When Will US Debt Hit the Wall?

Interest-Rates / US Debt Jun 25, 2015 - 03:15 PM GMTBy: DeviantInvestor

As I see it, the following are true:

As I see it, the following are true:

- Debt is increasing far more rapidly than growth in the underlying economies that must support that debt. Although this is also true in Japan, the UK, and Europe, I’ll focus on the US.

- Revenue is increasing but less rapidly than debt. This is a problem.

- There will come a time when the interest payments on exponentially increasing government debt will exceed what the economy can support. Call that point “hitting the wall.”

- Higher interest rates will cause the US economy to “hit the wall” sooner. Lower interest rates merely delay the “day of reckoning.”

WHEN?

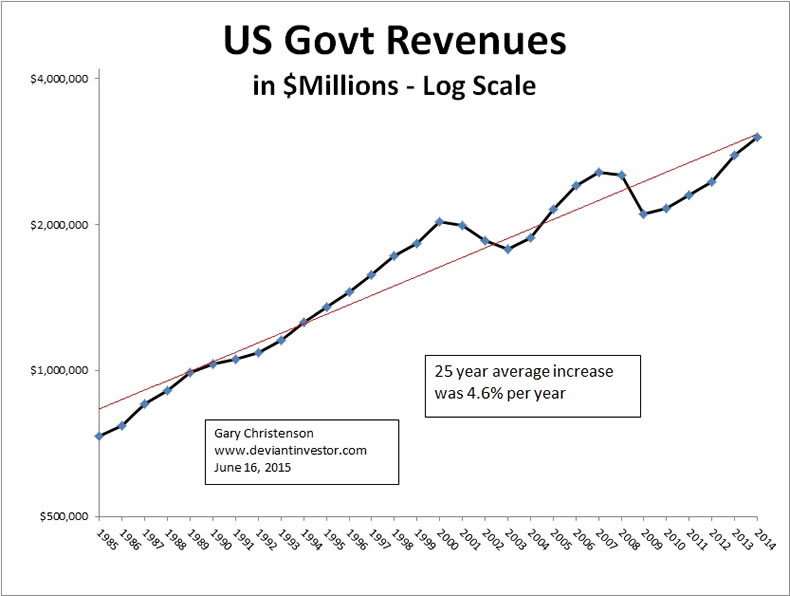

Examine the log scale graph of US government revenues for the past 30 years. The exponential rate is about 4.6% per year.

Total official US debt is over $18 Trillion but some of that is “Intragovernmental debt” – such as debt to the social security program. The remaining portion that is actually owed to pension funds, individuals, sovereign governments etc. is about $13 Trillion. It is increasing rapidly, thanks to out of control spending far in excess of revenues.

Date Public Debt Intragovernmental Total

In $ Trillions Debt Debt

9/30/2008 $5.81 $4.22 $10.03

9/30/2014 $12.78 $5.04 $17.82

Rate of Increase 14% 3% 10%

(annual)

It seems likely that revenues will decline in the coming recession, while expenses will probably increase for social programs, bailouts, and another war. Assume revenues optimistically increase at the historical average of 4.6% per year and public debt only increases at 14% per year. A more likely scenario is lower revenue and higher debt increases, for many reasons, not discussed here.

When does an economy “hit the wall?”

- When interest expense exceeds revenues? Yes, but probably well before that.

- When confidence in the currency and/or government fails?

- When total interest expense exceeds say 1/3 of government revenue? Yes, or perhaps well before that point.

We don’t know. Assume we delay “hitting the wall” until interest expense equals 1/3 of revenue. But that is dependent upon the total interest expense which is determined by the blended interest rate.

Year Estimated Revenue Estimated Public Implied MAX

Debt Interest Rate

2015 $3.16 $14.6 7.2%

2020 $3.96 $28.1 4.7%

2025 $4.95 $54.0 3.0%

2030 $6.20 $104.0 2.0%

Assuming that revenue increases 4.6% per year, public debt increases 14% per year, and that a maximum of 1/3 of revenue can be used for paying interest, the blended interest rate in 2030 cannot exceed 2%. Washington, we have a problem!

Much can happen between now and 2030 and these exponential projections are unlikely to be realized. The consequences of more QE, uncontrolled spending, more wars, and a weakening economy could be worse or better.

Regardless, if the maximum acceptable interest rate is 2% in 2030, or a few years before or after, there is a problem!

WHAT TO DO?

- Reduce spending. I’ll believe it when I see it.

- Increase taxes. Why use a Band-Aid to fix a broken leg?

- Hyperinflation: Is the “cure” worse than the disease?

- Vote in new politicians. Really? You actually believe that?

- Your call. What do you think?

This tiny exercise tells me that western economies are accelerating toward a wall, there are only a few years or perhaps a decade or two remaining before a major reset must occur, and that the time for delusional thinking is nearly gone.

What have you done to prepare for when one or many western economies “hit the wall?” Gold and silver might be better answers than devaluing currencies, overpriced bonds, or levitated stocks.

Share your opinions in a comment and let others, including myself, learn from your thoughts.

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2015 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.