Emerging Markets Are Set Up for a Crisis, What’s on Your Radar Screen?

Economics / Emerging Markets Sep 16, 2014 - 03:52 PM GMTBy: John_Mauldin

Toward the end of every week I begin to ponder what I should write about in the next Thoughts from the Frontline. Much of my week is spent in front of my iPad or computer, consuming as much generally random information as time and the ebb and flow of life will allow. I cannot remember a time in my life after I realized you could read and learn new things that that particular addiction has not been my constant companion.

Toward the end of every week I begin to ponder what I should write about in the next Thoughts from the Frontline. Much of my week is spent in front of my iPad or computer, consuming as much generally random information as time and the ebb and flow of life will allow. I cannot remember a time in my life after I realized you could read and learn new things that that particular addiction has not been my constant companion.

As I sit down to write each week, I generally turn to the events and themes that most impressed me that week. Reading from a wide variety of sources, I sometimes see patterns that I feel are worthy to call to your attention. I’ve come to see my role in your life as a filter, a connoisseur of ideas and information. I don’t sit down to write with the thought that I need to be particularly brilliant or insightful (which is almighty difficult even for brilliant and insightful people) but that I need to find brilliant and insightful, and hopefully useful, ideas among the hundreds of sources that surface each week. And if I can bring to your attention a pattern, an idea, or thought stream that that helps your investment process, then I’ve done my job.

Sometimes I feel like an air traffic controller at “rush hour” at a major international airport. My radar screen is just so full of blinking lights that it is hard to choose what to focus on. We each have our own personal radar screen, focused on things that could make a difference in our lives. The concerns of a real estate investor in California are different from those of a hedge fund trader in London. If you’re an entrepreneur, you’re focused on things that can grow your business; if you are a doctor, you need to keep up with the latest research that will heal your patients; and if you’re a money manager, you need to keep a step ahead of current trends. And while I have a personal radar screen off to the side, my primary, business screen is much larger than most people’s, which is both an advantage and a challenge with its own particular set of problems. (In a physical sense this is also true: I have two 26-inch screens in my office. Which typically stay packed with things I’m paying attention to.)

So let’s look at what’s on my radar screen today.

First up (but probably not the most important in the long term), I would have to say, is Scotland. What has not been widely discussed is that the voting age was changed in Scotland just a few years ago. For this election, anyone in Scotland over 16 years old is eligible. Think about that for a second. Have you ever asked 16-year-olds whether they would like to be more free and independent and gotten a “no” answer? They don’t think with their economic brains, or at least most of them don’t. If we can believe the polls, this is going to be a very close election. The winning margin may be determined by whether the “yes” vote can bring out the young generation (especially young males, who are running 90% yes) in greater numbers than the “no” vote can bring out the older folks. Right now it looks as though it will be all about voter turnout.

(I took some time to look through Scottish TV shows on the issue. Talk about your polarizing dilemma. This is clearly on the front burner for almost everyone in Scotland. That’s actually good, as it gets people involved in the political process.)

The “no” coalition is trying to talk logic about what is essentially an emotional issue for many in Scotland. If we’re talking pure economics, from my outside perch I think the choice to keep the union (as in the United Kingdom) intact is a clear, logical choice. But the “no” coalition is making it sound like Scotland could not make it on its own, that it desperately needs England. Not exactly the best way to appeal to national instincts and pride. There are numerous smaller countries that do quite well on their own. Small is not necessarily bad if you are efficient and well run.

However, Scotland would have to raise taxes in order to keep government services at the same level – or else cut government services, not something many people would want.

There is of course the strategy of reducing the corporate tax to match Ireland’s and then competing with Ireland for businesses that want English-speaking, educated workers at lower cost. If that were the only dynamic, Scotland could do quite well.

But that would mean the European Union would have to allow Scotland to join. How does that work when every member country has to approve? The approval process would probably be contingent upon Scotland’s not lowering its corporate tax rates all that much, especially to Irish levels, so that it couldn’t outcompete the rest of Europe. Maybe a compromise on that issue could be reached, or maybe not. But if Scotland were to join the European Union, it would be subject to European Union laws and Brussels regulators. Not an awfully pleasant prospect.

While I think that Scotland would initially have a difficult time making the transition, the Scots could figure it out. The problem is that Scottish independence also changes the dynamic in England, making it much more likely that England would vote to leave the European Union. Then, how would the banks in Scotland be regulated, and who would back them? Markets don’t like uncertainty.

And even if the “no” vote wins, the precedent for allowing a group of citizens in a country within the European Union to vote on whether they want to remain part of their particular country or leave has been set. The Czech Republic and Slovakia have turned out quite well, all things considered. But the independence pressures building in Italy and Spain are something altogether different.

I read where Nomura Securities has told its clients to get out of British pound-based investments until this is over. “Figures from the investment bank Société Générale showing an apparent flight of investors from the UK came as Japan’s biggest bank, Nomura, urged its clients to cut their financial exposure to the UK and warned of a possible collapse in the pound. It described such an outcome as a ‘cataclysmic shock’.” (Source: The London Independent) The good news is that it will be over next Thursday night. One uncertainty will be eliminated, though a “yes” vote would bring a whole new set of uncertainties, as the negotiations are likely to be quite contentious.

One significant snag is, how can Scottish members of the United Kingdom Parliament continue to vote in Parliament if they are leaving the union?

I admit to feeling conflicted about the whole thing, as in general I feel that people ought have a right of self-determination. In this particular case, I’m not quite certain of the logic for independence, though I can understand the emotion. But giving 16-year-olds the right to vote on this issue? Was that really the best way to go about things? Not my call, of course.

Emerging Markets Are Set Up for a Crisis

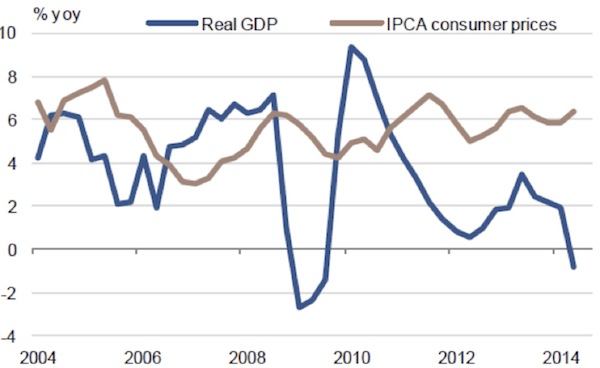

We could do a whole letter just on emerging markets. The strengthening dollar is creating a problem for many emerging markets, which have enough problems on their own. My radar screen is full of flashing red lights from various emerging markets. Brazil is getting ready to go through an election; their economy is in recession; and inflation is over 6%. There was a time when we would call that stagflation. Plus they lost the World Cup on their home turf to an efficient, well-oiled machine from Germany. The real (the Brazilian currency) is at risk. Will their central bank raise rates in spite of economic weakness if the US dollar rally continues? Obviously, the bank won’t take that action before the election, but if it does so later in the year, it could put a damper on not just Brazil but all of South America. Take a look at this chart of Brazilian consumer price inflation vs. GDP:

Turkey is beginning to soften, with the lira down 6% over the last few months. The South African rand is down 6% since May and down 25% since this time last year. I noted some of the problems with South Africa when I was there early this year. The situation has not improved. They have finally reached an agreement with the unions in the platinum mining industry, which cost workers something like $1 billion in unpaid wages, while the industry lost $2 billion. To add insult to injury, it now appears that a Chinese slowdown may put further pressure on commodity-exporting South Africa. And their trade deficit is just getting worse.

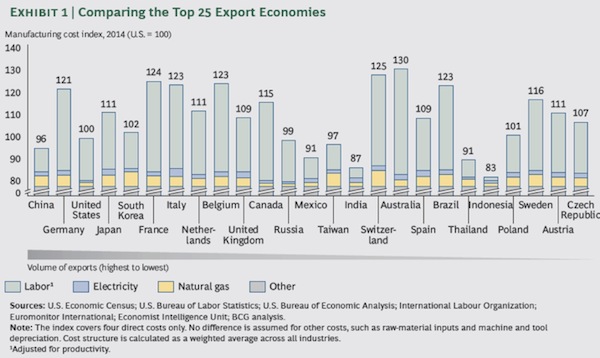

We could also do a whole letter or two on global trade. The Boston Consulting Group has done a comprehensive study on the top 25 export economies. I admit to being a little surprised at a few of the data points. Let’s look at the chart and then a few comments.

First, notice that Mexico is now cheaper than China. That might explain why Mexico is booming, despite the negative impact of the drug wars going on down there. Further, there is now not that much difference in manufacturing costs between China and the US .

Why not bring that manufacturing home – which is what we are seeing? And especially anything plastic-related, because the shale-gas revolution is giving us an abundance of natural gas liquids such as ethane, propane, and butane, which are changing the cost factors for plastic manufacturers. There is a tidal wave of capital investment in new facilities close to natural gas fields or pipelines. This is also changing the dynamic in Asia, as Asian companies switch to cheaper natural gas for their feedstocks.

(What, you don’t get newsfeeds from the plastic industry? Realizing that I actually do makes me consider whether I need a 12-step program. “Hello, my name is John, and I’m an information addict.”)

To continue reading this article from Thoughts from the Frontline – a free weekly publication by John Mauldin, renowned financial expert, best-selling author, and Chairman of Mauldin Economics – please click here.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.