How Germany Can Save Greece and the EU

Politics / Eurozone Debt Crisis Feb 20, 2015 - 05:38 PM GMTBy: Investment_U

Ryan Fitzwater writes: The European debt crisis has been chugging along for six years. But until recently, the financial media was more concerned with volatility in the U.S. markets.

Ryan Fitzwater writes: The European debt crisis has been chugging along for six years. But until recently, the financial media was more concerned with volatility in the U.S. markets.

Now our focus has finally turned back to our neighbors across the Atlantic. Specifically, the debt crisis in Greece.

Here’s what’s going on.

The Populist Party Has Spoken

At the end of January, Alexis Tsipras - the leader of Greece’s far-left Syriza party - was elected as the country’s 186th prime minister.

The election sent a clear message to the world that Greece is fed up with austerity measures imposed on them by the European Union (EU).

Tsipras has been calling for a “European debt conference” since 2012, with the goal of reducing Greece’s debt obligations along with those of other troubled euro-region countries.

That conference has yet to take place. And as a result, today the Greek government submitted a request for a six-month loan extension. Germany immediately rejected the request.

Clearly Greece is still having trouble paying its bills.

Greece: The Poster Child for Bailouts

Euro-area members and Greece have been at odds over terms that would allow the country to extend its $247 billion rescue plan beyond February.

If they can’t decide on a compromise, Europe’s most debt-ridden state will be left standing without a financial backstop.

As a result, Greece will likely start defaulting on some of its liabilities as early as next month.

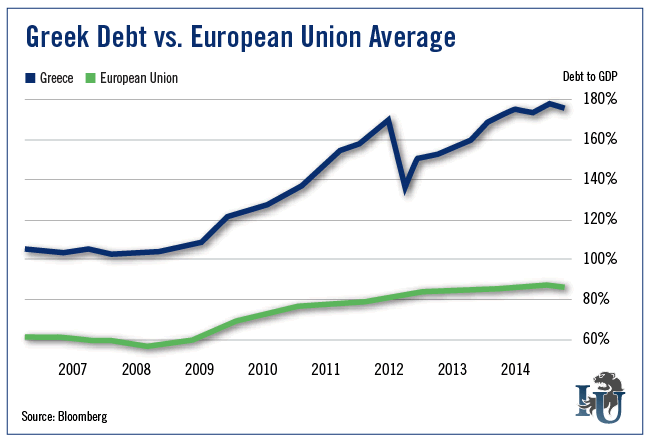

With debt-to-gross domestic product (GDP) over 176%, Greece has long been the center of Europe’s debt crisis conversation.

That should come as no surprise, seeing as it’s received multiple bailout packages over the last few years.

Unfortunately for Greece, those packages were bundled with structural reforms calling for the privatization of government assets and, the most detrimental part, aggressive austerity measures.

Too Harsh?

In theory, austerity is used to reduce budget deficits during adverse economic conditions. This is accomplished by cutting spending, increasing taxes, or a mixture of the two.

Yes, cutting spending is important for reining in debt. (Uncle Sam, please take notes.) Increasing revenue - through tax collection and/or boosting GDP - also helps. But, as you’ll see in a moment, history has proven that tightening the belt too hard and seizing too much income from citizens does more harm than good.

Fact is, the austerity measures put on Greece are excessive. They haven’t helped the country pay its debts. And any resulting GDP growth has been too slow.

As you saw in the chart above, the debt load dipped after bailout programs began. But since then the load has increased steadily. The measures are not working. In fact, they have made the problem worse.

One in four working-age adults in Greece is unemployed. And some estimates have almost half the population living in poverty.

The Greek government is certainly at fault for running up deficits in the first place. But the bigger issue here is the way the EU - Germany in particular - has been dealing with debt-saddled countries.

In fact, it’s a little ironic...

Germany... Look in the Mirror!

After World War II, Germany was in economic ruins. Its debt-to-GDP was estimated to be around 280% (significantly higher than where Greece stands today).

Luckily Germany’s creditors were smart. They realized that forcing Germany to repay its debt would make restoration nearly impossible and could derail all of Europe.

They also understood that getting paid $0.50 on every dollar they lent was better than getting nothing. So in 1953, they agreed to forgive roughly half of West Germany’s debt.

The rest of the debt would be subject to economic performance.

Fast-forward six decades... Germany is now the EU’s most powerful creditor. Cleary the debt relief and provisions worked.

If only Germany would look to its past and realize that the solution for Greece is right under its nose: Cut Greece a big break on its debt. Allow it to pay back loans based on how well its economy is performing.

The Debt Merry-Go-Round

Does Germany want to be remembered decades from now as the one that botched the infamous euro project? Or does it want to be the country that saved the EU and put Greece back on track?

Another bailout with harsh austerity measures would just kick the can further down the road. (It might also be the final straw that breaks the camel’s back.)

Debt forgiveness, on the other hand, coupled with pro-growth economic reform, can pull Greece off the debt merry-go-round.

Good investing,

Ryan Fitzwater

Source: http://www.investmentu.com/article/detail/43677/debt-forgiveness-how-germany-can-save-greece-eu

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.