Gold - The Weight of Time as Trend

Commodities / Gold and Silver 2014 Dec 15, 2014 - 05:31 AM GMTBy: Submissions

George R Harrison writes: We’ve all felt it. The ‘weight’ of time acting as Trends in the markets.

George R Harrison writes: We’ve all felt it. The ‘weight’ of time acting as Trends in the markets.

Trends that hold longer than expected and whose change in direction appears when we least expect or believe it.

Once time accumulates for an action and establishes a Trend, those trends take a lot of work to change.

It seems like the more time that passes after a task is done and energy has been spent, the harder it is to go back to revisit those tasks again.

It’s like getting motivated to mow the lawn after we’ve done it recently.

It’s easy to think about doing it again a day, 2 even 3-days after doing it, but, come a week or two later, and the ‘weight’ of time comes into the picture making the effort harder and harder to accomplish.

This is a natural function of Life AND Markets.

It takes an expenditure of energy to set things in motion and even more energy to alter or change that motion to another direction.

Markets too, once they’ve obtained the energy and motion (for a trend) tend to stay in that trend and energy flow.

An object (the Market) in motion (trending) tending to stay in Motion (in the same trend direction).

Let’s take a look at a popular market (Gold) to illustrate the point.

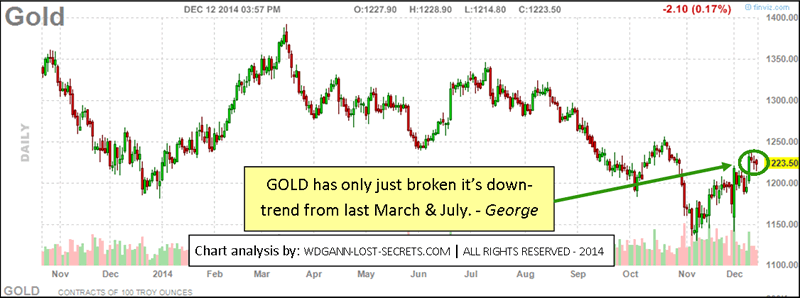

The chart below shows the still-continuing downward trend for Gold at present.

Gold prices have been in a declining trend for over 3-years now. Those 3-years have now accumulated a momentum of their own and ‘lent’ it to the market called ‘Gold’ and, that downtrend doesn’t want to alter it’s direction and is highly resistant to change at this point.

This principle is simply a law of Nature; one we shouldn’t fight. It takes a good deal of ‘energy’ or ‘money’ to alter a trend in motion.

The chart for GOLD above shows just such a trend in progress. In this case, Gold prices have been dropping for 3 years now.

This is a solid trend with the strong Weight of Time behind it.

It will take a great deal of energy to turn this market around. Much like it takes a great deal of time and distance to turn around an oil tanker once it’s in motion and decides to change course. Energy (money, in this case and a great deal of it) will be required to effect the change everyone has been talking about for the last 3 years while waiting for this trend to change.

A MAJOR TREND SHIFT IN GOLD?

NOT YET. But, we’re now seeing the earliest signs of some energy input into changing the trend from downwards to up again. In other words, a gradual shift towards an upwards trend has begun.

These are not at a 3-year level of trend momentum however.

The shorter downward trend periods of 6-months and 1-year have now been broken clearing the way to higher prices again.

But, these higher prices may be of short duration such as 3 to 6 months or less unless sufficient buying power comes into the market to lift prices above $1450/oz. within a month, or $1375/oz. in 6-months. Unless this happens we’re still stuck in a 3-Year downtrend that hasn’t quit yet.

A serious Bull market in Gold is not the way to bet until these price points are surpassed strongly.

In a deflationary world environment, rising prices for a commodity like Gold are pretty hard to justify or even hope for. However, ‘hope springs eternal’ in the minds of investors and traders.

I’ve written on this subject before from several different perspectives to illustrate the same fundamental laws.

When everyone has a ‘precious’ metal, it ceases to be ‘precious’ by definition. When practically everyone has something (like Gold or Silver) where is the demand going to come from to push prices higher? Anyone??

Instead of a trading plan built on wisps of hope (or hurricanes of hype), It’s far better to work within the natural cycles of trend momentum that markets and prices gravitate to in order to read the ‘signs’ that really matter.

What’s encouraged, in other words, is a Human approach to trading that works within the same rule base that the Markets must work within.

Something that gives the user a feeling of control and solid-ground to stand on because they KNOW that they’re using the very same laws that Nature uses to run the World.

There’s nothing as comforting as using analytical methods based on the Universe’s Billions of years of successful application of Natural Laws!

When we recognize that these laws of the Universe are the same laws that govern our lives and that we’re not, in any way, ‘outside’ this System, then we can voluntarily align ourselves with them and make better assessments of market conditions and timing for trading those markets.

Whether a king of manipulators or an everyday trader, we’re all playing in the same sandbox. The Sandbox (the Universe) frames and contains all our possible actions within it’s boundaries and no one can thwart it or escape the Rules of the Sandbox.

What about the massive market manipulation of our times? It turns out that this is nothing new historically and many have prospered during the many other times just like these.

Take comfort and look at it this way; At least the Laws of the Universe are Honest and Incorruptible in their equal application.

In fact, in today’s world, it’s now much safer (and more satisfying) to work within those Universal Rules in order to out-maneuver the man-made schemes and misinformation that are increasingly present in both the markets and their supporting media.

All change is difficult to both accept and act upon. Human Beings are often slow to respond, change their positions or their minds (that’s the Weight of Time coming into play). But, when the Master System that rules this Universe puts these changes of trend into effect, we have no choice but to both accept and act quickly and follow that new Trend. - George

© 2014 Copyright George R Harrison - All Rights Reserved

george@money-tigers.com

Disclaimer: All articles and posts are a matter of opinion (drawn from over 40-years of market research & experience) and areprovided for general information purposes only and are not intended as investment advice. Information and analysis above are derived from sources and utilize privately discovered methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisers.

From website: WDGann-Lost-Secrets.com

----------------------------------------------------------------------------------------

Bio Below . . .

Bio: George R. Harrison's background includes: Hedge Fund assistant manager; an intensely focused 44-year long researcher of the Markets; Market Analyst & Chartist and a recognized WD Gann expert, (having rediscovered and restored-to-print many ‘lost’ Gann techniques through his decades of research work) and creator of several revolutionary market analytical techniques and tools.

Mr. Harrison continues his market research & consultation work while living on the island of St. Croix in the US Virgin Islands.

Current market comments and archived articles may also be found on his website at www.wdgann-lost-secrets.com.

George may be contacted by e-mail at: george@money-tigers.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.