Don’t Be Fooled by the “Quiet Season” for Biotech Stocks

Companies / BioTech Jul 24, 2015 - 06:07 PM GMTBy: EWI

Marc Lichtenfeld writes: My favorite time to work is on weekend mornings before the rest of the house gets up.

Marc Lichtenfeld writes: My favorite time to work is on weekend mornings before the rest of the house gets up.

I wake up, quietly go down the stairs and turn on the computer. While I’m waiting for it to boot up, I enjoy the peaceful scenery of the marsh outside my living room window. There are always amazing birds out there like sandhill cranes and egrets that are just a few feet from my window.

I’m not sure if it’s the stillness of the morning, the lack of distraction or what, but it’s mornings like these when I’m most productive. And when it comes to the biotech sector, summer offers the same sort of calm... not to mention major buying opportunities.

I’ll explain.

You see, the first half of the year is filled with conferences. It starts with the mother of them all, the J.P. Morgan Healthcare conference in early January. Each year I go to the conference and meet with CEOs, fund managers, analysts and investment bankers. The goal is to obtain new information that helps me lead my readers to great biotech stocks. (You can check out my write-up from this year’s event here.)

As the first half of the year goes on, there are several other conferences at which companies release key data. The American Society of Clinical Oncology Annual Meeting, for example, is the most important cancer conference of the year. It takes place in June and pretty much marks the end of the conference “season.” Tons of clinical trial data is released over a period of just a few days.

But once we hit July, the biotech newsflow typically slows down.

That doesn’t mean there is no news. Companies will still release trial results as it becomes available. But things are much quieter until late December and early January when the J.P. Morgan Conference gets started again.

This is the time of year I love. Without the flurry of activity, just like a good weekend morning, I can catch my breath... to investigate new ideas and perform due diligence on older ones that I haven’t gotten to yet.

Many investors think that because there aren’t any important conferences, you can ignore the biotech sector during the second half of the year. But staying on the sidelines can cause you to miss out on some impressive gains.

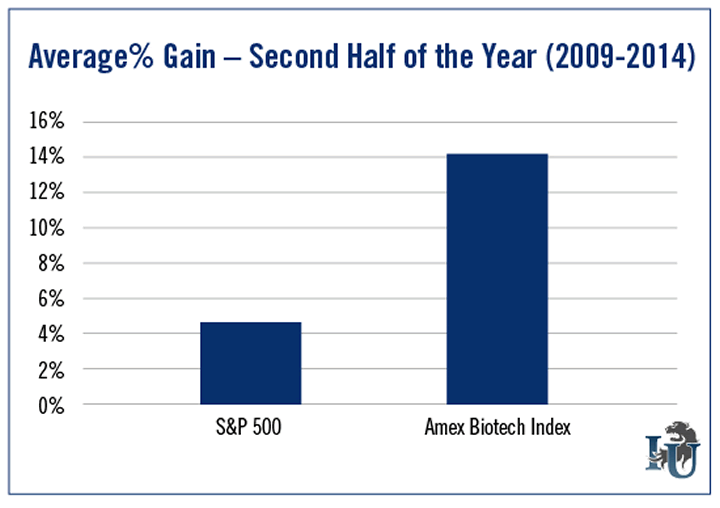

Over the past six years - since the bull market started - the Amex Biotech Index rose an average of 14.2% between July 1 and December 31. To compare, the S&P 500 rose an average of 4.7% during the same period.

The second half of the year is also a good time to get positioned in stocks you want to be involved in before conference season picks up. Shares start ramping higher in the weeks before the J.P. Morgan conference in anticipation of positive announcements and a rise in the entire sector.

It’s a good idea to start getting into your stocks before everyone else does.

For example, last year I waited until August to recommend Pharmacyclics to subscribers of my biotech trading service, Lightning Trend Trader. Had I recommended it earlier, right after the J.P. Morgan Conference, investors would have paid over $130 per share. But because I waited for the excitement to die down, we were able to get in at about $120 per share.

We exited the position seven months later at $254 after Pharmacyclics agreed to be bought by AbbVie (NYSE: ABBV).

It isn’t just the niche players that can soar during summer months, either. Even some of the big boys took off in the second half of 2014. Celgene (Nasdaq: CELG) gained 29.2%, and Amgen (Nasdaq: AMGN) climbed 33.4%.

So while the summer doldrums might apply to baseball - and the market in general - biotech is a good place to put money to work while you’re snoozing at the beach.

Good investing,

Marc

Copyright © 1999 - 2015 by The Oxford Club, L.L.C All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Investment U, Attn: Member Services , 105 West Monument Street, Baltimore, MD 21201 Email: CustomerService@InvestmentU.com

Disclaimer: Investment U Disclaimer: Nothing published by Investment U should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Investment U should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Investment U Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.