Will You Light $180,000 on Fire by Taking Social Security at Age 62?

Politics / Pensions & Retirement Nov 18, 2014 - 07:37 PM GMTBy: Dennis_Miller

On the television series Dragnet, Sgt. Joe Friday was known for his calm demeanor while questioning witnesses. When they began to ramble, he would corral them with comments like, “Just the facts, ma’am.” Sound advice for the witness stand, but when it comes to retirement planning, Sgt. Friday was giving the wrong instructions. Instead of asking for “just the facts” we should ask for “all the facts.”

On the television series Dragnet, Sgt. Joe Friday was known for his calm demeanor while questioning witnesses. When they began to ramble, he would corral them with comments like, “Just the facts, ma’am.” Sound advice for the witness stand, but when it comes to retirement planning, Sgt. Friday was giving the wrong instructions. Instead of asking for “just the facts” we should ask for “all the facts.”

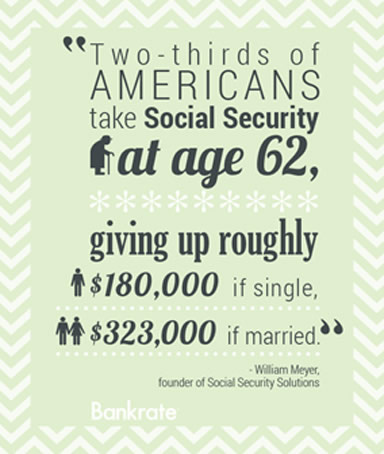

A recent article for Bankrate featured a frightening graphic quoting Social Security Solutions founder William Meyer: “Two-thirds of Americans take Social Security at age 62, giving up $180,000 if single, $323,000 if married.”

With those statistics in mind, holding off until age 70 can seem like a no-brainer. Let’s take a closer look, though, with “all the facts” in plain sight.

The Social Security Administration’s website offers a handy tool for estimating benefits. We used it to run through a few hypotheticals for a man I’ll call Joe Friday.

Let’s assume Joe was born on January 1, 1953. This would make him 62 on January 1, 2015, and he plans to retire immediately before this birthday. Joe would rather sail around the world than work. To keep it simple, let’s say he’s unmarried—or married to his boat, so to speak.

Joe’s current annual salary is $200,000, which puts him above the Social Security maximum ($114,000 in 2014). According to the calculator, if Joe starts receiving Social Security benefits beginning at age 62, his monthly check will be $2,000. If he waits until age 70, he’ll receive an estimated $3,562 per month (all amounts are in 2014 dollars), or $1,562 more. In other words, if he waits eight years, his monthly benefits will increase by approximately 78%.

And there you have “just the facts.” Wait eight years longer… receive 78% more each month. Now, let’s explore “all the facts.”

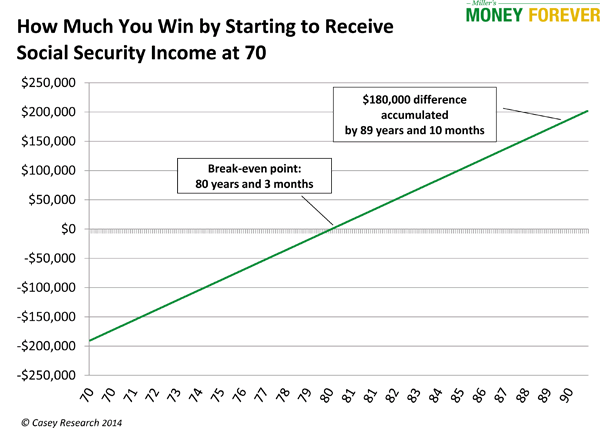

If Joe takes Social Security at age 62, he will have collected $192,000 by age 70. At this point, he is well ahead of the game.

About 10 years and 3 months later, or just after Joe’s 80th birthday, though, he will have received the same total amount in benefits whether he began taking them at age 62 or age 70. Taking the benefits at age 62, however, won’t put him $180,000 behind, as Meyer said, until he reaches 89 years, 10 months of age.

With that in mind, Joe should consider a few details before waiting to take Social Security:

- If he lives past 80 years, 3 months of age, he’ll receive more money. If not, waiting is a bum deal.

- These estimates are just that: estimates. They do not take into account potential changes to the Social Security system. The government could reduce benefits, tax a larger portion, or scrap the program entirely. With so many uncertainties, there’s something to be said for having some money in hand, even if it’s in exchange for more (but not guaranteed) money later.

- These calculations ignore the value of money. They assume Joe will spend, not invest his Social Security, from age 62 until age 70.

So, what is the right decision? If Joe asked me, I’d recommend he consider:

- His realistic life expectancy based on his health, lifestyle, and family history;

- Whether he needs the money now; and

- Whether he’s confident the Social Security system will remain intact throughout his lifetime.

If Joe were married, he’d also want to consider his spouse’s income and expected longevity.

When you make these decisions for yourself, keep in mind that taking Social Security at 62 or 70 are not the only choices. You can start receiving benefits any point after age 62; the amount will go up with each passing month.

I have a high school classmate who, at age 70, told me about his quadruple bypass and how he’d outlived every male in his family… by 20 years! He died shortly thereafter. My own grandmother passed away two months shy of her 100th birthday, and my mother’s twin sister just celebrated her 99th birthday. Although a man who reaches age 65 today can expect to live, on average, until age 84.3, you know many more details about yourself. Although it’s uncomfortable to think about, you can make a more personalized estimate than “84.3.”

Because you can’t know for sure if you’ve made the right decision until after the fact, the best decision is one that weighs all of your personal facts. Headlines and sound bites might make it seem like a no-brainer, but it’s not. I’m sure most of the two-thirds of Americans who take Social Security at age 62 have good reasons for doing so. Many who wait and enjoy increased benefits can likely say the same.

Learn more retirement truths every Thursday by signing up for our free e-letter, Miller’s Money Weekly.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.