The Real Key to This Week’s Crude Oil Price Uncertainty

Commodities / Crude Oil May 13, 2015 - 10:56 AM GMTBy: ...

MoneyMorning.com  Dr. Kent Moors writes: Quick update on oil, because it’s been quite the week already…

Dr. Kent Moors writes: Quick update on oil, because it’s been quite the week already…

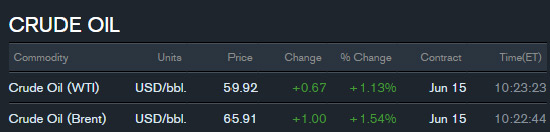

This morning West Texas Intermediate (WTI), the benchmark crude oil futures rate in New York, rose over $1 a barrel in less than three hours. Meanwhile in London, Brent (the more widely used international dated benchmark) has increased even faster – over $1.50 during the same period. Here’s where we stand as I write this:

Just yesterday, the talking heads on TV were telling us the market is oversupplied, thereby driving prices down. But now they will need to switch gears and “explain” why they are moving up.

All this uncertainty can be very, very profitable. It opens a lot of opportunities for investors who are positioned correctly.

But again, today the pundits will once again go down the list of usual suspects in a vain attempt to provide reasons for oil’s move up in a brief soundbite.

So here are the two “usual suspects” I can guarantee you they will point to.

And then here’s the real key for oil and energy investors…

1) The Middle East Factor

First, there’s the unrest in Yemen. Despite an apparently agreed-to ceasefire, the Saudi-led bombing runs are increasing, as are the civilian casualties from the intensifying civil strife with Houthi rebels.

Yet there is nothing “new” in this news to prompt a significant move up in oil prices.

True, there is always the chance of contagion in the region. When fighters take out landing runways at the only airport in Sana’a (the Yemeni capital) to prevent a single Iranian plane from landing, or almost 50 die in skirmishes on the Saudi border, these can indicate an expanding conflict.

Second, the move to a nuclear agreement between the West and Tehran is also not sitting well with the Saudis. Both new Saudi King Salman and the ruling family in adjoining Bahrain have snubbed President Obama’s Camp David meeting of regional leaders – a sure sign of a tiff developing. Both are facing another round of Sunni versus Shiite altercations. That’s sure to put a further powder keg in the center of an already unraveling situation.

But here’s the point…

Traders do take bearings from such matters. But not from the reality on the ground. Rather, the causality here is from the uncertainty of the situation.

As I have noted many times before, in a “normal” oil market (and I’m not certain what that phrase actually means anymore), futures traders will base their strike price on the expected cost of the next available barrel.

However, in times of uncertainty, that price will be pegged to the expected cost of the most expensive next available barrel. This is a function of traders providing as much cushion as they can from which to set their options (as insurance against volatility). The price of the futures contract (the “paper” barrel) rises quicker than the actual value of the underlying oil consignment (the “wet” barrel).

Yesterday I heard one energy analyst again talking about $100/barrel oil following from a major interruption in Middle East oil flows. As you well know, I spend much of my time handicapping global threats. Yes, if the world as we know it is altered, the price of oil will skyrocket.

This does not appear immediately on the horizon. Of course, we can never dismiss such a possibility out of hand.

2) The Dollar Factor

The dollar always been a traditional explanation for fluctuations in the price of oil. For four decades, just about all oil sales worldwide have been denominated in dollars. Trading countries must exchange local currency into dollars to effect the transaction.

Two things result.

The first is the U.S. is given the advantage of seigniorage, the benefit of having other nations use your currency. As more greenbacks are required abroad, the U.S. effectively receives an interest-free loan.

The second is the rise of the petrodollar market. These are the dollars now needed in banks abroad to finance the oil deals. So long as those dollars are not repatriated, they do not circulate in the American economy. That means additional currency can be printed and exported without a corresponding increase in domestic inflation. That impact is largely felt someplace else.

Nonetheless, a change in the foreign exchange (forex) rates for the dollar will have an impact on the price of oil. If the dollar increases in value, oil now costs more in other currencies, demand is lessened, and the price goes down because it now costs fewer dollars to buy a barrel of oil.

Conversely, if the value of the dollar goes down, oil now costs less to buy abroad and the price increases because it now requires more dollars to buy the same barrel on the market.

Here’s the Key: Neither Factor Touches My Mid-Term Outlook

OK, so the price is rising this morning and there are some ready-made culprits.

Yet in counter balance, there remain significant production surpluses worldwide.

The largess from U.S. share and tight oil has been a known commodity now for some time. More recently, OPEC has added additional production to the mix for reasons I have discussed previously in OEI (some cartel members overproducing in a frantic search for revenue; Saudi Arabia opening the spigot in punishment for such evasions off monthly production quotas).

In the traditional see-saw between supply and demand, we are in new territory. The supply side of the equation is no longer in question. Yet producers are hardly going to flood the market with available volume known to be in the ground, guaranteeing reduced profits and shooting themselves in the foot.

Absent a geopolitical spasm, such oversupply will temper significant price spikes.

Instead, my intermediate-term read of the oil market continues to be one for a ratcheting effect on pricing. A continuing trend higher will be the norm, but there will be occasional downward pressures.

It is for this reason that occurrences such as the rise this morning are not changing my mid-term outlook. I continue to see WTI at $65-$68 a barrel by July; Brent at $73-$78. By the end of the year, I still see WTI moving to $73-$78 and Brent to $82-$85.

That means we have plenty of opportunities to make nice returns from the sector.

Yet there is one troubling cloud emerging, one that should reduce the competitive environment in the U.S.

Keep an eye out here. I plan to address that next time…

Unless the pundits from “Chicken Little Brokerage” are right and the sky does fall before Thursday.

Source :http://oilandenergyinvestor.com/2015/05/the-real-key-to-this-weeks-oil-uncertainty/

Money Morning/The Money Map Report

©2015 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.