Stock Market Happy New Year

Stock-Markets / Stock Markets 2015 Jan 03, 2015 - 03:38 PM GMTBy: Tony_Caldaro

The market started the week at SPX 2089. After hitting an all time high at SPX 2094 by noon Monday, the market traded lower for the rest of the week. For the week the SPX/DOW lost 1.35%, the NDX/NAZ lost 1.80%, and the DJ World index dropped 1.30%. Economics reports for the holiday week were sparse, and biased to the downside. On the downtick: construction spending, the Chicago PMI, ISM manufacturing and the WLEI. On the uptick: consumer confidence and the monetary base. Next week’s report will be highlighted by the FOMC minutes and the Payrolls report.

The market started the week at SPX 2089. After hitting an all time high at SPX 2094 by noon Monday, the market traded lower for the rest of the week. For the week the SPX/DOW lost 1.35%, the NDX/NAZ lost 1.80%, and the DJ World index dropped 1.30%. Economics reports for the holiday week were sparse, and biased to the downside. On the downtick: construction spending, the Chicago PMI, ISM manufacturing and the WLEI. On the uptick: consumer confidence and the monetary base. Next week’s report will be highlighted by the FOMC minutes and the Payrolls report.

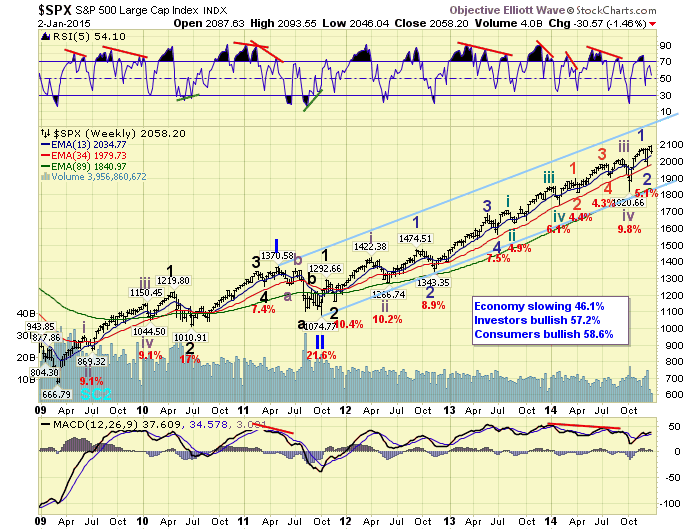

LONG TERM: bull market

As we enter 2015 we are maintaining the same long term count as we have for past few years: a five primary wave Cycle wave [1] bull market underway. While this bull market has lasted longer than nearly everyone expected. It has maintained a reasonable OEW pattern, even through this very extended Primary wave. To recap: Primary waves I and II completed in 2011 and a quite complex Primary III has been underway since then. Primary I divided into five Major waves, with a subdividing Major wave 1 and simple Major waves 3 and 5. Primary wave III appears to be doing just the opposite with its five Major waves. Major wave 1 was simple, and Major wave 3 has thus far subdivided quite a bit. In fact, we are counting the recent activity from the October 2014 Intermediate wave iv low as Int. v of Major wave 3. And it appears to be subdividing into five Minor waves.

Should the count be correct, we would expect the current uptrend to reach around SPX 2214. Then after a correction of about 5%, the market should then make new highs to complete Major wave 3. Then after a correction of about 10% for Major wave 4, Major wave 5 should take the market even higher. It would appear this bull market still has plenty of uptrends, and time, before it concludes.

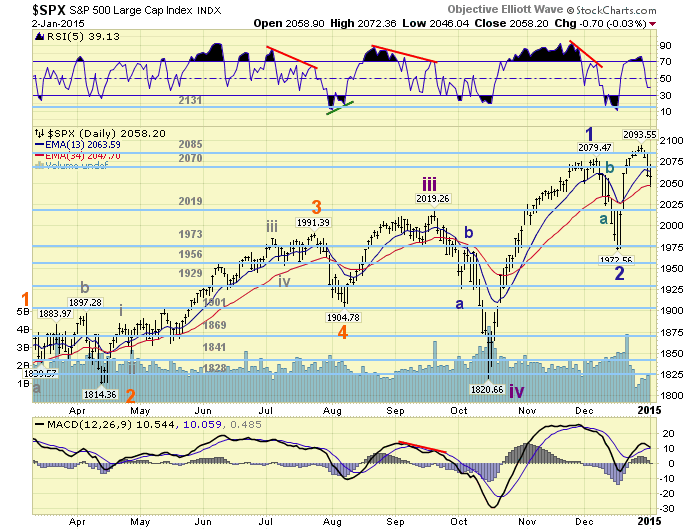

MEDIUM TERM: uptrend

After completing Intermediate wave iv in October at SPX 1821, the market rallied to SPX 2079 by early December. Then after a 5% correction into mid-December to SPX 1973, the market rallied to new highs just before year’s end. We have labeled the SPX 2079 high as Minor wave 1, and the 1973 low as Minor 2 of Intermediate wave v. The current uptrend from that low thus far is only part of Minor wave 3.

When one reviews the RSI on the daily chart they will note that uptrends get, and stay, quite overbought for quite some time before they top out. This one just barely hit overbought before declining to below neutral this week. It still appears to have plenty of upside left based on this indicator alone. Medium term support is at the 2019 and 1973 pivots, with resistance at the 2070 and 2085 pivots.

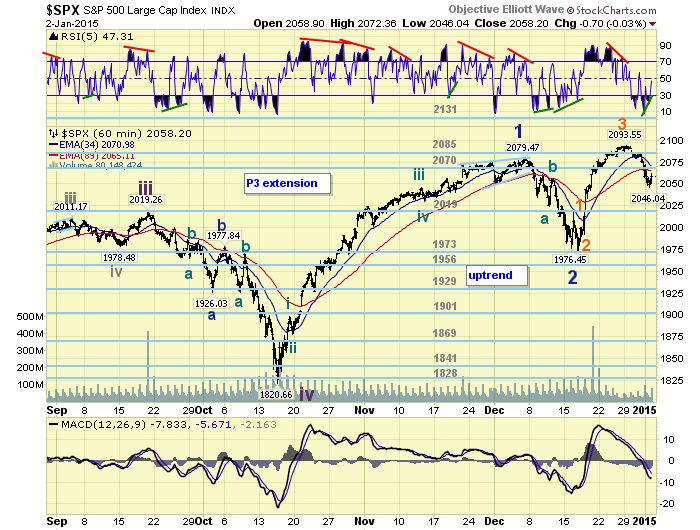

SHORT TERM

From the Minor wave 2 SPX 1973 low we have counted four waves up to Friday’s SPX 2046 low: 2012-1992-2094-2046 thus far. Our preference remains to count these four waves as Micro waves 1-2-3-4 of Minute wave one of Minor 3. However, the recent pullback of 48 points (2094-2046) was a lot larger than expected, and larger than that wave 2 pullback of 20 points (2012-1992). With this in mind, it is possible that Minute wave one ended at SPX 2094 and the recent pullback is Minute wave two.

Nevertheless, we are maintaining the Micro 1-2-3-4 count because of the Fibonacci relationships that have unfolded. Micro wave 1 (1973-2012) rose 39 points, Micro 2 retraced 50% of that advance to SPX 1992. Micro wave 3 rose 102 points, or an exact 2.618 relationship to Micro 1. Thus far, Micro wave 4 has retraced nearly 50% (2043) of that advance at Friday’s 2046 low. Should the market continue its pullback early next week, dropping below SPX 2040, then we would consider this pullback Minute wave two. Should the market rally beyond the OEW 2070 pivot, then we would consider Micro wave 5 underway. So the parameters for next week are below SPX 2040, and above SPX 2070. The first suggests a test of the 2019 pivot range, the second new highs are next. Short term support is at SPX 2058 and SPX 2046, with resistance at the 2070 and 2085 pivots. Short term momentum ended the week with a positive divergence.

FOREIGN MARKETS

The Asian markets were mostly higher on the week gaining 0.8%.

The European markets were all lower on the week losing 1.2%.

The Commodity equity group was mixed and lost 2.3%.

The DJ World index lost 1.3% on the week.

COMMODITIES

Bonds continue to downtrend but gained 1.0% on the week.

Crude is still in a downtrend and lost 4.4% on the week.

Gold remains in an uptrend but lost 0.8% on the week.

The USD is still in an uptrend and gained 1.2% on the week.

NEXT WEEK

Monday: Auto sales. Tuesday: Factory orders and ISM services. Wednesday: the ADP, Trade deficit and the FOMC minutes. Thursday: the ECB meets, weekly Jobless claims and Consumer credit. Friday: Payrolls (est. +245K) and Wholesale inventories. Best to your weekend, week, and new year!

CHARTS: http://stockcharts.com/public/1269446/tenpp

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2014 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Tony Caldaro Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.