UK House Prices Boom - Top Quick Cheap Tips to Help Sell Your Home

Housing-Market / UK Housing Aug 11, 2014 - 08:48 AM GMTBy: Nadeem_Walayat

Average UK house prices are now rising at the rate of £2,665 per month which exceeds average UK gross earnings of just £2,300 per month as house prices inflation is now being sustained at a rate of more than 10% per annum prompting many home owners to attempt to capitalie on the gains by putting their homes onto the market.

Average UK house prices are now rising at the rate of £2,665 per month which exceeds average UK gross earnings of just £2,300 per month as house prices inflation is now being sustained at a rate of more than 10% per annum prompting many home owners to attempt to capitalie on the gains by putting their homes onto the market.

It is now over 7 months since excerpted analysis and the concluding 5 year trend forecast from the then forthcoming UK Housing Market ebook was published as excerpted below -

UK House Prices Forecast 2014 to 2018 - Conclusion

This forecast is based on the non seasonally adjusted Halifax House prices index that I have been tracking for over 25 years. The current house prices index for November 2013 is 174,671, with the starting point for the house prices forecast being my interim forecast as of July 2013 and its existing trend forecast into Mid 2014 of 187,000. Therefore this house prices forecast seeks to extend the existing forecast from Mid 2014 into the end of 2018 i.e. for 5 full years forward.

My concluding UK house prices forecast is for the Halifax NSA house prices index to target a trend to an average price of £270,600 by the end of 2018 which represents a 55% price rise on the most recent Halifax house prices data £174,671, that will make the the great bear market of 2008-2009 appear as a mere blip on the charts as the following forecast trend trajectory chart illustrates:

Whilst many home owners are seeking to bank the gains to date. However the updated halifax average house prices (NSA) graph to July 2014 at £189,726 which is set against the forecast index level for July 2014 of £188,244 illustrates that house prices over the past 7 months have shown <1% deviation from the forecast trend and therefore the long-term trend forecast remains on track to achieve a 55% rise in average house prices by the end of 2018, so the gains to date for the current bull market are a mere fraction of that which is yet to come.

Many home owners have been busy putting their homes on the market to capitalise on Britain's house prices boom, especially as summer tends to be the most active buyer period of the year. Whilst early August is too late to embark on extensive renovation projects for this year. However, home owners who either already have their homes on the market or are imminently about to market their properties can still significantly boost their homes appeal to prospective buyers by implementing relatively easy to implement and low cost improvements that could literally all be implemented in just one day.

Firstly, the best way to pick up cheap ideas for relatively easy to implement home improvements is by visiting your local DIY store and taking the time to walk around, contemplating how the myriad of products on show could fit in with your individual property beyond the usual painting, decorating and maintenance tasks.

Here follows a short selection of cheap, easy DIY jobs that could help sell your home :

Replace Bland Old White Switches and Sockets

A relatively cheap way to boost your homes wow factor is to replace the usually bland white discoloured switches and sockets with something a little more fancy.

You don't have to to replace all of the switches and sockets across the house, just in key areas such as the Hallway, Lounge and Kitchen should do.

Whilst the procedure should be straightforward i.e. turn the power off at the mains and follow the wiring instructions which usually means replacing like for like wiring. But if you are in any doubt then get some one competent to replace and wire the replacement switches and sockets for you.

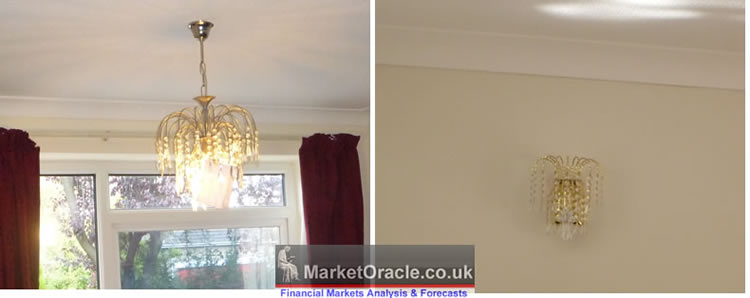

Light Fittings

Wall and ceiling light fittings tend to be ignored and overtime become dated, stained or damaged. However, replacing these is a relatively low cost way to literally brighten up your rooms.

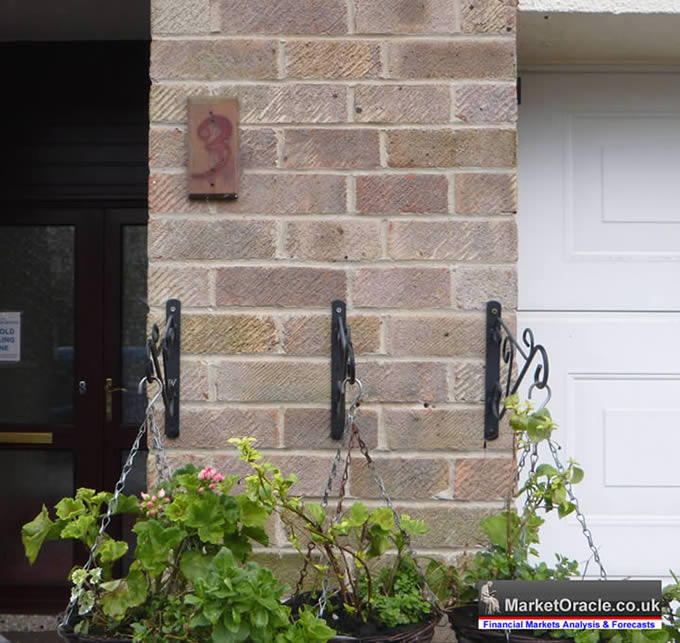

Add or Renovate Neglected Flower Baskets

Depending on the time of year (March to October), relatively cheap flower baskets with hanging wall brackets typically costing less than £10 each can be bought to quickly boost curb appeal to your property.

If you already have flower baskets that have been neglected then all you need to do to spruce them up is to buy a packet of assorted flower seeds that can cost as little as £1.

Then allow time for mother nature to do its work and you should soon see your old flower baskets transformed and start to bloom within a couple of months of sowing (March-Sept).

Solar Lights

You don't need to splash out on £5,000+ on solar installations to benefit from solar power, for even as little as £50 could go some way towards transforming your driveway and / or back gardens at night, which will especially attract night-time drive by viewing's.

The great advantage of solar lighting in terms of costs is that firstly you don't need to incur the expense of having outside wiring and power points installed and then not to incur electricity running costs, leaving just the costs for replacing the rechargeable batteries every 3 years or so.

However, before you dash out to the local discount super market you need to realise that most of the solar lights being sold are basically junk, for they lack the solar cell wattage and battery capacity, nor is the build robust enough to withstand the UK variable weather so unlikely to last more than a few months. In terms of what is a good solar product one needs to take into account the solar panels wattage, number of LED's, and the battery capacity. The basic formula that I use to identify good multi-led solar lighting products is to divide the wattage of the solar panel by the number of LED's and then X100.

Therefore if a solar rope light has a 100 LED bulbs, and a 1 watt panel, then its rating is 1/100*100 = 1. Based on my experience of using more than a dozen different solar lighting products over the years, the minimum solar watt rating per led I would consider buying is 0.75, anything less than this is unlikely to be able to generate enough charge to make it of much use. Unfortunately most of the solar lights on the market rarely mention the wattage of the panels so it is a case of attempting to guess the wattage by counting the number of individual rectangular solar strips in the panel where 10 strips would approximate 1 watt.

Count the solar strips as a rough guide, as it is more likely to be accurate for larger better build solar panels. The next consideration is the battery capacity which should approximate 600 mAh per 50 LED's. However this is of secondary importance as the batteries for most solar lights can be easily replaced with higher capacity rechargeable batteries.

Solar Lighting tips

1. Purchase rope lights instead of string lights as these allow for a far neater installation as the lights are spread evenly within the rope. Where pathways are concerned fix the rope light to the edging with galvanised metal pegs, packs of which can be bought for as little as £1 from the pound shops.

2. Test the lights before installing to ensure that they sufficiently charge to allow a minimum number of hours of light output per day. As a rough guide, I don't tend to install lights that light up for less than 4 hours per day in the low sun light months of October, November, February and March.

3. Use sealant to properly seal all parts of the solar lights against water ingress which will greatly prolong the solar lights life.

4. Once you have identified a reliable product then buy several spare lights so as to easily replace existing lights as they come towards the end of their lives as even the best quality solar lights are unlikely to last more than about 3 years, so keep a stock of replacement lights as as they may no longer be available when it comes time for a replacement.

House Signs and Numbers

Replace tired old or confusing house signs / numbers with a new one that can cost less than £10 which will not only make a better first impression but could also make your home much easier to find for first time visitors.

You can go further than the usual house number, especially if you intend on living in the property for some time by adding a more prominent house number / street name plaque, but do not go over board by personalising it by for instance adding a family name which obviously will not appeal to future prospective home buyers.

Another useful low cost improvement is for a reflective house number at or near the frontage of your property which would not only prove useful for prospective home buyers but also helpful for any new visitors or deliveries at either day or night that will make your property instantly stand out from the rest.

Air Fresheners

Pick up a couple of plug in air fresheners to make your home smell nice, they can be set to run for 3 months before needing a refill.

Though ensure you follow the instructions and don't let them run dry due to risk of over heating that could cause a fire! Probably better to get a couple of battery powered air fresheners instead.

For 15 major home improvements that will add value to your home and 5 to avoid that won't see the UK Housing Market Ebook available for FREE DOWNLOAD (Only requirement is a valid email address).

UK Housing Market Ebook - FREE DOWNLOAD

UK Housing Market Ebook - FREE DOWNLOAD

The housing market ebook of over 300 pages comprises four main parts :

1. U.S. Housing Market Analysis and Trend Forecast 2013-2016 - 27 pages

The US housing market analysis and concluding trend forecast at the start of 2013 acted as a good lead exercise for the subsequent more in-depth analysis of the UK housing market.

2. U.K. Housing Market Analysis and House Prices Forecast 2014-2018 - 107 pages

The second part comprises the bulk of analysis that concludes in several detailed trend forecasts including that for UK house prices from 2014 to 2018 and their implications for the outcome of the next General Election (May 2015) as well as the Scottish Referendum.

3. Housing Market Guides - 138 Pages

Over 1/3rd of the ebook comprises of extensive guides that cover virtually every aspect of the process of buying, selling and owning properties, including many value increasing home improvements continuing on in how to save on running and repair costs with timely maintenance tasks and even guides on which value losing home improvements should be avoided.

- What Can You Afford to Buy?

- Home Buyers Guide

- Home Sellers Guide

- Top 15 Value Increasing Home Improvements

- Home Improvements to Avoid

- Home Winter Weather Proofing 22 Point Survey

These guides will further be supplemented from Mid 2014 onwards by a series of online videos and regularly updated calculators such as the Home Buying Profit and Loss Calculator, which will seek to give calculations on whether to buy or rent based on personal individual circumstances, that will be updated to include the latest expected trend trajectories for future house price inflation i.e. you will have your own personal house price forecast.

4. Historic Analysis 2007 to 2012 - 40 pages

A selection of 10 historic articles of analysis to illustrate the process of analysis during key stages of the housing markets trend from the euphoric bubble high, to a state of denial as house prices entered a literal free fall, to the depths of depression and then emergence of the embryonic bull market during 2012 that gave birth to the bull market proper of 2013.

FREE DOWNLOAD (Only requirement is a valid email address)

Source and Comments: http://www.marketoracle.co.uk/Article46839.html

By Nadeem Walayat

Copyright © 2005-2014 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.