Gold Mining Stocks Nearing Rebound

Commodities / Gold and Silver Stocks 2015 Jul 24, 2015 - 02:20 PM GMTBy: Jordan_Roy_Byrne

Recently we've been writing about the downside potential in precious metals and the danger for precious metals bulls. The gold miners and Silver have led the rout while Gold finally cracked support ($1140-$1150/oz) last week. That led to a severe selloff across the complex. As we pen this on Thursday evening it appears Friday could be a nasty day if Gold breaks below $1080/oz. Nevertheless, the odds now favor a rebound in the weeks ahead and especially in the gold miners.

Recently we've been writing about the downside potential in precious metals and the danger for precious metals bulls. The gold miners and Silver have led the rout while Gold finally cracked support ($1140-$1150/oz) last week. That led to a severe selloff across the complex. As we pen this on Thursday evening it appears Friday could be a nasty day if Gold breaks below $1080/oz. Nevertheless, the odds now favor a rebound in the weeks ahead and especially in the gold miners.

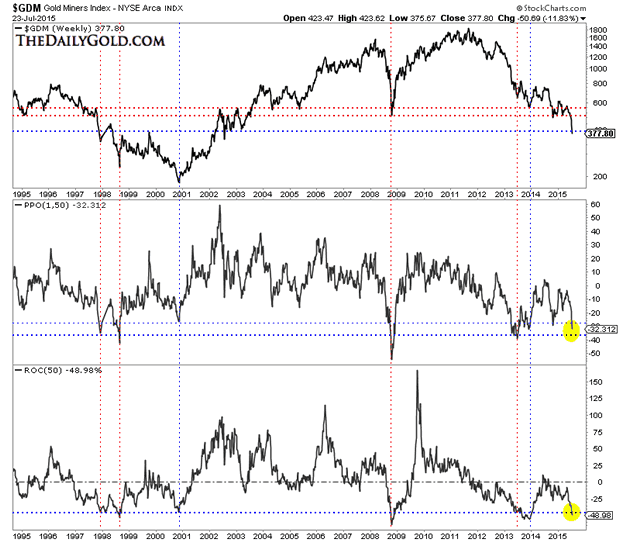

Though GDM (GDX) has closed below support at 400, it has done so in an extremely oversold state. In the first chart we plot GDM with its distance from its 50-week exponential moving average and its 50-week rate of change. If we count the two oversold instances in both 1998 and 2013 as only one then GDM is at one of its five most oversold points in the past 20 years. With a down day on Friday GDM would be at its third most oversold point in the past 17 years.

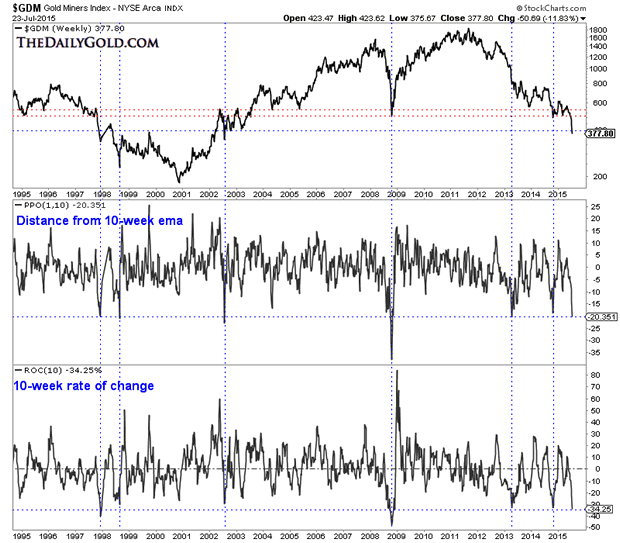

In the next chart we use the same indicators but use 10 weeks instead of 50 weeks. It gives us a medium term look. The oversold dates are nearly identical to those based on 50 weeks. If GDM has a down day on Friday to close the week then it could reach its 2nd most oversold point in the past 17 years.

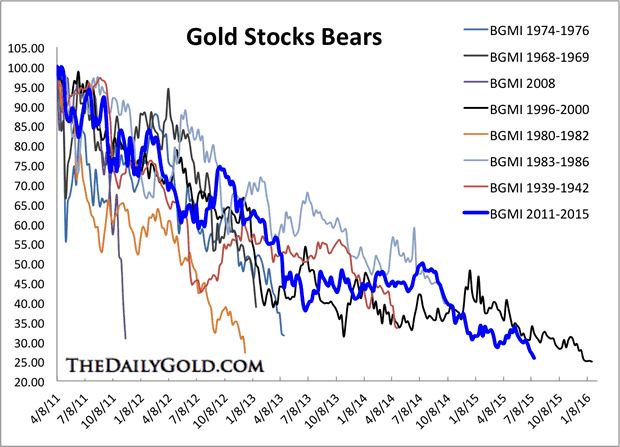

On a cyclical basis, gold mining stocks are arguably the most oversold ever. GDM and XAU have already surpassed their 1996-2000 bear markets. The next data point in the Barron's Gold Mining Index (whose bear market analog is shown below) will show the current bear surpassing that of 1996-2000. The HUI needs to close at 100 to equal its 1996-2000 bear. Any low in the gold miners weather it occurs in the coming days or next few months has a chance to mark the end of the bear market.

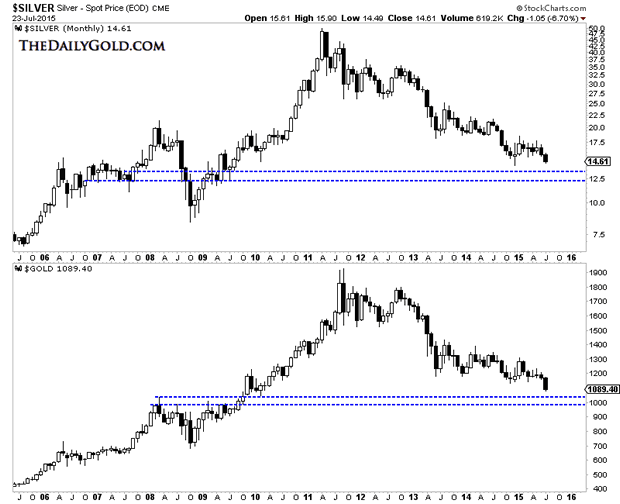

Another reason the miners are close to a rebound is Gold is (unlike in recent weeks) closer to important support. We've frequently mentioned targets of $1080/oz (50% retracement) and $1000 to $1040/oz. Below we plot the monthly candles for Silver and Gold. As we pen this article Thursday evening Gold is struggling to hold support at $1080/oz. A breakdown would create more selling but could quickly lead to a rebound from stronger support around $1040/oz.

The miners are now extremely oversold across all time frames and in position for a good rebound. Gold and Silver are not as oversold as the miners but that can certainly change within a few days. While we are unsure if the next low will mark the end of the bear market we can say that regardless, odds favor a big rebound.

Consider learning more about our premium service including our current favorite junior miners which we expect to outperform in the second half of 2015.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.