No Rest for Bitcoin Traders

Currencies / Bitcoin Mar 21, 2015 - 10:21 AM GMTBy: Mike_McAra

In short: speculative short positions, stop-loss at 283, take-profit at $153.

In short: speculative short positions, stop-loss at 283, take-profit at $153.

Intel might be looking into Bitcoin, we read on CoinDesk:

California-based semiconductor manufacturer Intel appears to be dipping its toe in the digital currency space, following a bitcoin-related job posting.

The multinational company is looking for a cryptographic researcher to join its Special Innovation Projects Group, part of its in-house research organisation, Intel Labs.

An advertisement posted on job site Indeed notes the chosen candidate will be required to "investigate hardware and software capabilities that advance the performance, robustness, and scalability of open, decentralised ledgers".

It continues:

"Working with a team of distributed systems, operating systems and security technologists you [the candidate] will focus on development of cutting-edge, cryptographic algorithms for improving [...] transaction verification within an open, decentralised ledger".

We've already heard about IBM looking into their own kind of digital money. Now, we see that Intel also begins work on cryptocurrencies. One job posting is definitely not enough to conclude that Intel is very serious about digital currencies so we'll definitely have to wait longer and see whether this will be followed by more effort to develop digital cash.

What this shows, however, is that Bitcoin is slowly making its way into various parts of the technological sector. Just to think about it, at first Intel doesn't seems like a company that would be very interested in digital cash, since they are mainly a hardware provider. But the fact that they're looking into digital currencies might indicate that ledger-based systems might have a lot more applications than only money transfers. Just what kind of application Intel will find for Bitcoin remains to be seen.

For now we focus on the charts.

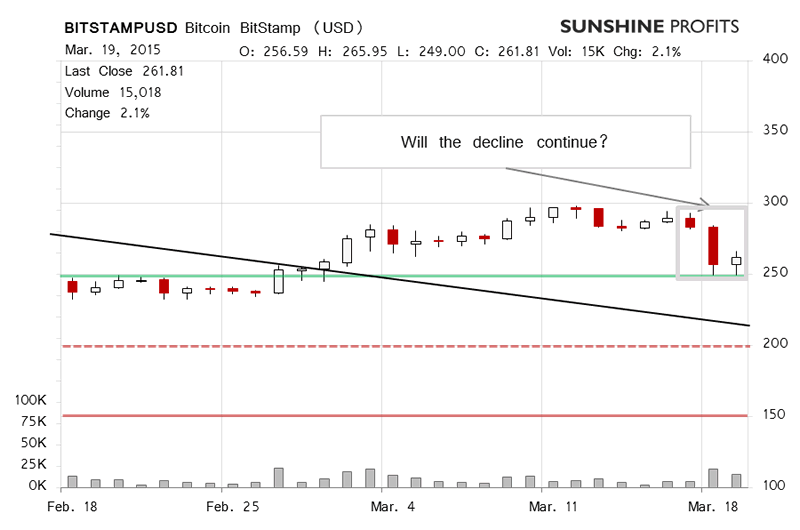

On BitStamp, we saw an important move on Wednesday. The action was more subdued yesterday in terms of price swings but the volume was actually significant, lower than on the day before but still significant. Quite importantly, we didn't see a meaningful rebound. Bitcoin stayed above $250 but the slump was not erased which might suggest that the short-term trend changed.

The main fear after a move like we saw on Wednesday is that it might be followed by a rebound. It wasn't yesterday. It hasn't been today (this is written around 12:00 p.m. ET) and the volume today hasn't been really significant. What does this mean? Our take here is that we might see a couple of days of sideways trading but the outcome might actually be a further slump. It seems that the rally might have run out of steam and that we've just seen the first signs of the continuation of the long-term decline.

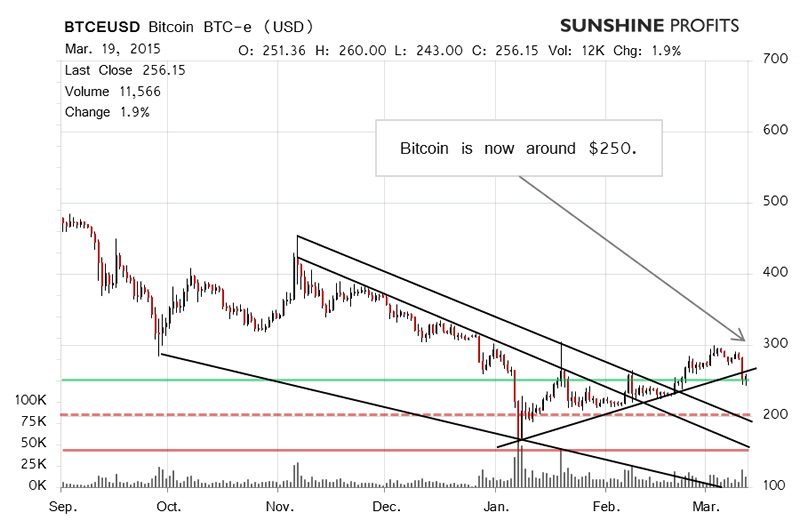

On the long-term BTC-e chart we actually see a possibly important development. Bitcoin closed below a possible rising trend line on Wednesday (upward sloping black line in the chart), it closed below this line yesterday and it's trading below this line today. It seems that we're hours from a third close below a possible trend line. Since there has been no indication of a stronger move to the upside and the recent move down was quite significant, it seems that we might actually see a continuation of the decline.

Looking at the RSI Index, Bitcoin has been going pretty much in one direction - from overbought down, but there's still plenty of room before we see oversold territory being hit. Consequently it seems that we might have just seen a break below a possible trend line, significant volume on a move down, weak volume and lack of rebound following the decline, continued weakening as far as price levels are concerned and possible room for further declines. The only thing that seems to stop the decline is the lack of the break below the $250 level (green line in the chart). Our take now is that the lack of rebound might indicate that the following action is going to be to the downside. Because of that, we think that opening hypothetical speculative short positions might be a good idea.

Summing up, we support speculative short positions in the market.

Trading position (short-term, our opinion): short, stop-loss at 283, take-profit at $153.

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.