ECB QE Action - Canary’s Alive & Well

Stock-Markets / Financial Markets 2015 Jan 26, 2015 - 08:38 PM GMTBy: Gary_Tanashian

Excerpted from this week’s Notes From the Rabbit Hole (NFTRH 327), a 35 page report covering economic data and indicators, US and global stock markets, commodities and clear technical and macro fundamental parameters on gold, silver and the miners…

Excerpted from this week’s Notes From the Rabbit Hole (NFTRH 327), a 35 page report covering economic data and indicators, US and global stock markets, commodities and clear technical and macro fundamental parameters on gold, silver and the miners…

Canary’s Alive & Well

This week we will cover the ECB QE action, Euro, USD and their implications for global trade. We’ll also update a still-intact rally in gold, silver and the miners along with some (NFTRH+) trade opportunities. But first let’s review December’s Semiconductor Equipment sector Book-to-Bill ratio, just out on Friday evening and discuss some of the dynamics in play with respect to the ‘b2b’ and the US economy.

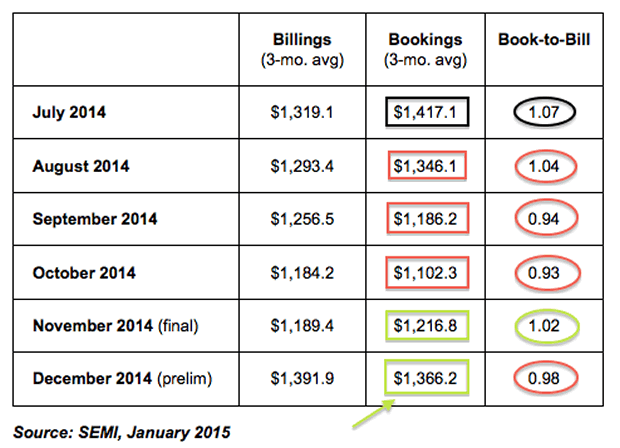

From Semi.org: The three-month average of worldwide bookings in December 2014 was $1.37 billion. The bookings figure is 12.3 percent higher than the final November 2014 level of $1.22 billion, and is 1.1 percent lower than the December 2013 order level of $1.38 billion.

“While three-month averages for both bookings and billings increased, billings outpaced bookings slightly, nudging the book-to-bill ratio slightly below parity,” said SEMI president and CEO Denny McGuirk. “2015 equipment spending is forecast to remain on track for annual growth given the current expectations for the overall semiconductor industry.”

For our purposes in gauging the US economy, it is the ‘Bookings’ category that is most important, because orders booked today represent future economic activity. So while the actual b2b has declined a bit, it was due to accelerated billings with bookings actually increasing in December.

As for Mr. McGuirk’s forecast, we’ll take that with a grain of salt as this highly cyclical industry in particular is subject to sudden re-do’s when it comes to forecasts. With positive trends currently firmly in place, what is he going to say ‘the trends have been good but we have a feeling it is all about to grind to a halt’?? We’ll just robotically update the b2b each month going forward and use actionable data.

For now, the Canary in the Coal Mine is chirping away, and so a key forward-looking US economic indicator is fine. But you may recall that in Q4 2014 we drew a parallel between high end Semiconductor fab equipment and new Machine Tool sales. So with the caveat that I have no hard data to correlate year-end Semi Equipment sales dynamics with those of Machine Tools, we wondered if the SEMI b2b might get a December bump just as we are able to set our watches by year-end (for tax management considerations) Machine Tool sales. I have marked up the graphic from EDAdata.com:

Far from the days of the skilled machinist deftly turning handles with great precision while making calculations to tight tolerances, today’s machinist is a programmer with a CAD/CAM system and wireless data download to what are in some cases $1,000,000 or higher production beasts. A typical range is in the $150,000 to $700,000 per unit. One machine can easily cost more than a fine 5 bedroom home in a nice neighborhood. The point is, this ain’t Grandpa’s machining industry. It is high end manufacturing technology.

We have been thinking about the strong US dollar and its likely effects on the US economy over time. So far, there is some moderation in the data that mainstream economists and financial media focus on. The December ISM report on manufacturing moderated, with particular focus on ‘New Orders’, Wage growth has failed to take hold, Jobless Claims bumped up last week above expectations and Existing Home Sales came in well lower than forecast by economists.

But generally, the picture is still okay, albeit wavering. Oh, the Consumer is giddy. Okay, well… we have been in an ‘as good as it gets’ phase so why shouldn’t he get out there and run up his credit card a little?

The point is, we have expected a couple things…

1) The relentless strength in USD to eventually wear away at US manufacturing and exports (this maybe be in its very early stages) and…

2) A year-end phenomenon in the US Machine Tool industry to remain unbroken. This would see a spike in December’s Machine Tool sales primarily due to reasons other than the economy.

The usual sources in the mainstream economic analysis sphere are looking at the usual economic data sets. We will watch those, but to be as early as possible in getting real economic signals we need to watch the Canaries that started the whole economic upswing as we noted in real time in January of 2013; Semiconductor Equipment and by extension, manufacturing in general. These led by a country mile the now readily observable economic revival.

Machine Tools sales are due for a spike and we have identified one company (NFTRH+, reviewed next segment) as a short after the year-end sales bump and continued stock price appreciation. We also have another company from the long side (NFTRH+, also reviewed next segment) for a trade. Company #1 is a standard US based machine tool builder with a lot of competition and Company #2 is also based in the US, but has far less competition for its unique product line. Back on the main topic…

Bottom Line

Certain economic data have softened in recent weeks in line with the idea that an impulsively strong US dollar can start to fray the edges of certain industries and sectors. But we will await confirmation by the Canary that started it all in January of 2013. SEMI just reported a very decent Semiconductor Equipment b2b and the Machine Tool segment is due for its traditional year-end bump.

If these prove to have been seasonal bumps, perhaps trades can be made but more importantly, we may yet get some confirming negative economic data points a little further into 2015. We should watch future ISM, b2b and Machine Tool sales closely.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2015 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.