7 Questions Gold Bears Must Answer

Commodities / Gold and Silver 2014 Dec 09, 2014 - 01:46 PM GMTBy: Jeff_Clark

A glance at any gold price chart reveals the severity of the bear mauling it has endured over the last three years.>

A glance at any gold price chart reveals the severity of the bear mauling it has endured over the last three years.>

More alarming, even for die-hard gold investors, is that some of the fundamental drivers that would normally push gold higher, like a weak US dollar, have reversed.

Throw in a correction-defying Wall Street stock market and the never-ending rain of disdain for gold from the mainstream and it may seem that there’s no reason to buy gold; the bear is here to stay.

If so, then I have a question. Actually, a whole bunch of questions.

If we’re in a bear market, then…

Why Is China Accumulating Record Amounts of Gold?

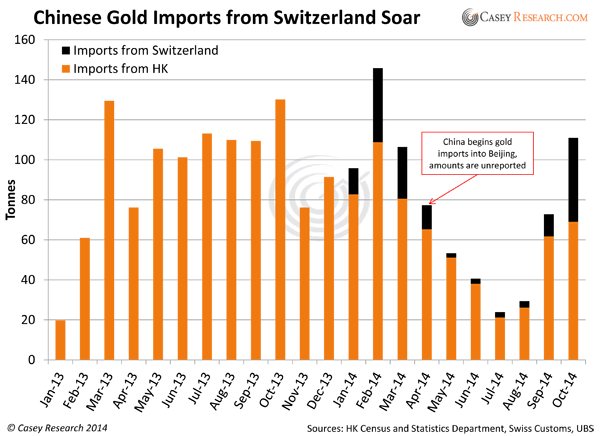

Mainstream reports will tell you Chinese imports through Hong Kong are down. They are.

But total gold imports are up. Most journalists continue to overlook the fact that China imports gold directly into Beijing and Shanghai now. And there are at least 12 importing banks—that we know of.

Counting these “unreported” sources, imports have risen sharply. How do we know? From other countries’ export data. Take Switzerland, for example:

So far in 2014, Switzerland has shipped 153 tonnes (4.9 million ounces) to China directly. This represents over 50% of what they sent through Hong Kong (299 tonnes).

The UK has also exported £15 billion in gold so far in 2014, according to customs data. In fact, London has shipped so much gold to China (and other parts of Asia) that their domestic market has “tightened significantly” according to bullion analysts there.

Why Is China Working to Accelerate Its Accumulation?

This is a growing trend. The People’s Bank of China released a plan just last Wednesday to open up gold imports to qualified miners, as well as all banks that are members of the Shanghai Gold Exchange. Even commemorative gold maker China Gold Coin could qualify to import bullion. Not only will this further increase imports, but it will serve to lower premiums for Chinese buyers, making purchases more affordable.

As evidence of burgeoning demand, gold trading on China’s largest physical exchange has already exceeded last year’s record volume. YTD volume on the Shanghai Gold Exchange, including the city’s free-trade zone, was 12,077 tonnes through October vs. 11,614 tonnes in all of 2013.

The Chinese wave has reached tidal proportions—and it’s still growing.

Why Are Other Countries Hoarding Gold?

The World Gold Council (WGC) reports that for the 12 months ending September 2014, gold demand outside of China and India was 1,566 tonnes (50.3 million ounces). The problem is that demand from China and India already equals global production!

India and China currently account for approximately 3,100 tonnes of gold demand, and the WGC says new mine production was 3,115 tonnes during the same period.

And in spite of all the government attempts to limit gold imports, India just recorded the highest level of imports in 41 months; the country imported over 39 tonnes in November alone, the most since May 2011.

Let’s not forget Russia. Not only does the Russian central bank continue to buy aggressively on the international market, Moscow now buys directly from Russian miners. This is largely because banks and brokers are blocked from using international markets by US sanctions. Despite this, and the fact that Russia doesn’t have to buy gold but keeps doing so anyway.

Global gold demand now eats up more than miners around the world can produce. Do all these countries see something we don’t?

Why Are Retail Investors NOT Selling SLV?

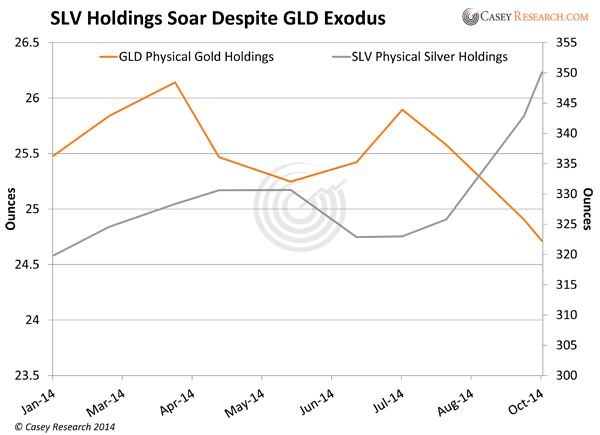

SPDR gold ETF (GLD) holdings continue to largely track the price of gold—but not the iShares silver ETF (SLV). The latter has more retail investors than GLD, and they’re not selling. In fact, while GLD holdings continue to decline, SLV holdings have shot higher.

While the silver price has fallen 16.5% so far this year, SLV holdings have risen 9.5%.

Why are so many silver investors not only holding on to their ETF shares but buying more?

Why Are Bullion Sales Setting New Records?

2013 was a record-setting year for gold and silver purchases from the US Mint. Pretty bullish when you consider the price crashed and headlines were universally negative.

And yet 2014 is on track to exceed last year’s record-setting pace, particularly with silver…

- November silver Eagle sales from the US Mint totaled 3,426,000 ounces, 49% more than the previous year. If December sales surpass 1.1 million coins—a near certainty at this point—2014 will be another record-breaking year.

- Silver sales at the Perth Mint last month also hit their highest level since January. Silver coin sales jumped to 851,836 ounces in November. That was also substantially higher than the 655,881 ounces in October.

- And India’s silver imports rose 14% for the first 10 months of the year and set a record for that period. Silver imports totaled a massive 169 million ounces, draining many vaults in the UK, similar to the drain for gold I mentioned above.

To be fair, the Royal Canadian Mint reported lower gold and silver bullion sales for Q3. But volumes are still historically high.

Why Are Some Mainstream Investors Buying Gold?

The negative headlines we all see about gold come from the mainstream. Yet, some in that group are buyers…

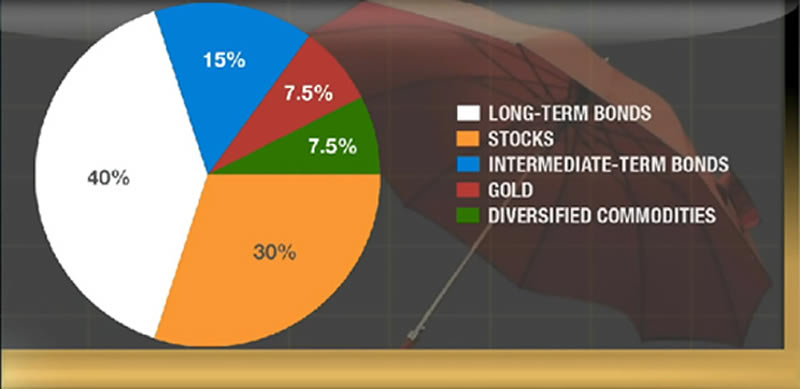

Ray Dalio runs the world’s largest hedge fund, with approximately $150 billion in assets under management. As my colleague Marin Katusa puts it, “When Ray talks, you listen.”

And Ray currently allocates 7.5% of his portfolio to gold.

He’s not alone. Joe Wickwire, portfolio manager of Fidelity Investments, said last week, “I believe now is a good time to take advantage of negative short-term trading sentiment in gold.”

Then there are Japanese pension funds, which as recently as 2011 did not invest in gold at all. Today, several hundred Japanese pension funds actively invest in the metal. Consider that Japan is the second-largest pension market in the world. Demand is also reportedly growing from defined benefit and defined contribution plans.

And just last Friday, Credit Suisse sold $24 million of US notes tied to an index of gold stocks, the largest offering in 14 months, a bet that producers will rebound from near six-year lows.

These (and other) mainstream investors are clearly not expecting gold and gold stocks to keep declining.

Why Are Countries Repatriating Gold?

I mean, it’s not as if the New York depository is unsafe. It and Ft. Knox rank as among the most secure storage facilities in the world. That makes the following developments very curious:

- Netherlands repatriated 122 tonnes (3.9 million ounces) last month.

- France’s National Front leader urged the Bank of France last month to repatriate all its gold from overseas vaults, and to increase its bullion assets by 20%.

- The Swiss Gold Initiative, which did not pass a popular vote, would’ve required all overseas gold be repatriated, as well as gold to comprise 20% of Swiss assets.

- Germany announced a repatriation program last year, though the plan has since fizzled.

- And this just in: there are reports that the Belgian central bank is investigating repatriation of its gold reserves.

What’s so important about gold right now that’s spurned a new trend to store it closer to home and increase reserves?

![]() These strong signs of demand don’t normally correlate with an asset in a bear market. Do you know of any bear market, in any asset, that’s seen this kind of demand?

These strong signs of demand don’t normally correlate with an asset in a bear market. Do you know of any bear market, in any asset, that’s seen this kind of demand?

Neither do I.

My friends, there’s only one explanation: all these parties see the bear soon yielding to the bull. You and I obviously aren’t the only ones that see it on the horizon.

Christmas Wishes Come True…

One more thing: our founder and chairman, Doug Casey himself, is now willing to go on the record saying that he thinks the bottom is in for gold.

I say we back up the truck for the bargain of the century. Just like all the others above are doing.

With gold on sale for the holidays, I arranged for premium discounts on SEVEN different bullion products in the new issue of BIG GOLD. With gold and silver prices at four-year lows and fundamental forces that will someday propel them a lot higher, we have a truly unique buying opportunity. I want to capitalize on today’s “most mispriced asset” before sentiment reverses and the next uptrend in precious metals kicks into gear.

It’s our first ever Bullion Buyers Blowout—and I hope you’ll take advantage of the can’t-beat offers. Someday soon you will pay a lot more for your insurance. Save now with these discounts.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.