Why the Paper-Price of Gold and Silver Matters

Commodities / Gold and Silver 2015 Jan 09, 2015 - 11:30 AM GMTBy: Joseph_Russo

Part 1: If you are at all inclined to agree with the largely defensive and reflexive concept that paper-prices (i.e. dollar-values) for all products, commodities, and services are virtually meaningless, you're going to want to read this.

Part 1: If you are at all inclined to agree with the largely defensive and reflexive concept that paper-prices (i.e. dollar-values) for all products, commodities, and services are virtually meaningless, you're going to want to read this.

If you are especially quick in holding to the notion that the paper-price valuations of gold and silver simply don't matter, read on - we're going to share some opinions as to why all of these paper-prices do matter.

In part-2, Cash Flow is King, without getting too bat-shit crazy about it, we will provide rational suggestions for building and protecting prudent strategies that can help you more effectively insulate yourself against the plethora of uncertainties the future holds surrounding the governments fiat dollar system.

Okay, so by now, most everyone on the planet with half-a-brain knows that the fiat paper currency and credit, which governments and banks fabricate out of thin air - is a complete fraud.

The current monetary paradigm is simply an imposed belief system, nothing more.

The current monetary paradigm is akin to an insane cult-like religion, whereby a circular cancer of ignorance and corruption takes such deep root that we end up where we are today, with a broken system of the many serving the few under a rather selective and unfairly biased rule of law. By design, the type of hierarchy enabling this system favors and benefits a small minority within its upper ranks and core leadership.

Subject to such impositions, each of us has no choice but to accept the varied stations of financial slavery under which this egregiously flawed currency scheme enforces its tyrannical set of laws. Law's passed by those at the epicenter of - and who benefit the most - from perpetuating the fraud.

3 Key reasons Why dollar-based paper-prices matter

- We all think, measure, and evaluate everything in terms of dollars.

- Similar to the native English language, the dollar-centric valuation and accounting system is a permanent strand of the American DNA.

- Given such deeply rooted cultural norms, it is difficult to imagine the general population capable of grasping any alternative standardized metric of valuation and accounting.

The "dollar-system" has indoctrinated several generations of honest, well meaning, and intelligent people to think only in terms of dollars - including those who have awakened fully to the dreadful charade.

We calculate everything having to do with ordinary life using dollar-based accounting. Families and businesses budget their income and expenses using dollar-based accounting - virtually everything we do is based upon and thought of in terms of dollars and cents - after all, its money right, and that's what makes the world go round.

Over the past hundred years, rather than adopting new forms of legal tender and currency metrics to correct such things as deceptive monetary debasement, or to reconcile insurmountable debt levels, or resolve a rich history of financial crisis and quasi-national defaults, such mathematically necessary corrective adjustments instead manifest as inflation within the dollar-based anchor.

Although it could be acute and hyper elsewhere in the world, for the average American, inflation more often occurs as a slow and persistent increase in the general cost of living, loss of purchasing power, and degradation of the productive nature of earned-money saved - accompanied by a lack of corresponding increases in ones earning and income capacity.

Inflation (just like taxes) is outright theft in its purest form.

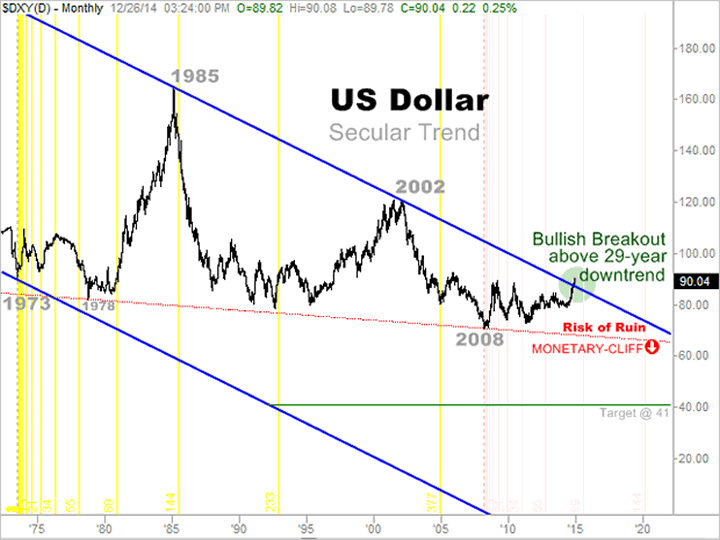

A Picture Paints A Thousand Words

Sadly, for the average person, the evidence of reality/deception inferred by a long-term price chart of the US dollar has no meaning or relevance to their lives whatsoever.

Why is that? It's because in the mind of the typical American, a dollar is in their frame of reference, a fixed value metric. With the dollar fixed in most minds as a stable and reliable unit of measure and account, a dollar is always a dollar.

With flawed fixed perceptions such as those associated with the American fiat dollar standard, in the minds of the vast majority of Americans, it is prices of basic goods and services that fluctuate up and down - not the purchasing power of their government issued money relative to such goods and services.

Since the installment of a privately owned federal reserve system in 1913, American dollars produced by this questionable entity have lost more than 90% of their value - or purchasing power.

Since 1985 alone, the $DXY (US-Dollar) chart illustrated, shows more than a 40% loss of value - or purchasing power. Interestingly, the private Federal Reserve does not technically produce American dollars, it creates Federal Reserve notes, which is the legal tender we carry around in our pockets and pay our bills with today.

In addition to these glaring realities, three items of particular interest are also resident in this price chart.

- The recent bullish breakout above a 29-year downtrend line

- The thin red-dashed Monetary Cliff line - or Risk of Ruin trajectory

- The noted downside price target @ 41 $DXY

Regarding the first point of interest, it is critical that we watch the staying power of the current bullish dollar breakout. The bullish sentiment can continue for some time, and accelerate to levels considerably higher than where they are today.

In contrast, the bullish breakout may turn out to be false, or a head-fake that may eventually reverse course, turning the dollar firmly back to the downside. Of course, only time will tell.

With regard to the Monetary Cliff line, if at any point in the future the price of $DXY falls decisively beneath this risk of ruin trajectory, and is unable to claw its way back above it, we would consider such an outcome the final nail in the dollar coffin, sealing its eventual fate toward complete failure.

What would happen on path toward such a failure is anyone's guess. A dollar collapse and re-set could simply manifest in more of the same shenanigans under a new elite-run global monetary scheme, which is the most likely result.

Alternatively, in a more rational and fair-minded world, a monetary re-set could produce a more durable, sustainable, and self-correcting free market monetary system. A monetary system beyond the control of centralized governance is without question, the ideal system for Main Street.

Wall Street and Washington however, heavily vested in and rewarded by the prevailing status quo, would crumble at the loss of controlling the issuance of money and credit. Guess which side wins the fight over such a re-set battle.

Relative to our last point of interest, the bearish target of $DXY 41 (though currently dormant) shall remain viable until (when/if) the dollar price is able to move up above the peak it set in 2002 near the 120 level.

That's it for part 1. In part-2, which you can read here, we'll talk further about why paper prices matter to gold and silver investors specifically - and we'll provide a medium-term chart of the US dollar with Elliott wave counts along with a few upside price target projections directly ahead.

Until Next Time,

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2011 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.