Introduction to Peak Food

Commodities / Agricultural Commodities May 26, 2015 - 03:04 PM GMTBy: Ned_W_Schmidt

Your high-tech toy watch won't buy you an egg. To date, the U.S. is on course to destroy 40,721,073 birds, mainly laying hens. Yes, elves at USDA do like precision in their numbers. Those birds are the casualty of pathogenic avian influenza outbreak. Despite the state of today's technology, eggs still come from chickens not from factories or 3-D printers. And eggs are not the only Agri- Commodity that has defied both technology and conventional wisdom. By the way, U.S. egg prices are up 120% or more in the past month.

Your high-tech toy watch won't buy you an egg. To date, the U.S. is on course to destroy 40,721,073 birds, mainly laying hens. Yes, elves at USDA do like precision in their numbers. Those birds are the casualty of pathogenic avian influenza outbreak. Despite the state of today's technology, eggs still come from chickens not from factories or 3-D printers. And eggs are not the only Agri- Commodity that has defied both technology and conventional wisdom. By the way, U.S. egg prices are up 120% or more in the past month.

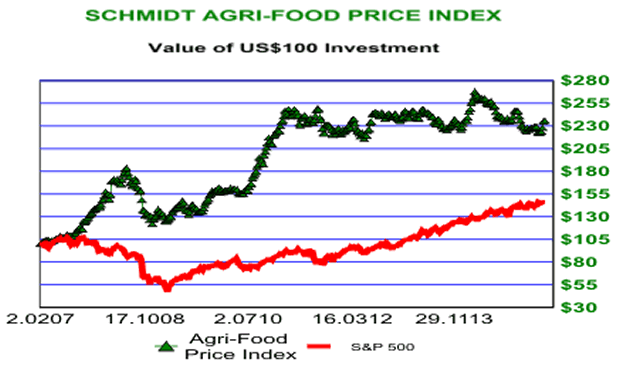

In above chart is plotted our Agri-Food Price Index, a measure of the price movement on 17 Agri-Commodities. Interesting point of the chart is what is not shown. On average, Agri-Commodity prices did not collapse as has been the expectation by much of the investment world. Rather, the index actually made a new high last year before correcting. In recent months the U.S. dollar mania has depressed any dollar denominated commodity index. With that nonsense now out of the way, Agri-Commodity prices, again on average, have advanced near 6.5% in the past month.

Why have Agri-Commodity prices shown such resilience? Why is a bushel of corn in China worth near $10 when it sells for less than $4 in the Midwestern U.S.? Whyis beef in the U.S. selling within one percent of an all time high? Why is China now importing 120 million tons of Agri-Grains on a path to import 200 million tons?(COFCO via Reuters, 21 April)

Answer to all those questions, and many others, has two parts. One which we are interested at this time relates to the supply side, and the implications of "Peak Food". That term was actually created by Tom Bawden in an article titled "Have we reached 'peak food'? Shortages loom as global production rates slow" which appeared in The Independent(UK), 28 January 2015. We note Bawden's articleand contribution as he alerted readers to an article "Synchronized peak-rate years of global resources use" by Seppelt, et al which appeared in Journal of Ecology and Society (December,2014).

Peak food was actually first discussed by Thomas Malthus in An Essay on the Principle of Population published in 1798. He contended that a clash between peak food production and population growth England, an island nation, would cause both higher prices and some parts of the population to be priced out of food markets. Despite the general lack of understanding of his work and history of Agri-Food, Malthus has been heavily criticized by uninformed economists. In middle of 1800s England was forced to become a net importer of food to feed the people, and has been ever since. Apparently Malthus was right, and the economists were wrong. Any surprise there?

Now, some 216 years later, we have some data and analysis that support his hypotheses. With the publication of the Seppelt, R., et al article, limitations on productive capability of the global Agri- Food system have been quantified for the first time. Research by Seppelt, et al adds some confirmation of what has generally been noted by a number of researchers and has been part of our central thesis on Agri-Food. Limitations do exist on ability of the world to produce food. Second, as demand for food expands prices for that food will rise over time, and at some times in dramatic fashion. While Malthus talked of population, in modern world disposable income and especially growth of disposable income in developing world is the specific fuel for Agri-Food demand.

Malthus was observing the relationship between food availability and population in England. While we tend to think of England as a nation, generally not thought about is that England is also an island. At any point in time the quantity of food that can be produced on an island is fixed. Over time, innovations in agricultural science can increase amount of food produced up to the limits of that fixed quantity of land. However, the ability of the land itself to produce food does not naturally expand, and is ultimately limited by natural constraints. If the population of the island expands, amount of indigenous food production per capita declines. Malthus observed that as that happened the price of food would become unaffordable for some segments of the population.

Bio-technology can create over time innovations in seeds, planting, and crop nutrition that do lead to "one time" gains in production on a fixed base of land. While these gains are "one time", the adoption of innovations happens over time. As an innovation is adopted over time by farmers, crop yields do give the appearance of increasing. If one looks at the data for crop yields, production per acre, the impression given is that some kind of trend line growth occurs. It does not.

We have been thus far trying to "set the stage" for this discussion of Peak Food. We started with Malthus causehe was the first to observe and report on the relationship between food production and population. He was able to do so because he could observe a far simpler system, an island called England, than exists today. However, remember that Earth is simply an "island" in space.

What did the research of Seppelt, et al conclude? The researchers looked at 27 renewable and non renewable resources. Our interest is primarily with the Agri-Foods they studied which are classified as renewable resources. 17 Agri-Commodities were studied, from cotton to corn to rice and soybeans. Included were the bulk of the Agri-Commodities that feed the world.

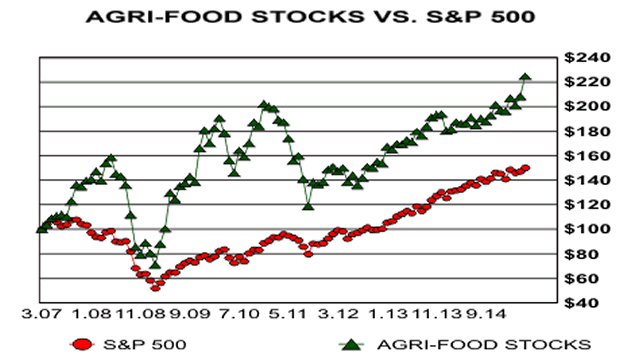

This research focused on the rate of change for production. If, for example, the world produced 1 billion tons of a grain last year and this year produces 1.1 billion tons the rate of change is positive 10%. If the following year the world produces 1.2 billion tons, the rate of change is positive 9.1%. Production is indeed increasing, but the rate of increase has peaked. The year in which the rate of change peaks is the Peak Year. Of the 17 Agri-Commodities studied, 16 had Peak Years in the time frame 1985-2009. Production of those Agri-Commodities is rising, but the rate of increase is slowing. More on this next time. But, one final question: Is knowing that world is in the era of Peak Food of importance to investors? Apparently the answer is yes, as Agri-Equities are at a new high.

References:

Bawden, T. (28 January 2015).Have we reached 'peak food'? Shortages loomas global production rates slow. The Independent.

Malyhus, T. (1798). An Essay on the Principle of Population. Free on Amazon Kindle.

Seppelt, R., et al. (December,2014). Synchronized peak-rate years of global resources use. Journal of Ecology and Society.

Ned W. Schmidt,CFA is publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food Super Cycle, and The Value View Gold Report, a monthly analysis of the true alternative currency. To contract Ned or to learn more, use either of these links: www.agrifoodvalueview.com or www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.