The Fed Will Raise U.S. Interest Rates in March 2015

Interest-Rates / US Interest Rates Aug 25, 2014 - 03:02 AM GMTBy: EconMatters

March or June?

March or June?

The big question for financial markets is whether the Fed will raise rates in March or June, it used to be Whether it would be June or September of 2015, and I think as the data gets better in the second half of the year, and QE ends in October, the timeline could be moved up even further, say January of 2015 for the first rate hike.

Read More >>> The Fed Needs to Raise Rates Now!

Data Dependent creates box for the Fed

For example, what happens to expectations if besides the consistent 200k plus employment reports each month we get a 350k number? What kind of pressure will this put on the Fed to move on rates, especially sense QE has ended in October? I think there is a distinct possibility over the next five months that we have a 350k plus employment report, and the Fed line about changing data and data dependent comes into play. In this case they set the bar for moving sooner or later, and the bar would be surpassed with a 350k employment report.

5.9% or 350k – which comes first?

Also what happens if the unemployment rate drops to 5.9% over the next 4 months, this key psychological rate number being below 6% is real close to approximating full employment by historical standards, and they are still sitting at zero percent in the fed funds rate? The questions and pressure just from their academic peers in the economics community for not addressing this change in data would be immense to say the least from a credibility standpoint.

I would estimate that there is a 40% chance that one of these two data measures in an outsized employment number of 350k plus, and/or a 5.9% reading on the headline unemployment rate comes to fruition that puts considerable pressure of the Fed to move up the first rate hike, or they have some serious explaining to do.

QE Ends in October

Things are going to be completely different when QE ends in October, they can no longer pacify markets with this kind of ‘tightening’ and financial markets are going to start re-pricing all on their own, in a sense telling the Fed where they will be going. This is what markets do, as investors try to front run Central Bank actions. And given how many participants have to switch directions, rates are going to start moving up in the second half of the year on any good economic data in the form of robust GDP reports, 250k plus employmentreports, and a drop in the headline unemployment rate.

Housing & Retail Sales

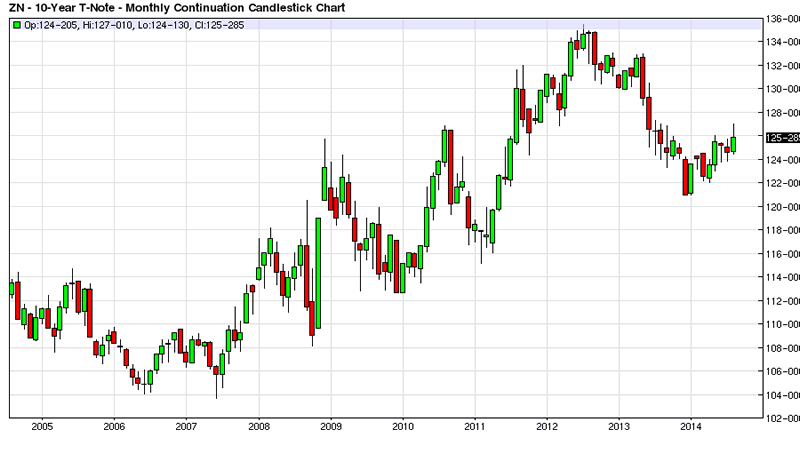

The second quarter earnings were better than expected, and if housing and retail sales start helping even a little bit, the bond market is going to start pricing in rate rises on the long end of the curve, which is where all the yield chasers have been hiding out. And once some key technical levels are breached to the upside regarding yields, the amount of stop hits and closing of positions is going to add further fuel to the rising yield momentum in the bond market as this is an extremely crowded trade, and they haven`t began to lose money off of very low yield levels. Once bond managers start to lose money in their portfolios as technical levels of resistance fail, selling begets more selling in these bond funds, and a 3% 10-year yield is here sooner than many complacent investors realize.

20140824101850.png)

Re-pricing of Bond Markets

Therefore, watch for above trend economic data that comes out over the next four months; this is the key driver for forcing the Fed`s hand on ‘data dependent’ rate hikes. And if the economic data continues to move in the direction that it is currently moving I expect the Fed to raise rates by March of 2015, and this date isn`t currently priced into the bond market.

Yield becomes a Four Letter Word

The future fund flows out of the bond market, especially at the long end of the curve over the next four months as the economic data comes in hotter each month, given the size of portfolio reallocation, is going to be staggering to watch as the realization that the Fed has to move on rates by March, and not June of 2015. Savvy investors can piggy back on this market dislocation when ‘Yield’ becomes a euphemism for ‘Sell’, as anything even remotely resembling a yield play will be sold with a vengeance over the next four to six months as the rate hike cycle begins in the United States.

Read More >>> Bond Kings to be Dethroned in Second Half of the Year

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2014 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.