U.S. Jobs - Why Janet Yellen Needs Her Own Magic Show

Economics / US Federal Reserve Bank Nov 11, 2014 - 07:36 PM GMTBy: Don_Miller

What do Siegfried and Roy have in common with Federal Reserve Chairman Janet Yellen?

What do Siegfried and Roy have in common with Federal Reserve Chairman Janet Yellen?

Shortly after the Bureau of Labor Statistics released unemployment data last month showing that joblessness had dropped below 6% for the first time since the 2008 crash, the Federal Reserve announced it would stop government bond purchases; Quantitative Easing is history.

The Federal Open Market Committee’s (FOMC) October 29 announcement states:

Information received since the Federal Open Market Committee met in September suggests that economic activity is expanding at a moderate pace. Labor market conditions improved somewhat further, with solid job gains and a lower unemployment rate. On balance, a range of labor market indicators suggests that underutilization of labor resources is gradually diminishing. ...

The Committee judges that there has been a substantial improvement in the outlook for the labor market since the inception of its current asset purchase program. ... Accordingly, the Committee decided to conclude its asset purchase program this month.

To better understand what all that means in English, we need to back up a bit.

In 2012, Principal Global Investors Economist Robin Anderson noted of Yellen:

Janet Yellen … is the latest in a string of Fed bigwigs to get behind an idea of using explicit inflation and unemployment targets to inform the market about the Fed’s future plans—forward guidance, in Fed-speak. ...

Essentially, the idea is to set up explicit thresholds for inflation and unemployment measures (the two mandates for the Fed) to help set expectations about the future of monetary policy if there should be a disconnect between the two.

In other words, the Fed leans on concrete inflation and unemployment data to form policy. That sounds intelligent, straightforward, and simple; however, it’s the kind textbook talk we should expect from someone living in a world of theory. Most of the time, the person making these statements has never been responsible for or had her job performance measured by a sales budget, expense budget, or achieving profit goals.

As I’ve mentioned before, in the words of Yogi Berra, “In theory there is no difference between theory and practice. In practice there is.”

Ms. Yellen quickly discovered that Yogi was right. In May 2014, during testimony before a joint congressional committee, she said the 6.5% unemployment goal was being taken off the table, and she refused to give Congress any goals or timelines. She simply repeated that rates would remain near zero for a considerable time and would rise only when stronger economic conditions allowed.

Can you imagine the president of any major corporation standing up at a stockholder meeting and refusing to answer shareholders’ questions? “I’m not sure how much we will sell next year, nor do I know how much money we will earn. But when we get there I will tell you. You can trust me.”

Well, the day arrived, and Ms. Yellen says it’s time for bond buying to stop. And a few months down the road, the Federal Reserve is likely to begin slowly raising interest rates, even though she said she plans to keep interest rates low for a considerable period of time. Why? The unemployment rate, as reported by the BLS and shown in the graph below, is now below 6%.

Ms. Yellen has jumped and is now saying “that was our secret target.” This is her justification for stopping bond purchases. Hmm… sure looks like the Fed knows what it’s doing. Surely announcing that happy days are here again just before the midterm elections was a mere coincidence.

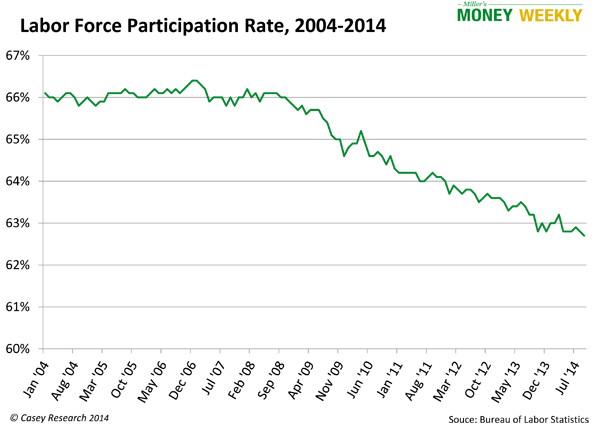

Take a look at the chart below showing the Labor Force Participation Rate as reported by the BLS on November 1.

I might be a 74-year-old with aging eyes, but even I can see that the line is going down. If true unemployment were going down, wouldn’t labor force participation be going up?

When it comes to raising interest rates Ms. Yellen has a big problem. Greenspan let that cat out of the bag at a recent New Orleans investment conference attended by members of the Casey Research team, noting that it was naïve to believe the Federal Reserve is independent of the government.

To justify the Fed’s easy-money policies, he said the government’s insatiable need for capital would have “crowded out” the rest of the economy. In straight talk that means if he hadn’t juiced the system with easy money, interest rates would have risen so high that capital would have been too expensive for the private sector. There is a universal truth: government-spending obligations preempt the need for sound money policies every time.

Ms. Yellen can trumpet all she wants about the Fed promoting employment and keeping inflation under control. Mr. Greenspan has made it clear that the real mission of the Fed is that of dealer to government spendaholics.

Over time, addicts want more frequent injections and bigger doses, and Ms. Yellen has inherited an addict in advanced stages. To solve the real problem (the addiction) requires an effective intervention (hopefully before it’s too late) and real behavioral change or the addict dies an ugly death.

Dr. Lacy Hunt estimates that every 1% increase in the interest rate would add $130 billion annually to the budget deficit. Projected deficit increases will run his estimate to $260 billion. Currently, if interest rates increased 4% it would add $520 billion to the deficit, accelerating the need for even more juice.

The government has reported that the annual deficit is going down. The Fed is keeping a lid on interest rates. When government debts are sold in a free market, though, interest rates will rise. Yellen knows this and she is doing everything she can to hide it. Ask her to set a target? Forget about it!

So, what do Siegfried and Roy have in common with Yellen? Both lean heavily on smoke and mirrors. Maybe it’s time for her to take their place in Las Vegas. For updates on her show times—along with timely investment news and economic analysis—sign up for our free weekly missive, Miller’s Money Weekly here.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.