Palladium Reaches 13-Year High Over $900 oz as Gold Trading Volumes Surge 66%

Commodities / Palladium Aug 18, 2014 - 05:48 PM GMTBy: GoldCore

Today’s AM fix was USD 1,302.75, EUR 972.93and GBP 778.51 per ounce.

Today’s AM fix was USD 1,302.75, EUR 972.93and GBP 778.51 per ounce.

Friday’s AM fix was was USD 1,313.60, EUR 981.69 and GBP 786.78 per ounce.

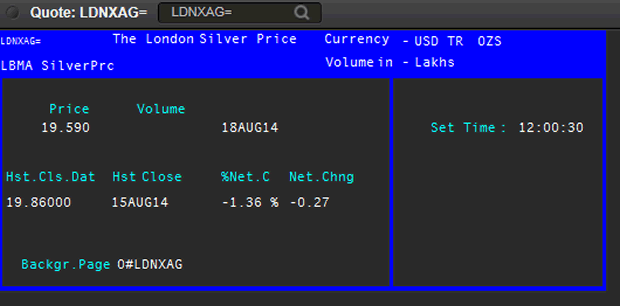

Today’s LBMA silver price was USD 19.59 per ounce.

Friday’s LBMA silver price was USD 19.86 per ounce.

LBMA Silver Price Today

For the week, gold fell 0.4% to $1,304.10/oz, while silver fell 1.75% to $19.62/oz.

Platinum fell 1.4% last week, while palladium singularly outperformed, surging 3.8%, its best weekly performance since early March. It's showing another 0.9% gain this morning, while platinum is down 0.3%

Palladium in US Dollars - 5 Years (Thomson Reuters)

Gold is marginally lower in London this morning after gold in Singapore fell to a low of $1,297.30/oz overnight before eking out small gains. Gold futures trading volume was 66% above the average for the past 100 days in London this morning as traders, hedge funds and banks begin to return from their summer vacation.

Silver for immediate delivery was flat at $19.63 an ounce. Spot platinum fell 0.2% to $1,458 an ounce, while palladium moved another 0.6% higher to $904 an ounce - new multi year nominal highs.

Palladium climbed to a 13 year nominal high in the longest run of gains in more than a month on concern supply will lag demand and add to shortages. Palladium is up for a ninth day in the longest run since July 9, reached $904, the highest since February 2001.

Palladium, mostly used in catalytic converters in cars alongside platinum and in jewellery, has advanced 25% so far this year on concerns about Russian supplies and as supply was cut by a mine strike that ended in June in South Africa, the second-biggest producer. Tension over Ukraine led to the U.S. and European Union slapping sanctions on Russia, the top supplier.

There have been no sanctions on palladium, which is heading for a third annual supply shortfall. Indeed, there is a risk that sanctions could lead Putin to use palladium as he has done in natural gas and secure higher prices for Russian exports.

Russia’s Foreign Minister Sergei Lavrov said talks on the conflict in Ukraine haven’t produced a resolution, with the only progress made being on the passage of humanitarian aid. He expects truckloads of Russian aid for the Luhansk region to be delivered soon.

Geopolitical risk remains high both in Ukraine and in Iraq. Escalating tensions between Russia and Ukraine are on the verge of spilling over into open conflict. Ukraine has accused Moscow of pushing more military equipment over the border including three missile systems.

Rebel separatists yesterday shot down a Ukrainian Mig-29 fighter jet, although the pilot managed to eject safely.

Moscow continues to deny sending military equipment or personnel into Ukrainian territory, but large convoys have been seen massing on the Russian side of the border.

Meanwhile some 16 lorries from a 280-strong Russian convoy carrying humanitarian aid for eastern Ukraine arrived at a rebel held border crossing yesterday. Kiev insists any aid should cross a government-controlled part of the border.

The U.S. widened its air campaign against Sunni separatists in Iraq, sending bombers for the first time in support of a Kurdish ground offensive to retake the Mosul Dam and promising to keep up strikes until the strategic post is out of the hands of Islamic State fighters.

Kurdish peshmerga fighters and Iraqi counter-terrorism forces have pushed Islamic State militants out of Mosul dam, state television reported on today. The television station quoted Lieutenant-General Qasim Atta, a military spokesman, as saying the forces were backed by a joint air patrol. He did not give details. An independent verification was not immediately possible.

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.