Velocity of Money - The Chart the Fed Doesn’t Want You to See

Interest-Rates / US Interest Rates May 17, 2015 - 03:10 PM GMTBy: Investment_U

Andrew Snyder writes: The folks at the Fed are getting desperate. Their patient is slowly healing, but he refuses to do it without a big dose of painkillers. It’s clear that if the money manipulators hide their pills now, our addict will throw an economic fit none of us is eager to experience.

Andrew Snyder writes: The folks at the Fed are getting desperate. Their patient is slowly healing, but he refuses to do it without a big dose of painkillers. It’s clear that if the money manipulators hide their pills now, our addict will throw an economic fit none of us is eager to experience.

On Wednesday, markets were shaken when the world’s top pill pusher Fed Chief Janet Yellen boldly told us that stocks are overpriced. It was a half-cocked assertion that Alex Green quickly overcame (read his argument here).

Now the question is why Yellen would make such an irresponsible statement.

The simple answer is she’s testing the waters... seeing if her addict is ready to kick his habit.

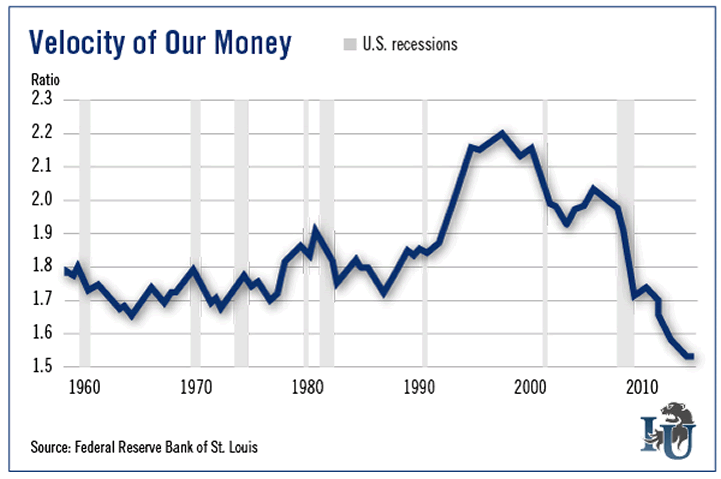

There is no doubt the folks at the Fed have seen the chart below. It highlights why Yellen is so worried about what comes next - or, worse, what doesn’t come next.

The chart is really quite simple. It shows the so-called velocity of our money - how deep and quickly every dollar we spend flows into the economy. For example, when the ratio climbs above 2.0, it tells us every available dollar in a preset period is spent more than twice. When the ratio dips, we’re spending less.

And, mister (or missus), the chart tells us you’re not spending much... and neither is your neighbor.

In fact, the velocity of our money is the lowest on record. That scares Yellen and her troops.

It means that instead of quickly using all those cheap dollars the Fed is printing to buy cars, boats and hotel rooms, we’re holding onto them (which explains our seven-year bull market). They’re not flowing through the economy, stimulating growth.

Why? Because folks are scared. They know that without all that cheap money, the economy will falter.

They know that without the painkillers, our patient will be writhing in pain.

That’s why Yellen did what she did this week. By making her hyperbolic comments, she took the pulse of the patient... seeing what would happen if she slashed its dosage.

The reaction was what we’d expect and what she feared. Stocks and bonds fell in tandem.

Normally, that wouldn’t be too much of a concern for a Fed chief. But remember, American economic growth is downright anemic. First quarter GDP growth was a paltry 0.2. Worse yet, the market now expects the revised number to be south of zero - horrible news for somebody looking to raise rates.

The bottom line here is all of that free money the Fed is pushing into the economy is not having the intended effect. The chart proves it. It’s certainly stimulated the equities market, but it has yet to spark sustained economic growth.

It means Yellen and her troops have their hands tied. They can’t raise rates by any worthwhile amount.

Because of this fact, expectations for a rate increase have continually been pushed back over the last 24 months. Don’t forget, this time two years ago, most economists expected rates to be far higher than they are today. Instead, long-term rates are threatening to drop even further. And, worse yet, they’ve turned negative across the pond (a phenomenon once thought impossible).

The Fed very well could raise rates this year. But it will be a token move at best... a mere fraction of the original plan. It will not have a material effect on the economy or the markets.

Yellen has no choice but to keep the painkillers coming. We’re flat-out addicted.

Our bull will continue running.

Good investing,

Andrew

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.