Gold Fix Overhaul as Chinese Banks Join Western Banks

Commodities / Gold and Silver 2015 Feb 03, 2015 - 01:56 PM GMTBy: GoldCore

Replacement for the near-century-old London gold fix will start in March

Replacement for the near-century-old London gold fix will start in March-

London gold fix to Shanghai gold fix – still not transparent

-

Stealth run on the London bullion market continuing?

-

Oil surges 11%; deflation deepening

-

Increasing signs of a slowdown of the U.S. economy is supporting gold

The overhaul of the gold fixing benchmark formally known as the London Gold Fix is due to begin in March. Participants are hoping that there is less disorder than was seen for the messy launch of the London Silver Price (LSP) last August.

The Queen inspecting gold reserves in the Bank of England

Although the new system is set to go into operation at the start of next month, the London Bullion Market Association (LBMA) has complained to Britain’s financial regulator, the FCA, that it still has not received guidelines as to how the new system will be regulated.

From the Financial Times

Without clear guidance from the FCA now and forthcoming final rules, participants will be unable to gain internal approval to take part in the new process,” the LBMA said in a letter to the FCA. “If a significant number of participants cannot get approval to take part due to lack of regulatory clarity, there will be a disruption.

The FCA responded bluntly

We announced a consultation on 22nd December into the seven benchmarks we would be regulating, which included the gold fix. That consultation closed on 30th January and we have said we intend to come forward with final rules before the end of the first quarter 2015.

Financial authorities are undertaking an assessment of financial benchmarks in the wake of a series of scandals, including over the gold fix.

The new system is set to replace the current one which is currently being run by just four western bullion banks, one of whom – Barclay’s – were fined for manipulation of the gold price last year. A second one, UBS, was found guilty by Switzerland’s financial regulator (FINMA) of “serious misconduct” and a “clear attempt to manipulate precious metals benchmarks,” particularly with silver.

The new system is set to expand participation to at least 11 members including some Chinese banks for the first time. Given that China is now the largest producer and buyer of gold in the world, it is significant that Chinese interests will have a say in determining the daily price fix along with the current British, Canadian and French banks.

The change in weighting at the London Gold Fix to give the Chinese representation of over 25% appears to be driven by fear that the Shanghai Gold Exchange (SGE) may soon supersede London as the hub of the global gold market and location where the daily gold price is determined.

This may explain the apparent rush by the LBMA to implement the new system instead of waiting an extra month to get the necessary guidelines from the FCA.

The current process, where the daily gold price is determined by telephone calls from the four participant banks has been in place since 1919. It is set to be replaced by an electronic system.

It appears that the same level of transparency, or lack thereof, will continue to prevail under the new system – as is the case with the LSP, established last year.

The vast bulk of decision making will still be made by banks, who generally view gold with antipathy, and apparently only members of the LBMA will have a role in fixing the price.

This lack of transparency will likely undermine the new system. It will likely be viewed as more or less an extension of the current system with which many market participants are currently dissatisfied.

If London is to maintain supremacy over Shanghai and indeed Singapore as a gold trading and settlement hub, it will need to do a lot more to convince the gold trading community of its bona fides and it would appear that time is not on its side.

Is There a Run on the Fractional Reserve Gold Banking System?

Beyond The Smoke And Mirrors of LBMA Gold Data – See Guide Here

DAILY MARKET UPDATE

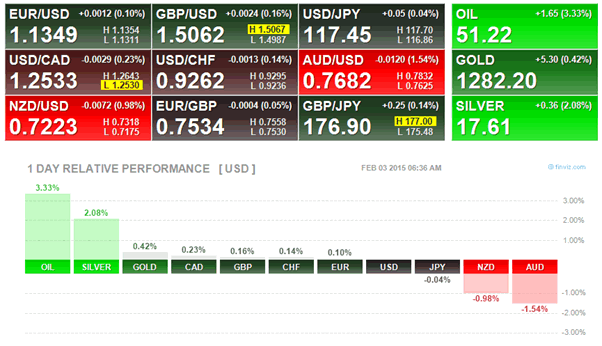

Today’s AM fix was USD 1,281, EUR 1,128.93 and GBP 851.84 per ounce.

Friday’s AM fix was USD 1,274.25, EUR 1,122.69 and GBP 847.92 per ounce.

Yesterday, gold lost 0.76% or $9.70 yesterday, closing at $1,274.60. Silver dropped 0.35% or $0.06, closing at $17.20.

In Asia, gold bullion in Singapore for immediate delivery edged lower in early trade on Tuesday, outshone by equities that got a boost from expectations that Greece may be nearing a debt deal with international creditors.

Gold prices have fallen marginally in early European trading, touching a session low just below the $1,275/oz mark, around 0.5% below where they ended Friday.

Greece’s new government has proposed ending a standoff with its international creditors by swapping its outstanding debt for new growth-linked bonds, Finance Minister Yanis Varoufakis was quoted by the Financial Times as saying yesterday. However, it is far too soon to say that the crisis has been resolved.

Increasing signs of a slowdown of the U.S. economy is supporting gold. U.S. consumer spending recorded its biggest decline since late 2009 in December with households using the extra cash from cheaper gasoline to pay down debt, while factory activity also cooled in January. Those numbers released on Monday followed data last week that showed a sharp slowdown in economic expansion to 2.6 percent in the fourth quarter from 5 percent in July-September.

Oil prices rose strongly again on Monday, tacking on a total of 11 percent over two straight sessions, as some investors bet that a bottom had formed to the seven-month long rout on the market

Gold in U.S. dollars – 1 month (Thomson Reuters)

Elsewhere, European and Chinese factories slashed prices in January as production flatlined, heightening global deflation risks that point to another wave of central bank stimulus in the coming year.

The world’s largest gold exchange traded fund, SPDR Gold Trust, said its holdings rose to 24.65 million ounces on Monday, the highest since October.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.