2015 - A Great Investment Year Ahead!

Stock-Markets / Financial Markets 2015 Dec 29, 2014 - 10:37 AM GMT In these closing days of 2014, I’d like to thank you all, (Clients, Students and readers alike), for an exciting year of discovery, teaching and market predictions.

In these closing days of 2014, I’d like to thank you all, (Clients, Students and readers alike), for an exciting year of discovery, teaching and market predictions.

The Holidays are a useful time to reassess the year past and place emphasis on the positive events and how they have brought us to today. The Year 2014 offered lots of positive market surprises. Positive, that is, for those who saw them coming and made plans to accommodate the change.

We can look forward to even greater potential for change going forward into 2015.

There are some really strong trends that are approaching or are reversing this coming year. Change is afoot and change is where the greatest opportunities for rapid appreciation of profit occurs.

The title of this article: ‘A GREAT YEAR AHEAD!’ needs a little explanation, lest it be misunderstood. Let’s define a ‘Good’ Year as one that an investor can survive and prosper through.

A ‘Great’ Year then, we’ll define is one in which we not only survive and prosper, but one in which we profit so greatly as to offset YEARS even DECADES of previous results. That would truly be a Great investing Year would it not?!

We’ll only be able to do this by following the tide of History and the Markets.

Anticipation of upcoming great events based on sound mathematical rules, places one at the ready for those events and in the best position to profit from them. These are the tried and true rules of good business.

Cycles of War Create Cycles of Prosperity

Among the fortunate discoveries uncovered during our continued WD Gann, independent research work and, associated with the Law of Vibration has been finding uncanny years and decades of repeating events that lie far beyond the markets alone.

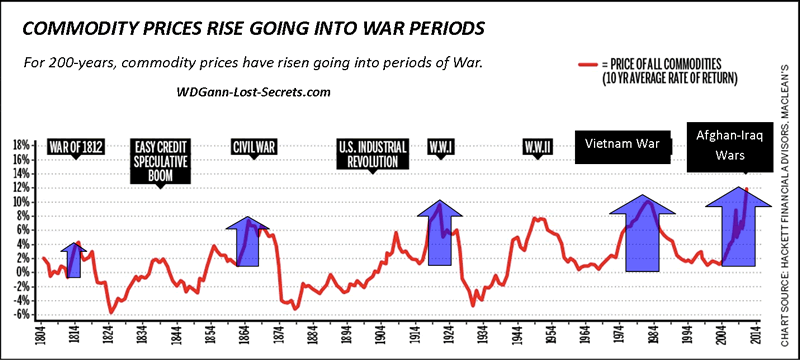

The Cycles of War and Prosperity are just two of these arenas. Though talk of war is unseemly at this time of the year, even Mr. Gann called attention to the fact that these very war periods brought about rising commodity prices and were strong drivers of markets.

Indications are that we’re in the early lead-up years to such a time again and moving towards that period (in 2019-2020) that will be very vulnerable to pressures for a new war period.

As can be seen on the 200-year commodity chart above, this cycle is almost constant in it’s application.

In short, it’s a ‘Rule’ you can largely depend on and a confirmation tool for the times we’re in. Although the chart above doesn’t cover our 2014 period, we’ve continued the price trend downwards from their peak in 2011. Therefore, despite the headlines, downtrending commodity prices indicate that there’s low risk of a major war at this time.

When prices start flirting with breaking out of this downtrend or prices begin a new rising trend, that would be an important sign that the rumblings of war are starting to reach a significant worldwide level.These ‘rumblings’ are too low to be heard by the common man but not too low to affect prices which reflect the change in demand by the parties planning wars. This is a bit early (about 4-years early by my count), but, something we should stay on the lookout for during this next year.

Once we’re aware of the ‘Times’ we’re in, and, we finally come to accept that Mankind hasn’t changed it’s behaviors or responses in the last several hundred (or thousands of ) years, then, we can prepare for the inevitable and home in on the details using simple historical checklists to confirm the trends under way.

Ultimately, We All Want Security

As businessmen and women, we can’t afford to get caught up in the emotions of events. We must deal with the reality of events.

That being the case, we seek out our security by finding the profit within the reality of events or markets.

Whether a market is going up or down, we, as investors, are in the unique position of being able to profit from both up and down price movement events! However, to fully take advantage of this opportunity, we can’t afford to assign an ethical or emotional context to what is clearly a historical (and mathematical) event. In other words, ‘what’ the market is which we’re trading (or the news or unpopularity behind it) should not be our main concern. Rather, ‘how’ a market is behaving within the boundaries of it’s unique structure and cycles should be our focus.

Let History Be Our Guide

Analysis is required to give us the context of a market’s actions and History can also guide us in the broad sense.

If, for example, our premise and analysis indicates that a major world war period is coming, then, we should also look at the surrounding economic and political environment for supporting signs that would accompany such an event as we move towards it in Time.

What should we look for as confirming signs?

Commodities should start working their prices upwards from strong declines going towards and during war years.Watch for this.

Politics: History shows that Worldwide political chaos comes on stage with new shifts in power bases dominating the pre-war scene. Reading the headlines today will certainly confirm that this is present today: CHECK.

The Economy: International economies tend to be in flux with money seeking safety in the world reserve currency of the time: CHECK.

The PEOPLE: During these periods the masses get restless and lawless. War is a great distraction to quiet threats to the political ‘status quo’. Political parties act only to save themselves and not the people whom they claim to represent. CHECK.

Well, you get the drift here. There are already a few confirming elements (3 out of 4 in the above list) to our future war premise and, those confirmations which revolve around the markets (changing of long-term trends) offer special profit opportunities especially during these very times when others will be confused, distracted or frozen in fear.

Remember, we don’t have to ‘like’ the events that are coming, but, they’re coming anyways.

We just have to be able to take advantage of the reality that this is how it is. There are mathematical cyclical and karmic reasons for repeating these tedious periods so, we can’t stop the karmic judgments of entire nations single-handedly nor should we attempt to for our own good.Rather, we need to become aware of the flow of events and where they’re headed. Then, place ourselves in the appropriate and best rewarding position as events unfold as they inevitably must.

Success in the markets lies in the Knowledge of Times & Trends as well as knowing the ‘signs of the times’ that we’re in. Count on the fact that knowledge drives out fear. Without fear to restrain & confuse us, there are no limits to opportunities to take advantage of except those limits we set for ourselves.

Get ready for a truly Great Investment Year! - George.

© 2014 Copyright George R Harrison - All Rights Reserved

george@money-tigers.com

Disclaimer: All articles and posts are a matter of opinion (drawn from over 44-years of market research & experience) and are provided for general information purposes only and are not intended as investment advice. Information and analysis above are derived from sources and utilize privately discovered methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisers.

From the website: http://www.WDGann-Lost-Secrets.com

----------------------------------------------------------------------------------------

Bio: George R. Harrison's background includes time as a Hedge Fund assistant manager; an intensely focused 44-year long period as a researcher of the Markets, a Master Market Analyst & Chartist; a world-recognized and uniquely qualified WD Gann expert, (having rediscovered and restored-to-print many ‘lost’ Gann techniques through his decades of research work) and creator of several revolutionary market analytical techniques and tools.

Mr. Harrison continues his market research & private client consultation and instructional work while living on the island of St. Croix in the US Virgin Islands.

Current market comments and archived articles may also be found on his website at www.wdgann-lost-secrets.com.

George may be contacted by e-mail at: george@money-tigers.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.