Gold Long Short GDXJ, DGZ ETF Technical Analysis

Commodities / Gold and Silver Stocks 2014 Nov 13, 2014 - 12:51 PM GMTBy: Austin_Galt

The analysis includes GDXJ which is a long gold fund and DGZ which is a short gold fund.

The analysis includes GDXJ which is a long gold fund and DGZ which is a short gold fund.

GDXJ Market Vectors Junior Gold Miners ETF

The Market Vectors Junior Gold Miners ETF (GDXJ) is an equity index that provides exposure to small and medium sized companies that generate at least 50% of their revenues from gold and/or silver mining. It is listed on the American Stock Exchange (AMEX) with price last trading at $25.73.

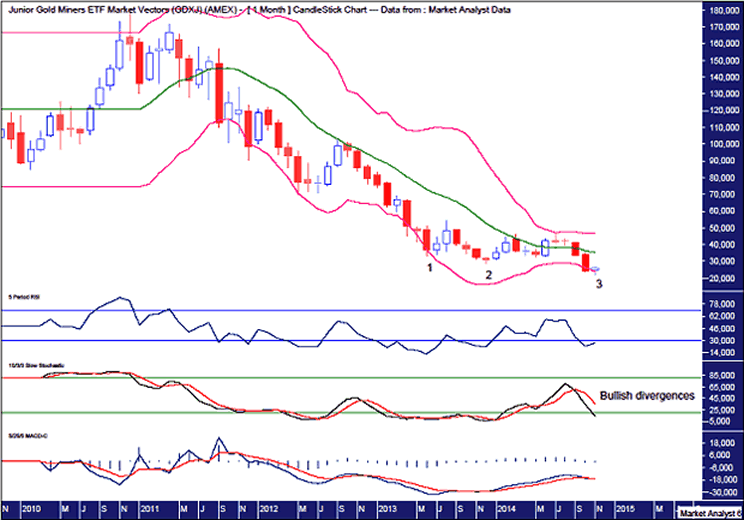

GDXJ Monthly Chart

The Bollinger Bands show price potentially finding support now at the lower band. These bands have tightened considerably in the last few months which may indicate a consolidation phase and even possibly a major trend change. For the time being, I'd be looking for a rally back up to the upper band which currently stands around $46.

The lower indicators, being the Relative Strength Indicator (RSI), Stochastic and Moving Average Convergence Divergence (MACD), are all showing multiple bullish divergences. Surely something has to give here. A rally perhaps?!

Also, there are three consecutive marginally lower lows which is a common pattern found at lows. That could well be the end of the downtrend although it is too early to say. Occasionally I have noted a big rally after the third low only for price to then come back and make a fourth and final low just to make things tricky.

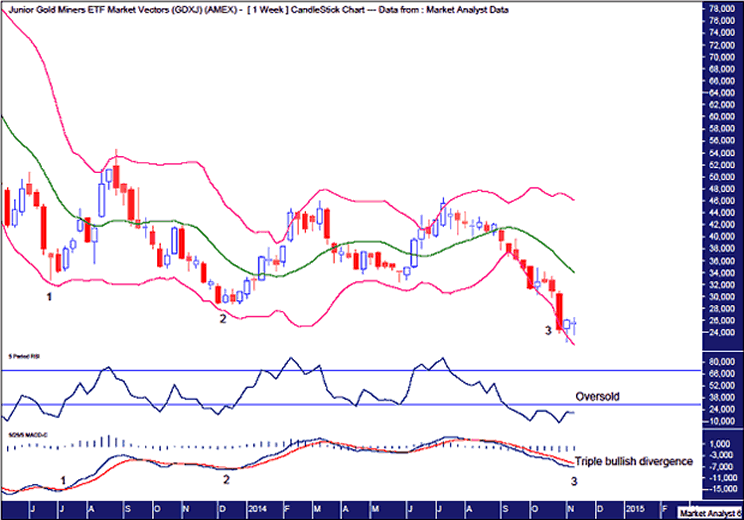

GDXJ Weekly Chart

Here we can see more clearly the three consecutive lows. The MACD indicator is showing a triple bullish divergence on the current low.

The RSI is oversold so a rally would certainly be no surprise here.

The Bollinger Bands show price clinging to the lower band on this recent leg down. After last week's bullish reversal, price looks like it might be moving away from the lower band. Next stop middle band?

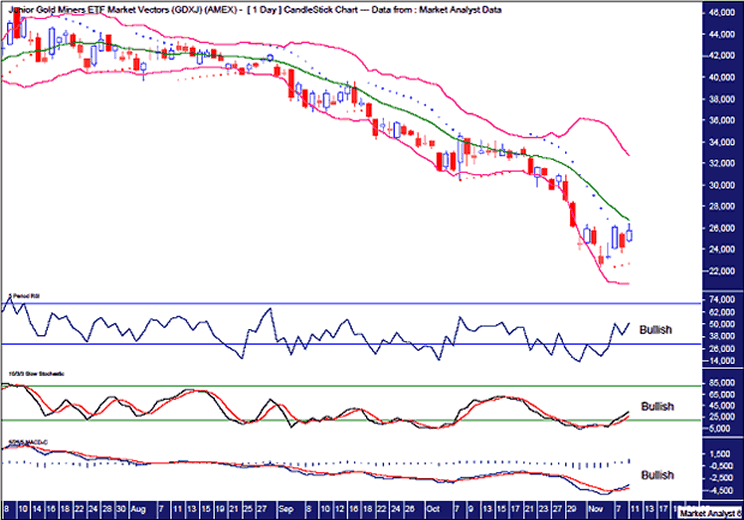

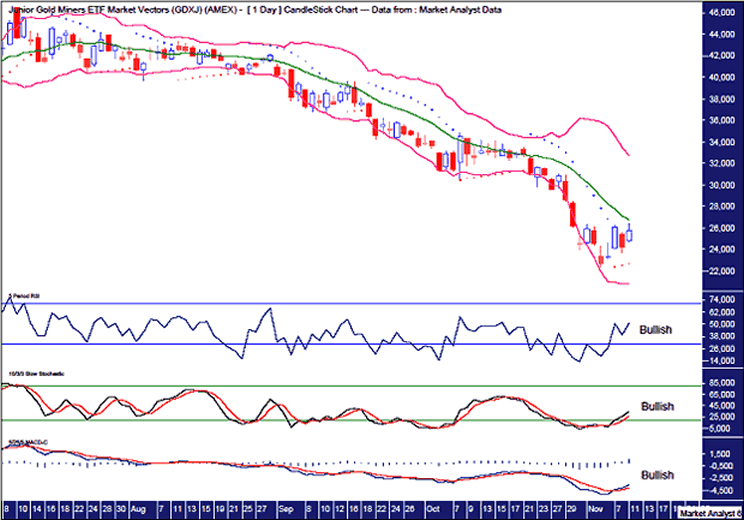

GDXJ Daily Chart

The Bollinger Bands show price has already moved away from the lower band and is now verging on the middle band.

The Parabolic Stop and Reverse (PSAR) indicator shows price busting the dots to the upside so a bullish bias is now in force here.

The lower indicators are all looking very bullish. Apart from some bullish divergences, the RSI, Stochastic and MACD indicators all appear to be trending up and giving good reason for the bulls to get a little excited.

Summing up, the short term is looking promising for the bulls but looking further out is still a bit uncertain.

Disclosure - I have no financial interest in GDXJ.

DGZ Powershares DB Gold Short ETN

The Powershares DB Gold Short ETN (DGZ) has an inverse relation to the movement in gold prices. It is effectively a short on the gold price. It is listed on the American Stock Exchange (AMEX) with price last trading at $16.01.

DGZ Monthly Chart

Price has been trending up since 2011 in line with the price of gold declining since then.

There looks to be a triple top in place or even still forming which is denoted by the numbers 1,2 and 3. This may lead to reaction back down. However, this triple top is against the trend so after any pullback, price should head back up and bust the triple top.

The Bollinger Bands show price is now back up at the upper band. Perhaps this will provide resistance and price heads back down. And if that happens then perhaps the pullback low will be down at the lower band. Let's see.

The Relative Strength Indicator (RSI) is showing a bearish divergence with the first high in the triple top pattern.

The Stochastic indicator shows the averages diverging quite a lot so perhaps some regression to the mean will see price move lower which sees these averages move back closer together.

Momentum has also been declining ever since the first high in the triple top.

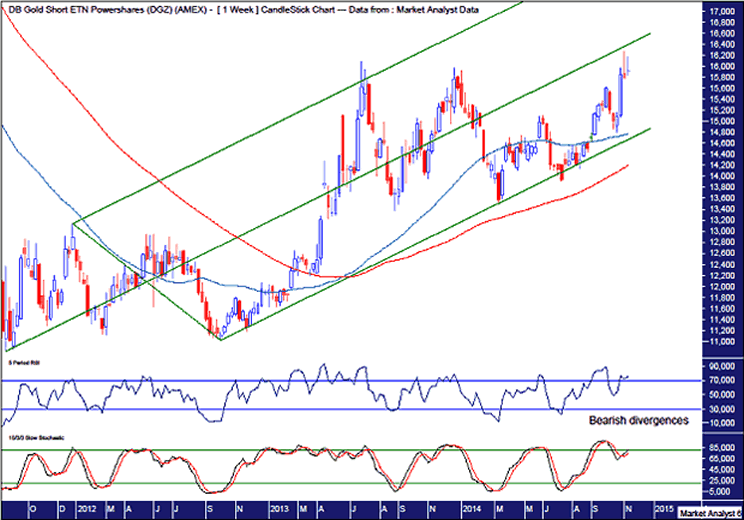

DGZ Weekly Chart

The Andrew's Pitchfork shows the nice uptrend that has been in force since the 2011 low. Price was able to get up into the upper channel for a large part of 2013 but has since come back into the lower channel. It now looks to be attempting to get back up into the upper channel but last week's bearish reversal candle may put the kibosh on that.

I have added the moving averages with time periods of 50(blue) and 100(red) and these demonstrate the bullish position of price as the blue line is above the red line.

However, there may be some short term headwinds according to the lower indicators. Both the RSI and Stochastic indicator are showing little bearish divergences on this high.

So perhaps price now pulls back and heads down to test the lower pitchfork channel line while one of the moving averages may provide support.

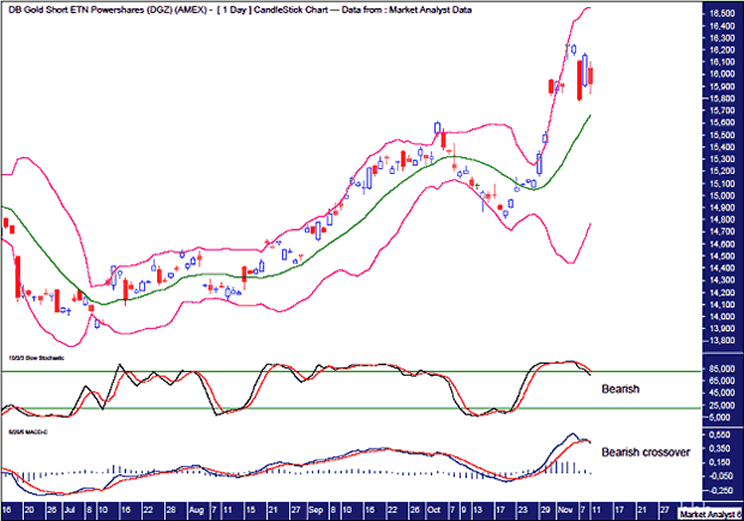

DGZ Daily Chart

The Bollinger Bands show price moving away from the upper band. That could well be the end of the recent uptrend.

The Stochastic indictor is now looking bearish and trending down while the Moving Average Convergence Divergence (MACD) indicator is showing a very recent bearish crossover.

So it still appears early days but the short term picture looks to be getting bearish however the medium term should still witness higher prices after any pullback occurs. Well, that's the way I see it after looking at the charts.

Disclosure - I have no financial interest in DGZ.

By Austin Galt

Austin Galt is The Voodoo Analyst. I have studied charts for over 20 years and am currently a private trader. Several years ago I worked as a licensed advisor with a well known Australian stock broker. While there was an abundance of fundamental analysts, there seemed to be a dearth of technical analysts. My aim here is to provide my view of technical analysis that is both intriguing and misunderstood by many. I like to refer to it as the black magic of stock market analysis.

© 2014 Copyright The Voodoo Analyst - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.