“Bail In Regime” Sees UK Banking System Downgraded By Moodys

Commodities / Gold and Silver 2014 Aug 07, 2014 - 06:28 PM GMTBy: GoldCore

Today’s AM fix was USD 1,302.00, EUR 973.53 and GBP 772.98 per ounce.

Today’s AM fix was USD 1,302.00, EUR 973.53 and GBP 772.98 per ounce.

Yesterday’s AM fix was USD 1,288.50, EUR 964.27 and GBP 765.23 per ounce.

Gold rose $18.30 or 1.42% yesterday to $1,306.40/oz and silver climbed $0.23 or 1.16% to $20.04/oz.

Gold is marginally lower in London this morning. Trade picked up yesterday but still remains lackluster and futures trading volume was 18% below the average for the past 100 days this morning, Bloomberg data shows. Overnight, gold bullion in Singapore consolidated on yesterday’s gains and remained in a tight range between 1,305/oz and 1,310/oz.

Silver for immediate delivery was marginally lower at $20.09 an ounce this morning. Spot platinum rose to $1,468 an ounce, while palladium added 0.2% to $859 an ounce. It is consolidating near its 13-year nominal high of $889.75 reached on July 17.

Palladium has risen 19% this year due to increased industrial and investment demand and due to concerns about supply from South Africa and especially Russia.

Gold in US Dollars - 2 Years (Thomson Reuters)

European shares are down after most Asian indices were lower overnight. Investors moved into bonds and safe haven gold yesterday, spooked by a Russian troop build-up on the border with Ukraine and tit-for-tat economic sanctions between some western powers and Russia.

The U.S. joined NATO and Poland in warning about the risk of Russia sending troops into Ukraine as President Vladimir Putin banned food imports in retaliation over sanctions.

Gold’s gain of 1.4% yesterday was the most since July 17, as global equities dropped to the lowest level since May. Gold rose due to increasing concern about the impact of Russian counter sanctions on Europe's already fragile economic recovery as data showed that Italy has fallen back into recession.

Russia will ban fruit, vegetable, meat, fish, milk and dairy imports from the United States, the European Union, Australia, Canada and Norway, Prime Minister Dmitry Medvedev told a government meeting on Thursday. The ban is valid from August 7 and will last for one year, Medvedev added.

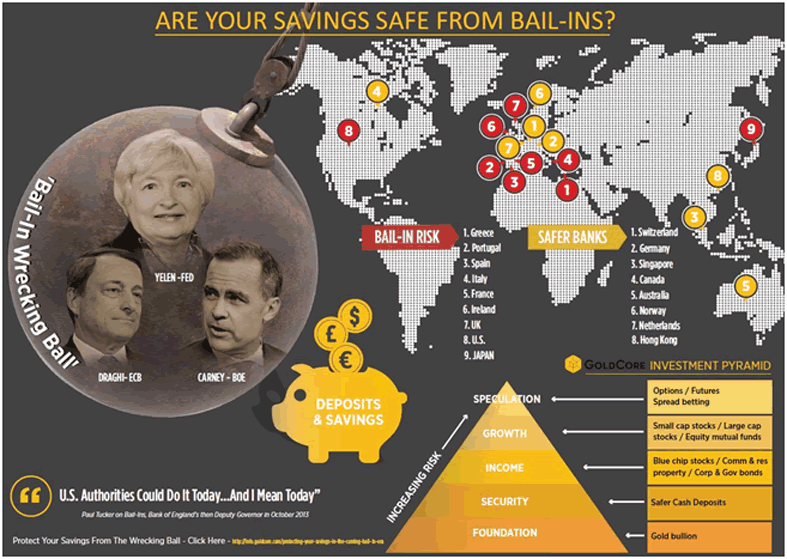

UK Banking System Downgraded To Negative Due To “Bail In Regime”

Bank of England plans to make bondholders and depositors bear the cost of bailing out failing banks has led Moody’s to downgrade its outlook on the UK banking sector.

The rating agency said that it had changed its outlook for the UK financial system from “stable” to “negative”, citing the developing global “bail in regime” of creditor and depositor bail-in.

Depositors in some Cyprus banks saw 50% or more of their life savings confiscated overnight.

Central banks claim that it is an attempt to ensure that taxpayers do not pick up the bill in the event of a bank getting into trouble again. However, it appears to be the case that the stealth global bail-in regimes brought in by the Federal Reserve, Bank of England and ECB are again protecting certain banks at the expense of creditors including depositors and potentially the wider economy.

There is a real risk that individual savers and companies will be forced to bail out profligate banks and have their savings and capital confiscated as happened in Cyprus. There has been little information provided and little debate about the risks and ramifications of bail ins.

In the financial crisis of 2008, UK taxpayers were forced to provide more than £60 billion in direct support to HBOS and Royal Bank of Scotland as they came close to collapse, as well as hundreds of billions of pounds in taxpayer-guaranteed loans and loss insurance.

Under the incoming credit bail-in regime, bondholders would be the first in line, after shareholders, to take any losses - then depositors.

Officials led by Mark Carney, the Bank of England governor, are attempting to bridge sharp differences among leading G20 countries as they prepare a landmark set of proposals aimed at ensuring bail-in legislation is adopted in G20 nations, the Financial Times reported two weeks ago.

Talks under the auspices of the global Financial Stability Board (FSB) over the summer are approaching a key stage as officials aim to clinch an agreement on bail-ins and the bailing in of creditors including depositors of banks.

Japan is one of the countries with problems with bail-in plans amid concerns that they are not easily compatible with the structure of its banking system. Its banks are heavily deposit-funded, and officials are uncomfortable about the idea of bail-ins.

Japanese banks are already vulnerable and bail-ins could hurt consumer sentiment in the already struggling Japanese economy. Concerns in Tokyo are said to be sufficiently profound for it to push its case right up to the summit itself.

China is also sceptical about the notion of private sector bail-ins given its banks are state-owned. “There are some very entrenched positions,” one official told the FT. Russia is likely to oppose the coming bail-in regime as well as many other large creditor nations.

The BOE’s Carney, who also chairs the FSB, said in March he wanted to “break the back” of the issue this year.

Moody’s said the reforms meant that its assumption of government support for UK banks would decline and that, despite improvements in the financial stability and profitability of Britain’s biggest lenders, it had a long-term “negative outlook” for the sector.

Carlos Suarez Duarte, a senior analyst at Moody’s, said that the “key driver of the change in outlook is that the UK government is now able to finalise the secondary legislation to implement the structural reforms relating to the UK resolution and bail-in regime and the related ring-fencing framework.”

Moodys largely ignored, as did much of the media coverage of their report, the real risk that bail-ins pose to people’s life savings and companies capital, the likely negative impact of this on consumer sentiment and employment in already fragile economies.

Depositors and those who have worked hard and been prudent and put capital aside or saved for a rainy day look set to be penalised again.

Bail-ins or deposit confiscation are coming to banks in the western world.

Must read guide to and research on Bail-ins can be read here:

Protecting your Savings In The Coming Bail-In Era

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.