The Stock Market Cycle’s Slippery Slope

Stock-Markets / Stock Markets 2014 Oct 10, 2014 - 03:43 PM GMTBy: Harry_Dent

Will this bubble burst anytime soon? Will we have inflation or deflation? There are lots of questions being asked.

Will this bubble burst anytime soon? Will we have inflation or deflation? There are lots of questions being asked.

The inability for economists and financial analysts to understand the most basic principle of cycles is just beyond comprehension… especially since we’ve been in this bubble era since 1995. How could so many be arguing that we’re not in a bubble when we have seen one bubble after the next rise and then burst as they always do?

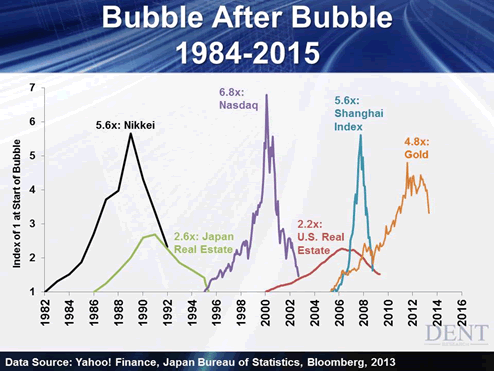

The Japanese stock bubble burst in 1990 and then Japanese real estate tanked in 1991. It’s been 19 years since their stocks dropped a whopping 80% and after 23 years real estate is still down 60%.

The tech bubble that peaked in 2000 crashed by 78% and it’ll likely crash again after approaching its highs. And when stocks proved fallible, investors rushed into real estate — the one thing that couldn’t go down. They couldn’t have made a greater mistake — it fell by 34% between 2006 and 2011 — with the worst sectors down by 55%. That really hurts when you are highly leveraged with a mortgage.

My promise here… even though it had a weak bounce: It will drop again (and don’t even get me going on China).

The chart below shows some of the more prominent bubbles.

The emerging markets bubble was as strong as the tech bubble that peaked in late 2007/mid-2008 and then dipped by 68%. It crashed 70% in China. China is still hovering around its 2008 lows today. Commodities peaked in mid-2008 and they still haven’t gotten back to those highs and will probably go much lower, according to our 30-year commodity cycle and it’s been reliable for nearly 200 years.

Then the last bastion was held by gold and silver. They were supposed to be the ideal investment strategy that would protect you in a downturn… according to the gold bugs, not us. That quickly turned into a not ideal strategy. We saw gold drop by 38% from its peak back in September 2011 and silver slid down by an unbelievable 63% since April of 2011 when we gave the major sell signal for the precious metals. There will be more to come in that scenario.

I don’t see how economists and analysts are blind to the Fed’s constant fueling of the bubble we’re in and that it will, not maybe but will burst. It couldn’t be more obvious. The denial factor grows stronger when bubbles are moving into the final stages and it’s a rampant symptom right now in a lot of people.

I’ve had to debate Ron Insana on CNBC many times. He categorizes the Fed’s policy in creating endless amounts of money out of thin air to solve all of our financial crises and problems as “enlightened policies.” How is that for delusion and denial?

It’s just mind-boggling.

I’m going to play devil’s advocate here for a second. If we’re going to print money… and it has no serious consequences… and it really is the new enlightened approach to economics, then why are we ***** footing around? Why don’t we print $17 trillion and pay off the national debt? Why don’t we print $10 trillion and pay off every household’s mortgage?

Or as Roseanne Barr recently joked in all of her typical political correctness: “Why don’t we give every broke person $10,000 a week? Then the rest of us can invest in liquor stores, casinos and porn websites.”

Ron Insana is actually one of the most intelligent people I debate on this topic but his view is still simply insane to me. Paul Krugman is the leading liberal economist and he thinks we should have printed much more money than we did.

If I’m not debating the “enlightened” ones, I’m hashing it out with the gold enthusiasts. They see hyperinflation, gold going to $5,000 plus and the dollar crashing to near zero. Did this happen in the last financial crisis? No, it didn’t. The dollar went up and gold and silver crashed.

Inflation is not the consequence. The consequence is preventing our economy from rebalancing unprecedented debt, financial leverage and speculation. The inevitable consequence is creating an even bigger bubble that will have to burst and it will do that soon.

Deflation is the trend and we saw the money supply in the U.S. actually contract 6% for a few months before the Fed stepped in with their unprecedented stimulus. They are inflating to fight deflation.

Even the central banks can’t keep this bubble going forever, and in fact, it seems to have expanded to about as far as it can go to me and stock gains have been minimal since the beginning of this year.

You need to prepare for another across-the-board bubble burst and the deepest downturn since the Great Depression with deflation… not inflation. It will fall deeper and it will last longer than it did in 2008.

This isn’t the time to listen to those leading politicians, economists and pundits who say we’re not in a bubble and we’re finally seeing a sustainable recovery.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.