Gold Sector Review - Inflation, Fundamentals, Psychology/Sentiment and Technicals

Commodities / Gold and Silver 2014 Nov 13, 2014 - 06:46 PM GMTBy: Gary_Tanashian

Below is a summary of some of the aspects we follow in NFTRH to gauge a future investment stance on the gold sector. It is much more complex than simply hearing dogma that seems to make sense and then holding on for dear life…

Below is a summary of some of the aspects we follow in NFTRH to gauge a future investment stance on the gold sector. It is much more complex than simply hearing dogma that seems to make sense and then holding on for dear life…

Inflation

The hype is dying. 10 years of inflation hysterics have gone down the drain even as global policy makers pull out inflationary bazookas and use them at the slightest hint of economic trouble. The BoJ’s recent action was just the latest and most striking in its timing. Global markets were bouncing within correction mode and the Yen had just pinged a key resistance level. The BoJ then blew the Yen up with policy designed to at once reward risk takers and asset holders and mercilessly punish the Japanese people, renowned for the ethic of saving.

But the global inflation is dying despite these periodic bazooka blasts. The US Fed as much as admits it wants inflation. More accurately, it will do anything to stave off the next deflationary impulse because when that takes hold it is going to unwind the system, and they know it. Why on earth do you think noted Hawk James Bullard was trotted out the moment the stock market took a routine correction in October? Here Jim, get out there and eat that mic and calm them down.

Gold is not about inflation and in this cycle it, as a squarely risk ‘OFF’ asset, is about the opposite, the deflationary unwinding of the inflated excesses which now are no longer clustered in commodities and global markets, but in US stocks and the balance sheets of certain corporations set up to benefit.

In a dis-inflationary environment, which is the preferable one for the gold stock sector, the pain comes first and the rewards for those left standing come second. We have not exited the pain phase for gold bugs and most people still think ‘no inflation, bad for gold’ when they should be thinking ‘no inflation… that means eventual deflationary impulse… bad for the economy and stock markets and one day, from the ashes good for the gold sector when and only when gold out performs other assets positively correlated to the economy’.

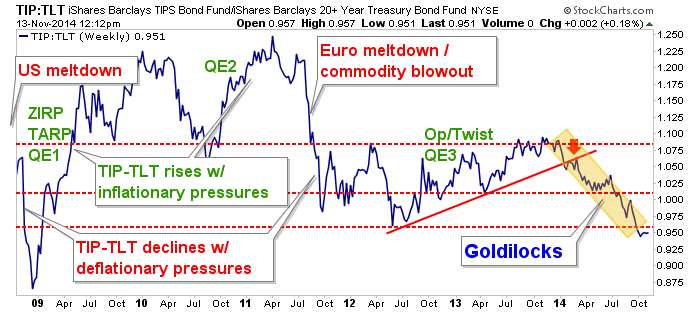

Goldilocks has been in play in the US as the global dis-inflationary pull has dropped the TIP-TLT ‘inflationary expectations’ gauge lower. At some point Goldlilocks will morph to something less benign for the economy and for stock bulls. But it has not yet.

Macro Fundamentals

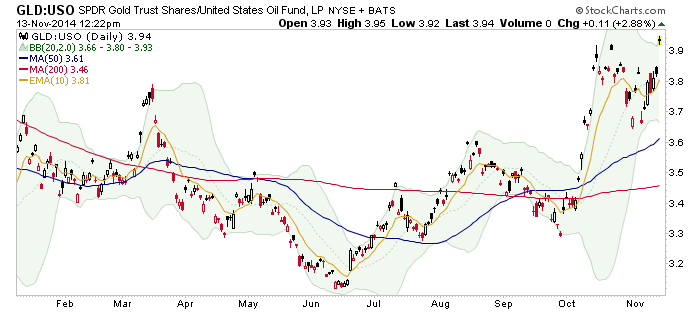

Here is a constructive chart for gold mining fundamentals, gold (GLD) vs. oil (USO). Counter cyclical gold would need to continue rising vs. cyclical (miner cost input) crude oil. Gold would rise vs. oil and commodities in general as the economy starts to slip up.

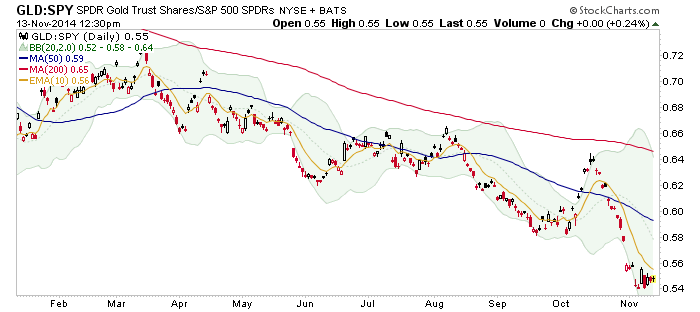

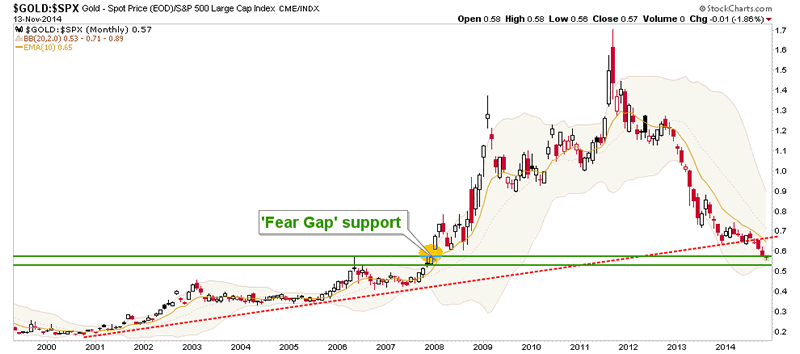

An example that is squarely adversarial to the gold sector is gold vs. the US stock market (GLD-SPY). Investors being herding animals (en masse), why on earth would they be looking at gold stocks in an environment like this?

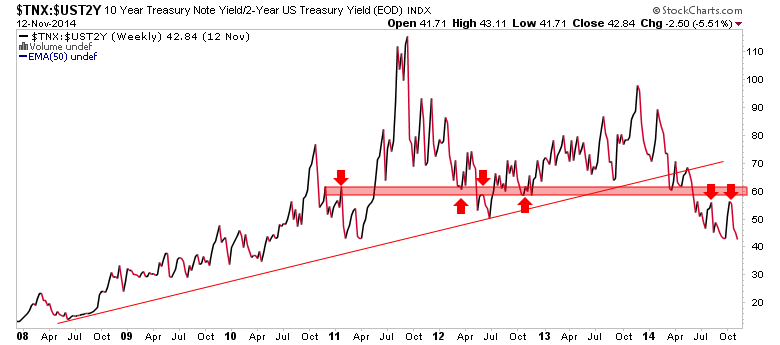

The yield curve is and has been an important reason why we have had to remain in caution mode on gold’s price for so long now. A rising curve is bullish for gold and a declining curve is bearish. It has amazed me how many reputable fundamental analysts have missed this one key indicator. We do not have time in this article to go into all the reasons, but suffice it to say that, manipulated* or not, a decline in long-term yields vs. short-term yields tends to be gold bearish and economy bullish.

* Yes, there is the word manipulation. It is everywhere in the global macro. Until the BoJ’s recent antics the most bald faced manipulation had been in my opinion, the brilliant Operation Twist, with its inflation “sanitized” selling of short-term bonds and buying of long-term bonds. It is the gift that keeps on giving to this very day as the curve was put under control (Op/Twist was announced in September of 2011) and has been down trending ever since.

There are more fundamental considerations that we routinely cover in NFTRH, but the above gives you an idea of some headwinds facing the gold sector. Jimmied by policy or not, the fundamentals are not positive on balance.

Psychology/Sentiment

Reference last week’s article Gold Bug Psychology Must be Neutered…

I don’t write stuff like this trying to provoke. I write it trying to cut through the b/s. The simple message is that gold bugs fight a righteous fight monetarily speaking. That is because the asset, gold, is a counter weight to unbelievable degrees of shenanigans going on with out of control people in high places who believe, or would have us believe, that it is all as simple as shifting things on balance sheets to get them out of the light of day, promoting risk taking and letting an ‘organic’ economy finally take root.

What a load of crap. It makes me want to puke and suspect it does for the average gold bug as well. But the adherence to honesty is exactly what makes someone hold so dearly to their beliefs (and in some cases, their portfolios). The current environment, perverse as I believe it is, is designed to make people finally give up on the dream of making things better.

I have negative feelings about the gold bug leadership because I think a good proportion of them are little more than ego stoked doofuses who can’t see through their own bias and agenda. But the power of the message is rooted in right and wrong and that is exactly why they (some of whom you may know as mighty intellectual thinkers) hold such power. Most people are basically good and they want to fight for good.

This impulse to fight for what is right has been used every step of the way by the gold sector leadership to keep people in line. A lot of people casually familiar with the financial markets were rapidly brought on board into that 2011 blow off amid the climax of the last inflation phase (silver and commodities blew off) and then the Euro crisis (gold blew off).* That was a time for caution as what we called the Euro crisis “Knee Jerks” came flying in out of fear and pure momentum. I knew they would cause damage (to we long-term gold bulls and to themselves) although I sure did not know the duration and intensity that the damage would carry.

So I wrote an article talking about how the sector needs to be cleaned out, the leadership needs to be rejected (just recently a high profile interview came out talking about how Ebola could end the price declines in gold and silver. How pathetic. We warned of this in NFTRH and sure enough, destruction was visited on the sector within days. Want another example? September of 2013; the FOMC rolls over and does not begin to taper QE, some gold bug website immediately publishes a high profile article glad handing the leadership for a job well done in fighting the forces of evil and we immediately publish a post Scary Gold Bug Article on Cue. Next up? Price destruction for the sector.

So the view stands that along with fundamentals that are not fully in line, the Pych profile is not fully fixed either. Not yet. It’s a bear market and bear markets tend to see to these things eventually.

*Isn’t it notable that gold had its blow off during a deflationary event (Euro crisis)? That is telling and supportive of our thesis that it is a deflationary pull and eventual economic contraction that would provide the real investment backdrop for gold and especially gold miners.

Technicals

Well, the post has already gone on longer than intended and I have not even gotten to the area I am probably known for, which is the TA. Suffice it to say that anything can change in a heart beat, especially in markets dependent upon manipulation. One thing loses control, and gold could be gone. That’s the case for actual, physical gold.

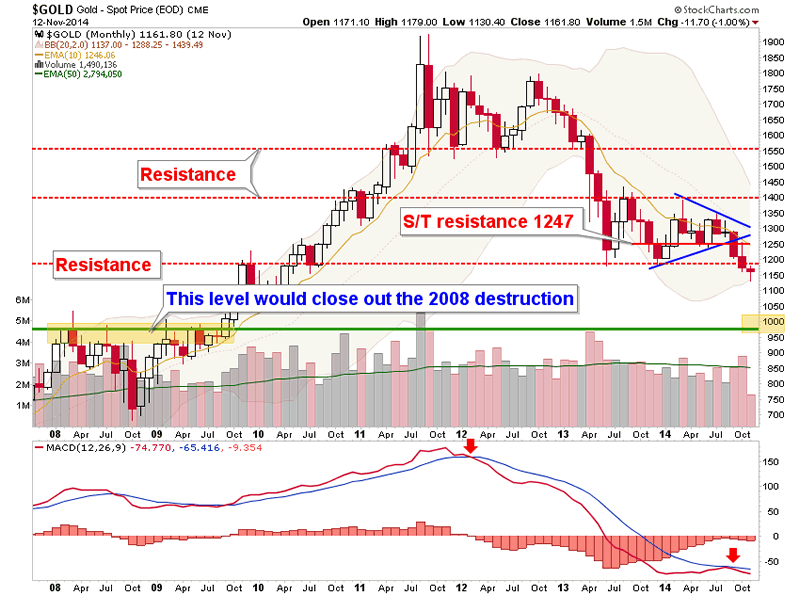

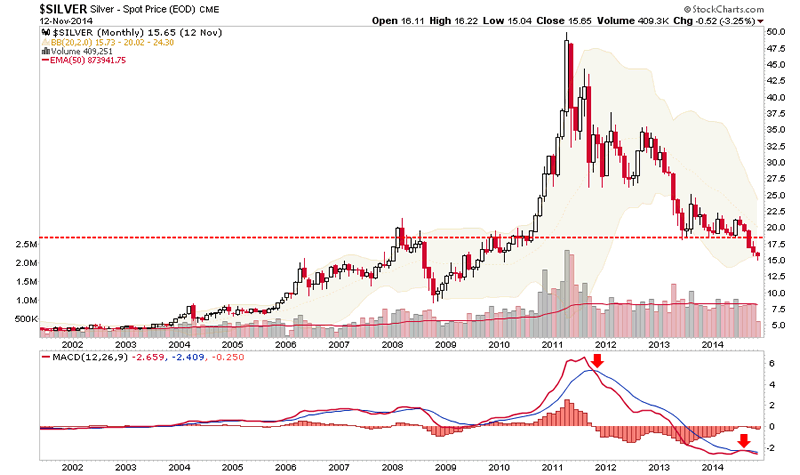

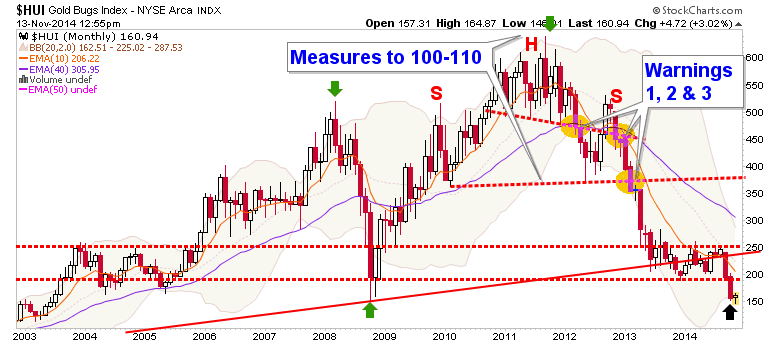

But the reality is that when gold lost 1180 recently and when silver lost the 18 area a while back, the long-term price charts were cooked. Further, HUI broke down after a summer full of hype about Ukraine faded (as we knew it would) so here is what we are left with…

If gold can climb above 1180 and hold there it can start to think about negating its bearish technicals. Otherwise it is what it is, a bearish price chart.

If Gold vs. the stock market can close the 2008 ‘fear gap’ and begin a new phase sooner rather than later, great, we would have honesty returning to the system and another positive for the gold mining investment case.

But these things have not happened yet. What’s more, silver is just a mess below a key breakdown point.

Gold stocks are trying to bounce from the recent bottom at around the 2008 lows. While we have been observing this bounce by short-term charts in NFTRH’s interim update service, the monthly plainly tells would be investors to use caution. The H&S measurement no longer seems so crazy these days.

Wrap Up

There is so much more to the picture that even this bloated article could not scratch the surface of. So remember that the next time some little easy to read info-blurb passes by your eyes and sounds very clear and logical. Things are not clear and timing is not finite. Things are in motion and events will take just as long as they take to adjust to the next big opportunity in the gold sector.

Only hard and sometimes boring work will see people through the changes from the end of one thing and the beginning of another. By my eye, the next big opportunity for speculators would come from the short side. On a positive note, that would be the final act of this phase, especially if it closes out the target on the H&S noted above.

Aside from that, I am always willing and ready to admit I am on the wrong course, so that is why daily and weekly charts are used routinely. We caught the prospect of the current bounce and we’ll tend it and see if it turns into something more. But short of certain parameters, a bounce is all it is.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2014 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.