Puerto Rico Debt Crisis: Should U.S. Investors Care? (Video)

Interest-Rates / Global Debt Crisis 2015 Jul 10, 2015 - 08:09 AM GMTBy: EWI

White House: No U.S. bailout for Puerto Rico

White House: No U.S. bailout for Puerto Rico

Editor's note: You'll find the text version of the story below the video.

The warning signs have been obvious for a long time: The unwinding of global debt was not a matter of if, but when.

That time may be here.

On June 30, Greece became the first developed country to miss a debt repayment (€1.5 billion) to the International Monetary Fund.

Now observers are wondering if default is ahead for Puerto Rico.

Earlier this week, the commonwealth's governor took to the airwaves to say that Puerto Rico's $72 billion debt is "unpayable."

The governor's declaration brought to mind this comment from the May 2013 Elliott Wave Theorist:

The nominal values of the world's financial assets have been serially inflated like a school of puffer fish by record piles of unpayable debt.

We've consistently said that the deflation of those financial values will follow.

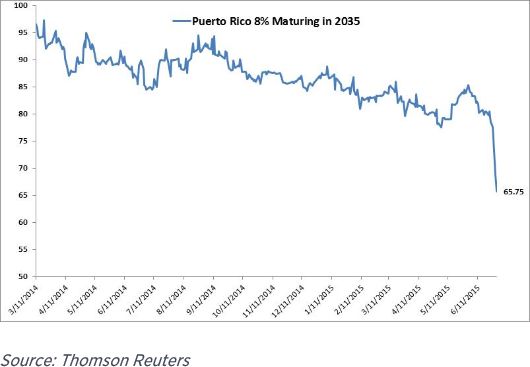

Indeed, Puerto Rico's bonds fell hard after the governor's warning -- as this chart shows:

Some bonds set record lows and were trading between 65 to 70 cents on the dollar. Puerto Rico has the highest municipal bond debt per capita of any U.S. state or territory.

Some investors might ask, "Why should I worry about the bonds of a Caribbean island that's smaller than Connecticut?"

Here's why:

Some of the top-performing municipal bond funds over the past five years have held huge stakes in Puerto Rican debt. Now that Puerto Rico's governor has ... asked for U.S. bankruptcy protection for the commonwealth, investors in those funds may take a big hit.

U.S. bond funds have an $11.3 billion total exposure to Puerto Rican debt as of June 29.

CNBC, June 30

An estimated 377 out of 1,184 bond funds hold Puerto Rican debt (AP). What's more, hedge funds have recently been buying Puerto Rico's securities, on the assumption they can have their cake and eat it too. In other words, they believe they get relative safety and enjoy tax-free yield.

But keep in mind what Conquer the Crash has to say:

U.S. investors today own billions of dollars worth of municipal bonds, thinking they are getting a great deal because that bond income is tax-exempt. This tax break may be a bonus in good times, but like so many seemingly great deals, this one will ultimately trap investors into a risky position. ... If the issuers of your tax-exempt bonds default, you will have the ultimate tax haven: being broke.

A Shorter Fuse on a Bigger Debt Bomb

Free report from Elliott Wave International

This eye-opening report reveals the precarious consumer, corporate and government debt situation around the world. Read this three-part report now for key research and statistics that uncover concerns about U.S. and global debt, and its imminent threats to investors.

This article was syndicated by Elliott Wave International and was originally published under the headline (Video, 3:05 min.) Debt Crisis in Puerto Rico: Should U.S. Investors Care?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.