Stock Markets 2008- Sell in May and Go Away?

Stock-Markets / US Stock Markets May 16, 2008 - 01:13 AM GMTBy: Hans_Wagner

Investors who want to beat the market need to be aware of the key trends that will affect their portfolios. To some this year looks like a classic “Sell in May and Go Away.” The theory is the market goes into hibernation for six months from May to November, and during the other six months it gets back into gear and makes its move up. The chart below, from Chart of the Day , shows the history of this phenomenon. Moreover, according to Standard & Poor's the November to April period outperformed the May to October period 69% of the time.

Investors who want to beat the market need to be aware of the key trends that will affect their portfolios. To some this year looks like a classic “Sell in May and Go Away.” The theory is the market goes into hibernation for six months from May to November, and during the other six months it gets back into gear and makes its move up. The chart below, from Chart of the Day , shows the history of this phenomenon. Moreover, according to Standard & Poor's the November to April period outperformed the May to October period 69% of the time.

Why Does this Happen?

The reasons for this happening are varied. Some theorize the larger traders take time off for their summer vacations. Another theory is based on when more cash moves into the markets. Pension funds tend to invest larger amounts in January, while individuals add money to their IRAs in April. Those who receive bonuses also invest their money in January.

The market analysts, who typically are to optimistic, might have an influence on this result. The theory is that analysts typically lower their full-year earnings estimates before the third quarter results are announced. September is the worse performing month and the third quarter is typically the worse performing quarter. So they tend to influence the market to the down side after they have provided their rosier forecasts. Then starting in November these same analysts start to make their earnings predictions for the New Year, causing investors to buy based on their optimism.

In addition, most mutual funds their fiscal year ends at the end of October. Often the managers of these funds will sell their losers before the end of October so they do not have to show their investors in the annual reports they submit that they do hold loosing stocks.

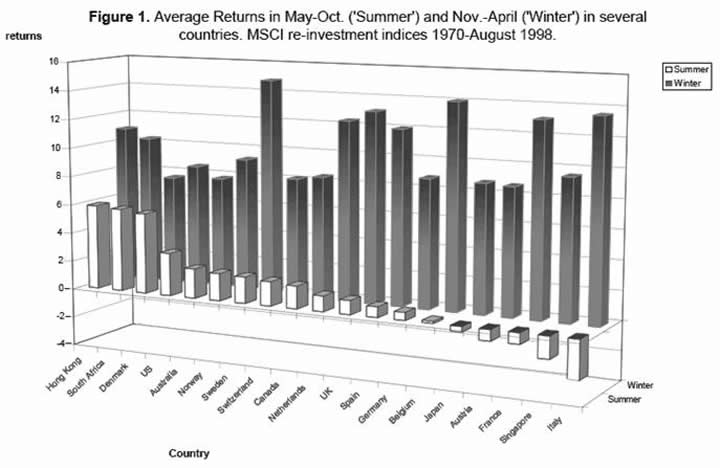

According to a study titled “The Halloween Indicator, “Sell in May and go Away': another Puzzle, by Ben Jacobsen and Sven Bouman , this seasonal effect is even more pronounced in Europe. They also found it to be true in 36 of the 37 developed and emerging markets they studies. In the UK they went back to 1694.

On the other hand Mark Riepe of Schwab Center for Investment Research notes in the Journal of Financial Planning , July 2003 that this does not hold true when one goes all the way back to 1926. It seems that the “Sell in May . . .” strategy did not perform as well as remaining fully invested until 1987. The influence of the 22 percent drop in the S&P 500 on Black Monday, October 19, 1987 should not be forgotten. Nor should investors forget the 17 percent drop from June through October 2001 and another 23 percent over the same months in 2002. These significant events influence statistical analysis of the “Sell in May . . .” theory.

It seems that this is a more recent occurrence (since 1950) in the United States that is greatly influenced by the significant drops in the markets in that third quarter of several years.

Finally, we need to remember that the market is driven by perception. If investors perceive that the “Sell in May” idea works then it is likely to be somewhat real. As a result, we need to be prepared to adapt to what the market gives us, keeping in mind that this phenomenon has some influence over the market.

What to Consider for 2008

There are several fundamental factors that will influence the markets in 2008, including:

• The Presidential elections in the United States;

• The recession in the United States;

• The 2008 Summer Olympics in China;

• The $160 billion tax rebate that is being delivered to many Americans in May; and

• The strength of the global economy.

Since the United States is in a recession, I expect many traders and investors will be looking to react quickly to any further signs of market weaknesses. I also believe we are likely to see much more volatility in the months ahead, which should present some good buying opportunities for some quicker trades.

This will compel investors and traders to pay close attention, as they will not want to be caught on the wrong side of a trade. This means stock picking will be very important. In addition, it makes sense to protect long positions using stops and covered call and put options.

One of the drivers of growth for corporations is the continued growth in major emerging economies such as China and India. I am looking for companies that have a substantial portion of their earnings coming from international operations to experience higher growth than those that are primarily looking to earnings growth within the United States. We are experiencing the impact of the global economy and I believe it will change our markets.

The Bottom Line

So should we sell in May and go away? I do not think so. We should continue to see good opportunities and I expect the market to remain volatile as investors continue to worry what will happen next. In addition, the global economy continues to grow and China will keep on spending at least up until the 2008 Olympics. They want to show the world they are a first rate nation. As a result, this will be a stock pickers market through the summer and into the fall. However, we need to remain wary as the higher volatility should cause sudden drops, representing buying opportunities, once they are over.

These two books also offer further insight into picking quality stocks and using options to enhance your returns.

Active Value Investing: Making Money in Range-Bound Markets (Wiley Finance) by Vitaliy Katsenelson.

Options Made Easy: Your Guide to Profitable Trading (2nd Edition) by Guy Cohen is an easier read to help investors understand options.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

Hans Wagner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.