Global QE and the Gold Price

Commodities / Gold and Silver 2015 Jan 23, 2015 - 04:17 PM GMTBy: Clif_Droke

After months of waiting, the European Central Bank (ECB) finally carried through with its stated promise of unlimited monetary support to its ailing economy. The ECB announced its own version of quantitative easing (QE) on Thursday, a move which lifted the dark clouds that have recently hung over financial markets.

After months of waiting, the European Central Bank (ECB) finally carried through with its stated promise of unlimited monetary support to its ailing economy. The ECB announced its own version of quantitative easing (QE) on Thursday, a move which lifted the dark clouds that have recently hung over financial markets.

In March the ECB will begin purchasing 60 billion euros' worth of government and corporate bonds through September 2016. In response to the announcement the equity markets of several major countries rallied while the price of gold and silver also rose.

Gold also received a boost after the Danish central bank reduced its key interest rate for a second time this week, underscoring the concerted nature of the monetary policy response. Central banks the world over are finally waking up to the threat of deflation and have responded in lock step this week. On Wednesday, the Bank of Japan lowered its inflation outlook to 1% from 1.7%, which boosted the yen. Meanwhile the Bank of England held off on a previously announced intention to increase interest rates, which resulted in a 1.63% rally in the FTSE stock index.

The great danger facing the global economy in recent months has been the threat of deflation. The U.S. has been the lone standout as its economy has proven resilient and has been largely immune to deflationary pressures (with the gasoline price being a conspicuous exception). The great debate raging among economists has been whether and for how much longer the U.S. can hold out against the global economic slowdown. That question may now be moot thanks to the latest European central bank announcements. Indeed, equity markets have discounted this and investors are clearly eager to embrace loose money.

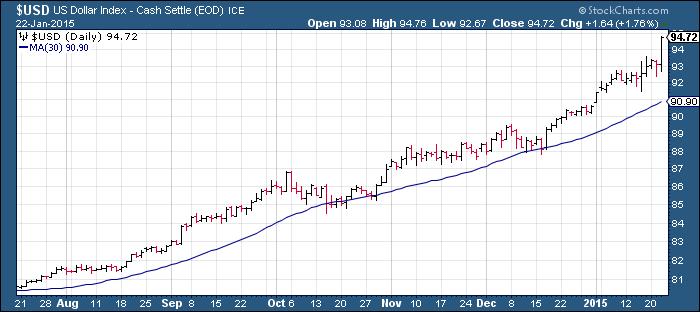

Yet investors haven't completely cast off their fears as evidenced by Thursday's rally in the U.S. dollar index to yet another multi-year high. By contrast, oil, copper and other economically-sensitive commodities were down on Thursday despite the ECB announcement. Could it be that investors aren't quite ready to believe the seriousness of central banks' commitment to monetary stimulus?

Investors certainly can't be blamed for being skeptical given how long it took European banks to respond to the deflationary threat. Foot-dragging is a universal policy among central banks, even when faced with a major economic crisis (witness the slowness of the Federal Reserve's response to the 2007-2008 credit crisis). When central bankers finally decide to act, however, the policy response tends to be both emphatic and sustained and nearly always has the desired effect of countering deflation.

Critics maintain that QE "doesn't work" but there's no denying the efficacy of the Fed's QE program in staving off deflationary pressures in the wake of the 2008 credit collapse. Without it the U.S. almost certainly would have suffered another Great Depression. Indeed, the one ingredient missing that has prevented a re-inflation of global economies in the wake of 60-year cycle bottom last October has been the austerity (or semi-austerity) policies in many European and Asian countries. But now that policy makers are finally realizing the folly of such policies, deflation's days are numbered in the euro zone. Other countries may soon follow the ECB's lead, thus fostering the re-inflation of the global economy.

Now that the promise of coordinated global monetary stimulus may soon become a reality, what are the intermediate-term implications for gold and silver? The precious metals should continue to benefit from the uncertainty that still surrounds the global economic outlook. Investors aren't likely to shake off their fears of deflation overnight and as long as even the slightest apprehension remains, gold is likely to benefit. But what happens when the promise of global QE becomes an established reality? At that point there may be an adjustment phase where gold and silver prices enter lateral trading ranges. In the overall scheme of things, though, gold and silver will likely benefit in the early stages of QE.

The U.S. experience with QE from 2009 through 2014 teaches that the precious metals benefit from the first few years of QE. The reason is because it usually takes investor psychology a good three years to adjust to the reversal of a major economic or financial market trend. Gold's price rallied from late 2008 through the summer of 2011 before entering a bear market. That's pretty close to the traditional 3-year period of psychological adjustment.

If the U.S. QE experience teaches us any lesson it's that a pan-European and pan-Asian QE should have a similar impact on investor psychology. The foreign investors who have incessantly worried about the impact of deflation will likely take a while to completely shake off these fears. It certainly won't happen overnight. As long as even the vestige of fear persists, gold can benefit from it.

Mastering Moving Averages

The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. The moving average is one of the most versatile of all trading tools and should be a part of every investor's arsenal. Far more than a simple trend line, it's a dynamic momentum indicator as well as a means of identifying support and resistance across variable time frames. It can also be used in place of an overbought/oversold oscillator when used in relationship to the price of the stock or ETF you're trading in.

In my latest book, "Mastering Moving Averages," I remove the mystique behind stock and ETF trading and reveal a completely simple and reliable system that allows retail traders to profit from both up and down moves in the market. The trading techniques discussed in the book have been carefully calibrated to match today's fast-moving and sometimes volatile market environment. If you're interested in moving average trading techniques, you'll want to read this book.

Order today and receive an autographed copy along with a copy of the book, "The Best Strategies For Momentum Traders." Your order also includes a FREE 1-month trial subscription to the Momentum Strategies Report newsletter: http://www.clifdroke.com/books/masteringma.html

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.