Can the Fed Come To the Rescue Again If Needed?

Stock-Markets / Stock Markets 2014 Oct 11, 2014 - 11:45 AM GMTBy: Sy_Harding

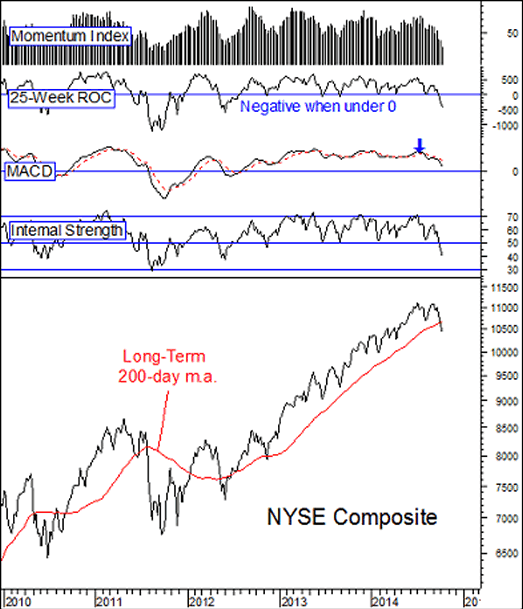

My concerns about high market valuations, excessive investor euphoria, the Fed eliminating its QE stimulus, growing economic woes in euro-land and so forth, became more serious when my firm’s technical indicators triggered a sell signal on July 31.

My concerns about high market valuations, excessive investor euphoria, the Fed eliminating its QE stimulus, growing economic woes in euro-land and so forth, became more serious when my firm’s technical indicators triggered a sell signal on July 31.

As readers know, we had been cautious, expecting a 15% to 20% correction at some point, to a low in the October/ November time-frame. With the July 31 sell signal on the technical indicators, we put 20% of our portfolio in initial downside positions in inverse etf’s.

As is typical, we were early and took some grief as the market continued somewhat higher in August.

However, our intermediate-term indicators remained on the sell signal and we have added to downside and safe haven positions at the higher prices. Now the NYSE Composite has broken beneath its long-term 200-day moving average, and the sell signal is being further confirmed on the charts.

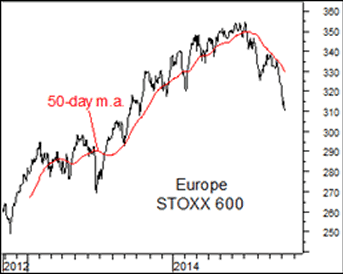

It is different this time than when so many previous ‘pullbacks’ since 2012 were only brief ‘buy the dip’ opportunities. The market is more overvalued, and has gone longer without a normal correction. The Fed has halted its QE stimulus that has been so important since 2009. The economies of the major trading partners of the U.S. are slowing. Global markets, particularly in Europe, seem to be leading the way down.

But still, why sell and take downside positions if all we expect is a normal 15% to 20% correction, and then an important buy signal and resumption of the bull market?

To begin with, a 20% correction would wipe out all of this year’s gains and most of last year’s. But, while we don’t expect it, there is also the possibility of something worse.

The market is pumped up to high valuation levels not by a strong economy, but by the stimulus efforts of the Federal Reserve. Therefore, since 2009, each time either the economy or the stock market stumbled the Fed had to come to the rescue.

However, its ability to do so this time is questionable

The Fed’s major tool in re-stimulating the economy or markets has always been its ability to cut interest rates, aggressively if necessary. However, as part of the rescue effort from the 2008 financial meltdown, the Fed used up that tool, cutting its Fed Funds target rate all the way to zero (actually 0.0 to 0.25%). And it has had to leave the rate there since in an effort to keep the anemic economic recovery going.

Could it fire up another round of QE? Perhaps, but only in a desperate situation. The Fed would be extremely reluctant to do so after spending the year winding down the previous QE program, and with the widespread worries about how it will be able to unwind the $3 trillion of QE assets already on its balance sheet.

So anything could happen.

I do not expect a bear market, ‘only’ a 15% to 20% correction, and then a very important buy signal.

However, anything is possible if investors, who have not experienced even a 10% pullback since 2011, should panic. In such an event, positioning for a correction will also have investors positioned for something worse.

In the interest of full disclosure, I and my subscribers have positions in inverse etf’s RWM, PSQ, and DOG, and we are contemplating adding more depending on what our indicators tell us.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.