The Quiet Energy Crisis as Mexican Crude Oil production tumbles

Commodities / Investing Mar 07, 2007 - 10:18 AM GMTDo you think gasoline prices are too high? Do you think illegal immigration is a problem? Well, get ready for more of both, because Mexico, the #3 supplier of imported fuel to the U.S., is spiraling into a quiet energy crisis that could interrupt our oil supplies, send shockwaves through our economy, and force a million or more Mexicans to migrate across our border.

Consider this: In December 2005, Mexico sent the U.S. 1.7 million barrels of oil per day (bpd). This past December, Mexico only exported 1.2 million bpd to the U.S.

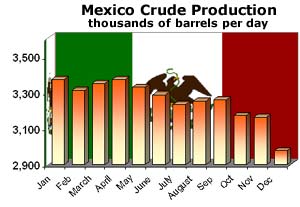

Why is Mexico sending less oil? Because it's producing less oil. Total oil output fell to just below 3 million bpd in December 2006. That's down from nearly 3.4 million barrels at the start of the year, and Mexico's lowest rate of oil output in seven years.

There's a single force at work here — production is falling at Cantarell, Mexico's biggest oil field (and the second-largest producing field in the world). Accounting for more than half of Mexican oil production, Cantarell lies deep under the waters of the Gulf of Mexico. Water and gas are encroaching on the oil, and that's lowering output.

Cantarell's output tumbled by half a million bpd last year, according to figures released by the Mexican government. That is much, much faster than estimates from Mexico's state-run oil company, Petroleos Mexicanos (Pemex). If this decline rate continues, Cantarell's production will be cut in half by 2010.

And Pemex has another problem — it simply doesn't have the money to develop its other resources.

More than half of the company's revenues were taken by taxes last year, so you can see why. (In 2005, it faced an even bigger tax bite!)

In terms of exploration and production, Pemex invested $14 million in 2006 and plans to invest $16 billion in 2007. But that's not enough. Last November, Pemex said it needed to invest $18-$20 billion a year. What's more, the company has $5.5 billion in debt coming due in 2007.

Why not bring in outside investors? You'd have to change Mexican law to do that. So …

Things Could Get Worse: The Collapse Scenario

David Shields is an oil industry consultant in Mexico City, and he's been warning about Cantarell's collapse for the past two years. He's told the press that Cantarell's output will likely keep dropping like a stone. In fact, Shields expects Cantarell's production to fall to just 500,000 barrels per day within three years.

According to some experts, there's only 825 feet between the gas cap covering the oil in Cantarell and the water, which is pushing in at a rate approaching 300 feet per year. If the water rises enough, it could cut off the flow of oil quite suddenly.

At present, Pemex only discovers one new barrel of oil for every 14 it extracts. It's trying to change that by developing new fields. Let's look at two of the big ones …

Ku-Maloob-Zaap sounds like a punk rock band, but it's an offshore project holding 13% of Mexico's known oil reserves. It is already producing 400,000 bpd, and new production will be added in the short term. It could reach 680,000 bpd by the end of this year, perhaps exceeding 700,000 bpd within two or three years, thanks to new works projects.

Chicontepec is a huge onshore oil field that contains 40% of Pemex's known reserves. That's the good news. The bad news is that Chicontepec consists of small pockets of oil tucked into fractured rock. Pemex doesn't have the drilling technology it takes to exploit this field.

Because Chicontepec and Ku-Maloob-Zaap are more technically challenging than Cantarell, Pemex's production costs are set to rise from $4.17 a barrel in 2006 to more than $5 a barrel in the years ahead. The end result is a pinch on revenues.

In addition, developing these projects takes money and time, and as I've already shown you, Mexico doesn't have much of either.

Pemex predicts that Cantarell's production will drop 212,000 bpd this year. But remember, it tends to underestimate these things. If Cantarell's production ends up falling another 400,000 barrels this year, Pemex simply won't be able to keep up.

And that's when this problem becomes a geopolitical powder keg …

An Oil Decline Would Set Off a Domino Effect in Mexico

I already told you that 55% of Pemex's sales went right into government coffers last year. On top of that, Mexico relies on oil exports for about 40% of its revenue. So Cantarell's decline is a big problem for Mexico's President Felipe Calderon, who won a narrow victory in last year's election.

Any major decline in oil revenues will force Calderon to cut government spending. That's a big problem since he's already having a hard time containing popular discontent!

For example, tens of thousands of angry Mexicans marched through Mexico City recently to protest rising corn prices (due to demand for corn-based ethanol). More than 25% of Mexico's rural population (and 11% of the urban population) lives in extreme poverty. For these people, cheap corn tortillas are the difference between eating and going hungry.

Calderon has vowed to raise spending on social programs, but that will be hard to do with less oil money coming in. If Cantarell's production collapses, Pemex's revenues will dry up, and a huge chunk of the Mexican government's budget will vaporize. Social spending won't go up — it will go down.

We're already seeing something like 250,000 Mexicans enter the U.S. illegally every year. With more than 25 million Mexicans living in poverty, how many more will trek north if Cantarell collapses and the government lacks the money to fund social programs?

Other International Oil Producers Are Also Running on Empty

Mexico is just one of the quiet oil crises we have around the world. In fact, four out of five major OECD producers are now in decline (Norway, U.K., U.S. and Mexico), leaving only Canada with growing production …

Kuwait's giant Burgan field has also peaked …

Iran's energy use is rising so fast that its oil exports are being crimped badly …

And despite the fact that the Saudis are supposed to be sitting on a thousand years of oil, their oil production declined 8% last year.

The Saudis will say they made their cuts to “stabilize” the market. Maybe. But I think I see a more urgent pattern taking shape. One that casts a dark shadow of rising oil prices later this year …

Opportunities for Savvy Investors Will Abound

Have you noticed how well oil's been holding up even as most other assets have been correcting lately?

That's not a fluke. That's the market telling you that there are strong fundamental reasons for higher oil prices.

After all, U.S. oil demand and oil imports are rising steadily. The same goes for China, India, and other developing nations. With supply in a pinch and demand red-hot, there is one way for prices to go — through the roof!

Here are two ways to get a diversified stake in energy:

Oil exchange-traded funds (ETFs) — I expect oil prices to be much higher by the end of this year. Oil stocks that are leveraged to the price of oil should do even better. So, it's no surprise that I like the Energy Select SPDR ETF (XLE) , which contains stocks like ExxonMobil and Chevron.

Experimental Energy ETFs — As oil prices rise, alternative energy will also get hot again. If you have a higher tolerance for risk, consider the Powershares WilderHill Clean Energy ETF (PBW) . This fund invests in companies that are concentrating on experimental technology, which could benefit not just from higher oil prices, but also from government subsidies and a rush of investment money into alternative energy.

Yours for trading profits,

By Sean Brodrick

P.S. For the latest on metals, energy and other commodities, check out my blog at redhotresources.blogspot.com .

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.MoneyandMarkets.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.