Gold Bugs Shifting Sentiment

Commodities / Gold and Silver 2014 Sep 10, 2014 - 03:52 PM GMTBy: Gary_Tanashian

Warning… Condescension ensues… NFTRH 307’s opening segment, dated 9.7.14:

Warning… Condescension ensues… NFTRH 307’s opening segment, dated 9.7.14:

From a post on the HUI at the site last week:

“There are worse things that could happen than filling a gap and scattering the wrong kind of gold bugs back out. Then it would be up to the longer-term charts to do the heavy lifting if the daily does fulfill this downside potential.”

The gap was filled, the top end of the anticipated support zone was reached and indeed, the wrong [i.e. momentum players] kind of gold bugs are scattering back out. The hard sell down on Thursday was very likely due in large part to the selling by traders with a fetish about gold as a geopolitical or terror hedge.

We should continue to tune out these people and while we are at it, tune out the ‘Indian wedding season’ and ‘China demand’ pumpers in favor of real fundamentals like gold’s relationship to commodities and the stock market, the Banking sector’s relationship to the broad market, Junk Bond to Quality credit spreads and US Treasury bond yield relationships.

It’s boring stuff compared to all that demand in China, Modi’s pro-gold regime in India and of course how we are all going to go down the drain amidst war, terror and an age of global conflict unless we have a ‘crisis hedge’. The only terror gold investors should care about is that perpetrated upon paper/digital currencies by global policy makers.

So last week was good in that it blew out those who were hanging on through the 2 month long grind that did indeed turn out to be short-term topping patterns. I don’t mind telling you that my patience was tested by the bullish spirits, especially on up days with Ukraine in the headlines. I did not think it would take 2 months to resolve, but every time the sector looked like it would crack, a new geopolitical flashpoint would show up in the mainstream financial media.

That condition is now being closed out. Taking its place could be a bottom of at least short-term significance (i.e. to a bounce). We have a fundamental backdrop that is not fully formed and a big picture technical backdrop that has degraded in gold and silver and is not proven in the equities. So whether we bounce only, go bullish for an extended rally or even bull market, or (and it’s still on the table folks) fail into the ‘final plunge’ scenario, we are dealing in potentials, not confirmed trends.

Moving on let’s check sector sentiment.

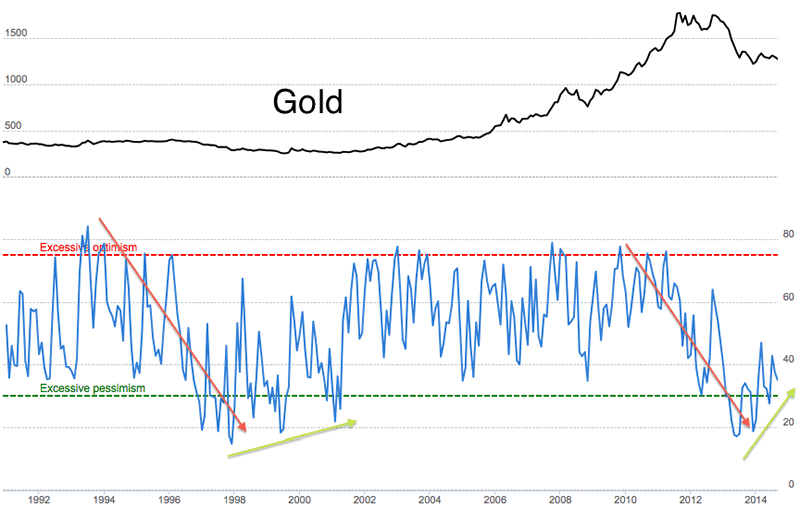

The current hook down in gold’s Optix (Sentimentrader.com’s aggregated Public Opinion data) is correcting recent surges in optimism. This is coming amidst a small positive trend. ‘Uh oh, dumb money is getting positive!’ think contrarians anxiously. But the historical view shows that the Optix rises in the initial stages of a bull market.

So I am not calling a new bull market here, but I am calling a condition to one, which is a positive trend (subject to ongoing corrections like the current one) out of deeply depressed levels by the Gold Optix.

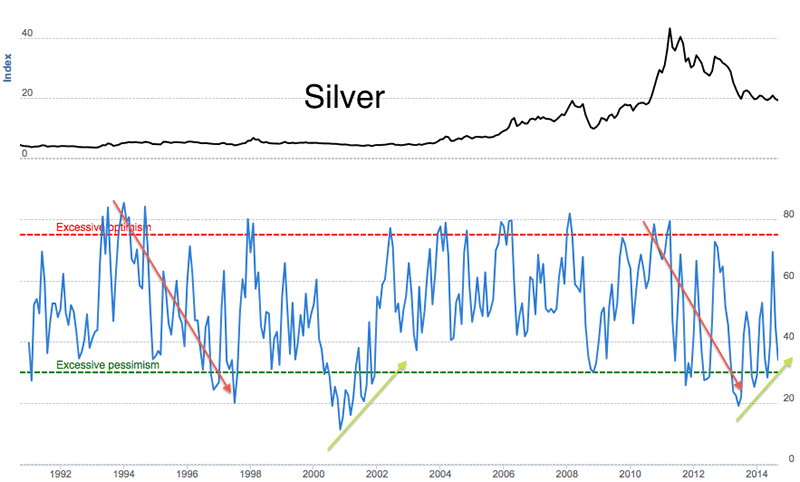

Silver is even better, as it became way over loved, conveniently right at the time we noted severely over bought technicals in nominal silver and in its relationship to gold. If we were to go strictly by this graph (which we of course will not) it looks like silver is ready to bottom and turn up.

A view of how unhealthy silver’s sentiment backdrop became recently comes from the most recent spike in the Optix to near the red line, while the price of silver barely went anywhere. Again, we cannot make foolproof claims about what lay ahead but what we can claim is that a bearish condition is gone, replaced by a more bullish one.

The bottom line is that while gold’s technical situation was compromised last week and silver is testing major support one more time (4th) than I personally find agreeable, the sentiment backdrop has become more favorable. Not shown above are the Commitments of Traders data, which improved again last week, but have room to improve further.

This segment will probably be released as a public article to maybe try and convert one or two more people away from the stuff talking about weddings and war and corresponding sentiment traps that people in this sector all too often fall into from a bullish perspective.

Gold is getting drubbed in ratio to the US stock market and in the face of a strong US economy. Those are facts and also fundamental considerations. In seeking a macro pivot phase, we are looking ahead to a potential time of change, but easy connect-the-dots analysis is not going to bring such a phase on, no matter how often the wrong kind of gold bugs click the heels of their ruby slippers.

We’ll clip it here and move on to the nuts and bolts technical and fundamental analysis.

[end excerpt, new material follows]

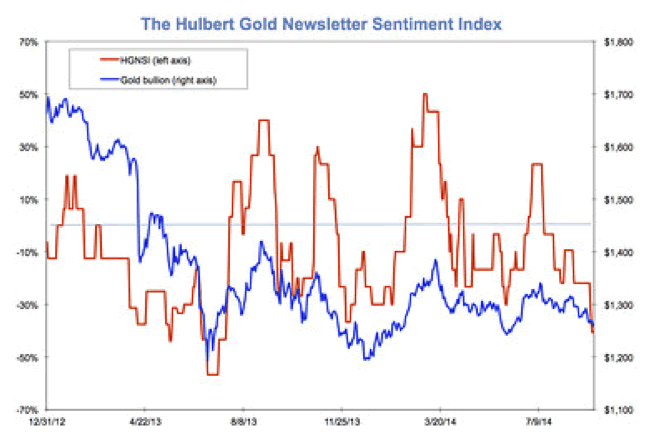

Mark Hulbert: Gold may be a buy as investors turn ever more bearish

Okay, Hulbert’s HGNSI is on board the contrary theme as well. That only reinforces matters. Gold trend followers are now hyper bearish, which is good because this is one sector you buy when it is reviled, not cheered for.

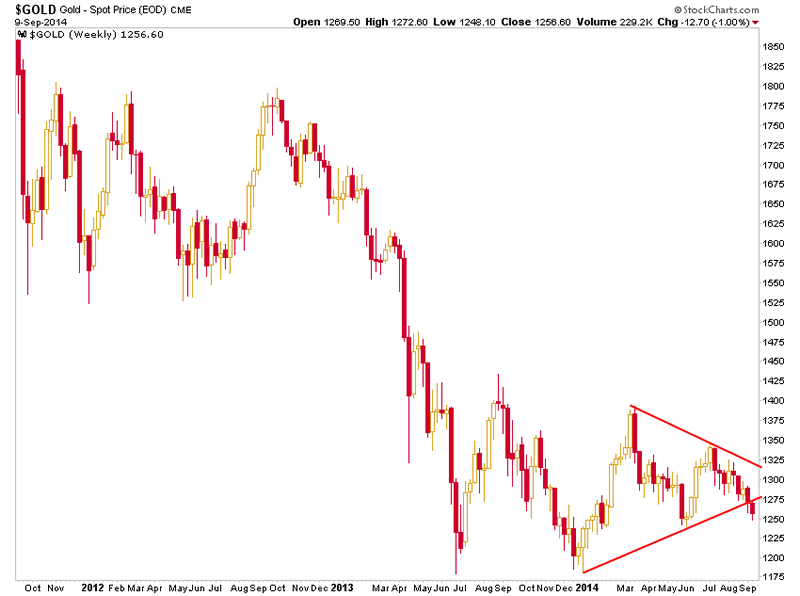

But let’s also keep in mind the reason why said trend followers lurched bearish; a very real technical breakdown per this overly simplified chart of a Symmetrical Triangle breakdown. That’s what’s got everyone freaked out. Support at 1250 must hold and gold needs to reverse back above 1275 and then we could have a view of a bear trap getting sprung amidst over done negative sentiment.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart/trade ideas!

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.