overtaking manipulation, now is the time to jump in on the coming silver bull market...

Money Morning/The Money Map Report

©2014 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.