Gold And Silver Nothing Is Ever As It Seems And No Respite For PMs

Commodities / Gold and Silver 2015 Dec 20, 2014 - 07:01 PM GMTBy: Michael_Noonan

An eminent collapse of the US fiat petrodollar? China and Russia, with their enormous build-up of physical gold over the last several years, waiting in the wings to lead a new gold-backed currency? The growing BRICS alliance to unseat the elite's Western NWO and its banking system?

An eminent collapse of the US fiat petrodollar? China and Russia, with their enormous build-up of physical gold over the last several years, waiting in the wings to lead a new gold-backed currency? The growing BRICS alliance to unseat the elite's Western NWO and its banking system?

A growing likelihood on the first question, and no and no to the latter two questions. In fact, the elites are probably doing more to destroy the fiat Federal Reserve "dollar" than any other group or alliance. There has been talk about the US destroying the dollar for at least the past four years. Kyle Bass even made the pronouncement whereby a senior Obama administration official told him, "We're just going to kill the dollar." That is exactly what is happening and coming from "inside information."

What most people refuse to understand, if not even acknowledge, is the extent to which the elites have an utter stranglehold on the world's financial system, and by world we do not mean just the Western world. China and Russia are included. There is no single country that can exist without the machinations of the elite's banking system. They have been running the world for a few hundred years and are masters at it.

Russia has enough gold to back its ruble in some way. Understand that the current price for gold does not represent a fair standard of value. It is vastly undervalued, and one day, the reality of what should be a fair value for gold and silver will occur. They are both money and measures of value. Most people have reversed their thinking and measure the value of PMs by valueless fiat. This is a huge mistake and reflects how well the elites have successfully exercised mind control over the masses to maintain this false belief.

The agenda for a New World Order is at least 100 years old, when bankers and corporate presidents were all aiming to control every aspect of industry via financial manipulation, straight from the well-established Rothschild "game book," as it were. This unabated zeal for world control is not something that has been in the works for just the past several decades. Knowledge of this does not come from an announcement in the New York Times or Wall Street Journal; rather, one has to diligently read through a myriad of source material and then see how the dots are connected.

In a nutshell, if the elites have their way, and to date they remain unopposed, the fiat Federal Reserve Note, aka the debt "dollar," will be replaced with some form of a new international currency, or perhaps SDRs [Special Drawing Rights], an international basket of currencies. All money may exist as computer credits that can be readily tracked. If anyone dare oppose the bankers, poof, your credits just disappeared, and you have nothing. Bankers rely on debt largesse and fear.

There will be no sovereign nations. All countries will be held accountable to the new Wizard Of OZ bankers behind the curtain, much like the experiment called the European Union. The EU may fall apart, but the lessons learned will not be lost, and in fact they will be honed to format what is to come. The handful of banking elite that rule the Western economies will become "elite-er"

What of China and Russia? Both have advocated respect for the IMF with expressed desires to be participants in the system. The system will change, to be sure: no more Federal Reserve fiat "dollar" as the world's reserve currency. Not a few hold out the errant belief that the BRICS nations, primarily China and Russia, will replace the elite's banking system. Absolutely not! The elites are redesigning the next phase of their control over the financial world to include the BRICS, all eager to join the "club" for the first time and be major participants on the financial world stage.

The question is, will Russia make it before the Obama administration, under direct control of the elites, destroys the Russian economy? Perhaps a better question to ask is, CAN the elites take down Russia? Just as the United States, as a physical country was replete with so many natural resources, which have all had their existence sucked out of them, Russia has the most natural resources of the entire world, and the bankers want control over them. There is one big obstacle: Vladimir Putin.

If Putin had his way, he would kick the Russian Central Bank out of Russia. It was created, designed and controlled by the Rothschilds, so Putin has little control over it. The Russian central banking elite have been getting wealthy from their arrangement, and they are not about to give up their Golden Goose.

If you want to understand why Obama has chosen to overthrow the sovereign Ukrainian government and replaced it with a puppet leader that has been conducting genocide against Russian loyalists in Eastern Ukraine, the Donbas area, it is a not-so-indirect [non]declaration of war. This has been followed up by another form of war via all the economic sanctions Obama has been strong-arming the EU to enforce against Russia to their own detriment. The US does not care, as long as it gets its way.

Western bankers will not allow Putin to remove the Russian central bank, as he is trying to do. The elites have a 3-pronged attack against Putin: 1. military threat, [Russia is more than up to the task], 2. economic sanctions, [mostly backfiring and costing the EU more], and 3. Russian banker oligarchs who will do anything to oppose Putin in order to preserve their banker-criminal enterprise. With US history as a guide, presidential opposition, Lincoln, Garfield, Kennedy, and Reagan prove that assassinations have their effect and may not be out of the question.

It is interesting to see the West [really just Wall Street banks] attack the ruble causing it to lose about 60% of its value relative to the fiat "dollar."*** Will it succeed, or is Putin allowing the attack to push down the value of the ruble, and at the bottom rush in to buy as much as he can, using the sale of over-valued Treasury holdings owned by Russia? In the process, flooding the market with US bonds will put pressure on the fiat "dollar," and viola, a reverse financial coup by Putin.

***Russia has less than $700 million in debt, the US has over $18 trillion; Russian debt is about 15% of GDP, the US runs at over 100% of GDP; Russia runs a budget surplus, the US runs a burgeoning deficit; Russia has gold to back it currency, the US now only has the military to back its fiat and increasingly widely shunned "dollar;" Russia has the largest natural resources in the world, the US has depleted or ruined most of its natural resources. With which of these two countries does the rest of the world want to conduct business?

China is not in a position to have its renminbi become a world reserve currency, and that country has been announcing its support in becoming a stronger member in the IMF via participating in SDRs with its national currency. For China, it becomes a major world player and participates in a remake of the financial COMPOSITION [not replacement] of the existing world banking system.

For the elites, it is a match made in heaven. The US, as a spent nation, gets dumped and China becomes a willing replacement in the pecking order. To what degree Russia is a participant remains to be seen. While China and Russia have become stronger trading partners, China is not above seeing Russia weakened to China's advantage. All is never as it seems.

2014 is ending unexpectedly for PMs, considerably weaker than what most thought would be sharply higher prices. Based on what the charts are conveying, at least the initial part of 2015 will not fare much better. Supply and demand are not the driving factors. World financial dominance is. A number of PM "experts" are not focusing on this aspect.

If it has not yet become clear, seeing how the banking elites are attacking Russia, militarily and economically, willing to destroy that country, and seeing how the US is being used in its own self-destruction, willing to impose its military might and debt sabotaging of other nations, then those who cannot understand the process will never understand how gold and silver have become useful pawns in the service of the elite bankers and now how China is positioning itself to become the next United States as a world superpower. The role of Russia remains a question. The role of gold and silver is also a burning question.

As to substantially higher gold and silver prices in the "great reset" scheme, it makes no sense for the still-in-control elites to allow PMs to be dramatically revalued too high. Neither gold nor silver will ever be allowed to compete with their fiat monetary system. We have no clue how gold and silver will ultimately be re-priced, nor do we think does anyone else, despite all the numbers being bandied about.

What we know for sure is that the trend of any market is the most powerful and most influential force, and this week's analysis of the PMs market is a simple fact-based one. It takes time and effort to change a trend. To whatever degree these market are being manipulated, even the manipulators eventually "show their hand" through price and volume activity. We see no change for prices remaining low, if not even making newer recent lows in the months ahead.

It does not alter the view and necessity for the ongoing accumulation of the physical metals, for having them will be essential when the big "reset" finally hits. Time remains on the side of the buyers, but low prices may give way to higher premiums in order to keep the game alive.

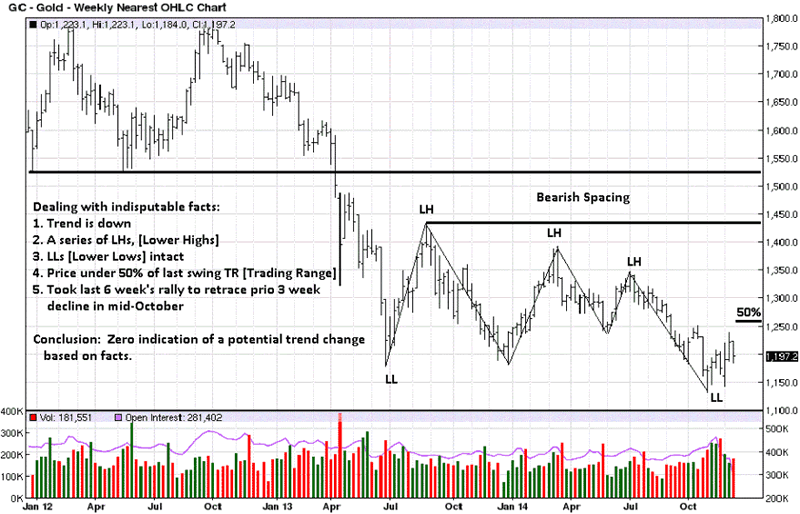

Last week, we wanted to see gold rally strongly on increased volume, taking out 1250 with ease. That did not happen and until it does, gold remains on the defensive and subject to staying at current levels. The longer gold stays at these levels, the greater the probability for another low. Chart comments provide the factual explanation.

Gold Weekly Chart

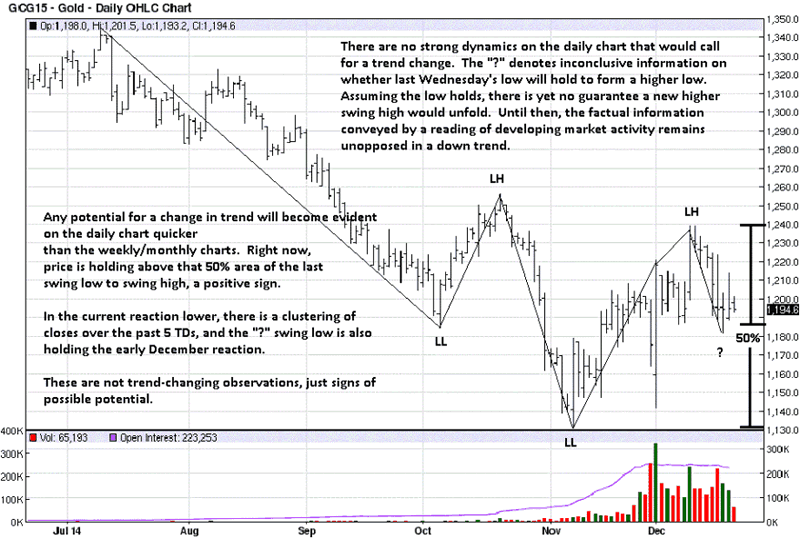

It remains to be seen if last week will become a higher swing low by holding or if price will continue lower. There is some evidence of support at last week's low, but we do not need to know in advance if support will hold or fail. Instead, let the market confirm any potential strength, and then look for a buying opportunity. Keep in mind, while the overall trend remains down, any rallies are suspect in their sustaining power.

Gold Weekly Chart

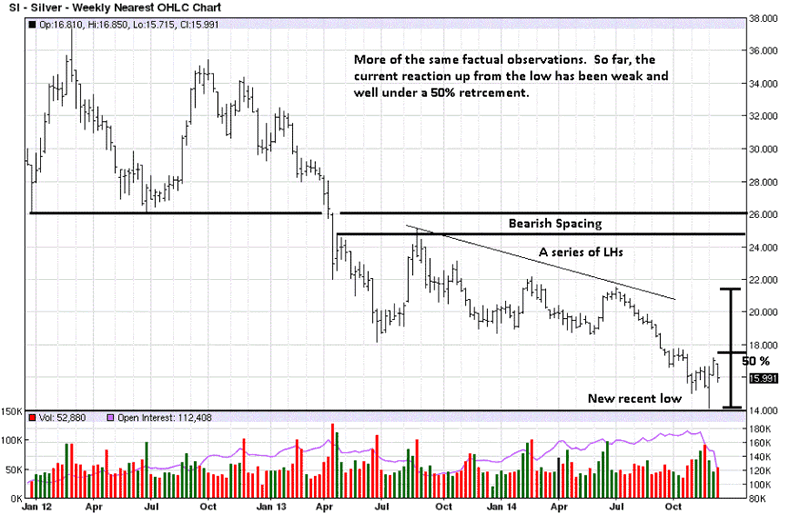

Put into the same context as described for weekly gold, there is not much else to add for silver, and keeping it simple makes the most sense. There is nothing that addresses being on the long side for paper silver based on this chart.

Gold Weekly Chart

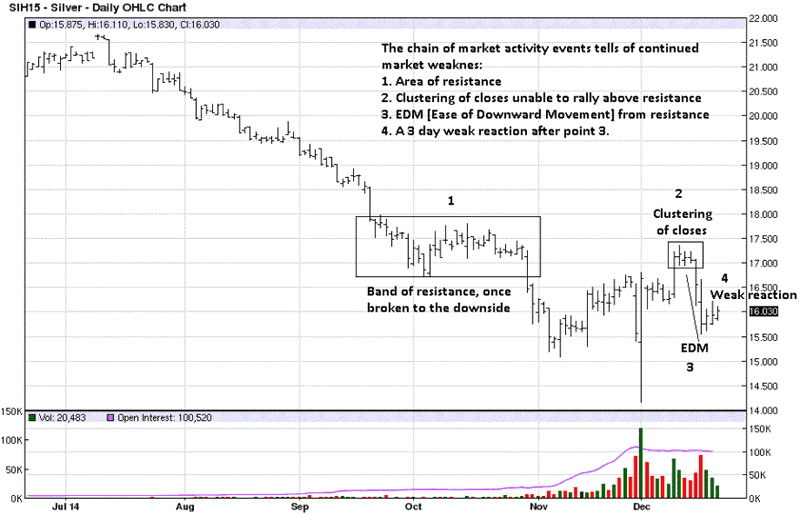

When accepting the power of a trending market and not viewing it from a biased perspective anticipating "inevitably higher" prices, you can better see how developing market activity provides a clearer landscape for decision-making. It is not always so easy to take such a clinical look at the markets, but seeing how steps 1 through 4 unfolded in a logical way is the best example of how to use market generated information.

Silver is at point 4, a weak reaction. Unless or until there is evidence of a strong rally, supported by volume and upper range closes, a weak reaction, like this, will lead to lower prices in an effort to discover demand. The markets have worked this way for over a 100 years.

Gold Weekly Chart

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2014 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.