Are We Seeing a Trend Reversal with U.S. Interest Rates?

Interest-Rates / US Interest Rates Jul 27, 2015 - 07:13 PM GMTBy: Submissions

Frank Suess writes: In the second quarter, we saw a jump in yields across the board. The yield of 10-Year US Treasuries jumped from 1.9% to 2.4% over the course of the quarter, representing a yield increase of 50 bps. This led to a decline of almost 2% in the Bloomberg US Treasury Bond Index. In Europe the development was much more dramatic; over the quarter, the Bloomberg German Sovereign Bond Index lost around 4.5% in value. This was due to an increase in the German 10-Year yield from 0.2% to 0.8% (60 bps). It is not completely clear what sparked the massive yield increase in Europe. It might have been a technical correction due to the very high prices bonds were trading at, increased risk aversion towards Europe due to the situation in Greece (Bill Gross even called shorting German bunds "the short of a lifetime"), or possibly aggressive short positions by some investors.

Frank Suess writes: In the second quarter, we saw a jump in yields across the board. The yield of 10-Year US Treasuries jumped from 1.9% to 2.4% over the course of the quarter, representing a yield increase of 50 bps. This led to a decline of almost 2% in the Bloomberg US Treasury Bond Index. In Europe the development was much more dramatic; over the quarter, the Bloomberg German Sovereign Bond Index lost around 4.5% in value. This was due to an increase in the German 10-Year yield from 0.2% to 0.8% (60 bps). It is not completely clear what sparked the massive yield increase in Europe. It might have been a technical correction due to the very high prices bonds were trading at, increased risk aversion towards Europe due to the situation in Greece (Bill Gross even called shorting German bunds "the short of a lifetime"), or possibly aggressive short positions by some investors.

With 30 years of falling interest rates, bonds are today considered to be low risk investments and government bonds are even considered to be an almost riskless asset. However, the developments in the last quarter have shown that this is not the case and losses can occur rapidly when interest rates begin to rise. We therefore need to consider a few important questions in connection with interest rates. Is the development in the last quarter to be perceived as the long awaited turnaround in interest rates? Are Treasuries, other government bonds, and bonds in general as safe as they are perceived by most market participants? How would an increase in interest rates impact a portfolio?

Yields still at historic lows

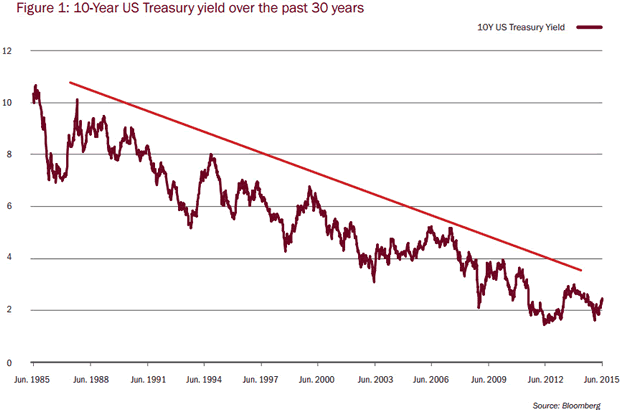

First of all, it is important to put the development of the last quarter into perspective. Both the US and German 10-Year government yields are still at very low levels (see Figure 1). Although we don't know when the interest rate environment will change, in our view it is still too early to call it the normalization of interest rates after the recent yield development. This is especially the case when we take into consideration that since 2009 we have seen four quarters where the yields increased by more than 20%, but were then followed by new lows.

When we take a long-term look at the development of 10-Year Treasury yields, as depicted in Figure 1, it becomes clear that, excluding some variations, over the past 30 years, yields have been heading in only one direction: down. And this might continue or at least interest rates could stay low for some time.

A look around the globe

As we have mentioned in the beginning of the article, the yield developments in Q2 were not identical across the board. The Eurozone saw a considerably stronger spike in yields than the US did. It is therefore important to differentiate between different countries and regions, when it comes to assumptions related to interest rate developments. In this context, let's have a closer look at the United States, Europe, Japan and China.

With the exception of the US, where the yield increase is possibly related to an anticipated rate hike by the FED, the developments of the previous quarter are not related to a rate hike by a central bank, but rather price changes on the secondary market. It is our understanding that a real turnaround in interest rates will take place when central banks start to hike rates, which is precisely why we will spend some time looking at rate hikes here.

From the countries mentioned earlier, the United States seems closest to a rate hike. However, this does not mean that we expect an imminent and substantial increase in rates any time soon. The US was the first country to start with its QE program in November 2008, ended it in late 2014 and has in the meantime seen a visible economic recovery. Unemployment figures are currently at 5.3%, close to what the FED considers full employment. Inflation is expected to reach 2.2% next year, which is close to the target inflation rate of 2%. Although downward revisions to GDP expectations have taken place, the economy seems robust and is expected to grow 2.2% this year and 2.8% in 2016. All indications are that a rate hike would be appropriate. Yet, many other countries are still in "QE-mode" and an increase in rates would make the US Dollar more attractive in relation to other currencies, resulting in a burden on the US economy and US companies. We therefore believe that an increase, if any, is likely to come in homeopathic doses and could even be reversed should the economic condition worsen.

Europe just started its asset-purchasing program in March, 2015, and the balance sheet is still around 800 billion below their target of 3.3 trillion Euros. The official aim of the European QE program is to provide liquidity to the banking sector to jump start lending and thus increase economic activity. The inofficial aim, in our view, is to depreciate the Euro in order to increase European competitiveness. An increase in rates now would be a counterproductive measure for both the official and inofficial aim because rate hikes throttle lending and increase the relative attractiveness of a currency. It is therefore very unlikely that a serious rate hike would be implemented by the ECB anytime before the current program runs out in September, 2016.

The QE program in Japan, dubbed "Abenomics", is starting to show first positive results. Japan has left the brief recession of last year behind and grew by 3.9% in annualized terms in Q1 of 2015 and is expected to grow well into 2017 (more on Japan in the next article). After having seen decades of deflation and having one of the largest debt-to-GDP ratios, we highly doubt that the Bank of Japan will increase rates at the first sign of a slight economic recovery.

China's economic indicators are being revised downward. GDP growth is expected to decrease from 7.4% in 2014 to 6.5% in 2017 and export numbers are showing weakness. Additionally, we believe that the property downturn is likely to continue. Taking the above-mentioned into consideration, it is understandable why China has started to loosen its monetary policy. Since Q4, 2014, the People's Bank of China (PBoC) has reduced lending rates from 6% to 4.85%. Furthermore, since the beginning of 2015, reserve requirements for banks have been reduced

twice. Both of these steps are monetary instruments used for loosening monetary policy. Due to the weak economic data, coupled with the fact that bank-lending rates in China are currently between 7-8% in real terms, we believe that the PBoC is likely to further reduce rates and not increase them for the time being.

Where do we think interest rates are headed?

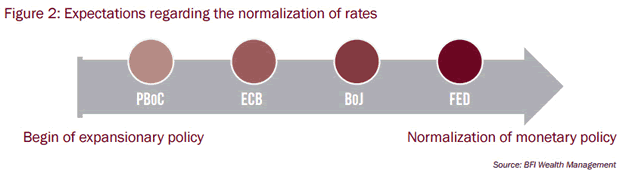

As we have outlined above and summed up in Figure 2, we believe that different countries and regions are at different stages in their monetary policy and a one-size-fits-all answer to the question where interest rates are headed cannot be provided. Nonetheless, we do not believe that an increase on a wide scale would be economically feasible for the time being and there are substantial risks involved due to high debt levels. The German 10 Year yield development (from 0.2% to 0.8%) in the last quarter illustrates that coming from a low base, a triple digit increase in the financing cost can happen very rapidly. Imagine if a government or company that took on debt at a very low cost would suddenly be faced with triple the cost when refinancing or issuing new debt.

How does a rate hike impact my portfolio?

As we are uncertain if and when a rate hike will take place, we will turn to the most burning question for investors: How does a rate hike impact my portfolio? Even if the turnaround doesn't come anytime soon, it will occur eventually. So it is important to understand the impact it can have on one's portfolio.

When interest rates rise, newly issued bonds are issued with a higher coupon than prior to the hike. This means that older bonds issued with a lower yield become relatively less attractive; investors are willing to buy them only at a lower price and thus the price of the bond decreases. Bond yields are therefore negatively correlated to the bond price.

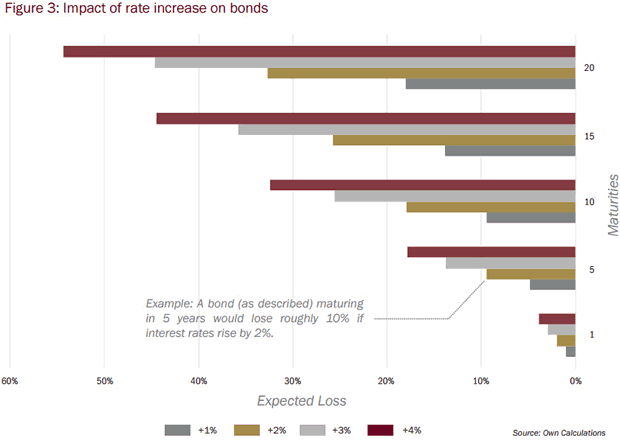

Figure 3 depicts the value zero-coupon bonds with different maturities would lose if interest rates would rise by 1,2,3 or 4 percentage points. The calculation is based on simplified assumptions (change from a zero interest rate environment and a parallel shift in the yield curve), but is meant to illustrate the impact of a rate hike on bonds. There are two main aspects we would like to concentrate on. Firstly, the higher the rate hike, the more bonds lose. This is intuitive, as the higher the hike, the less attractive a bond, that was issued with a lower yield, becomes. Secondly, the time to maturity is also a critical factor. When interest rates rise, future cash flows from bonds are discounted at the new higher rate. The longer it takes until the capital is repaid, the higher the negative impact on the bond price. There are several other aspects in connection with bond pricing, but going into all the details would go beyond the scope of what we want to cover today.

As a general rule, we can say that an interest rate hike would also be negative for equities. Future earnings, cash flows, etc. are discounted using a higher rate and this should technically lead to a decrease in prices. Furthermore, when yields rise, bonds become relatively more attractive in comparison to equities and investors tend to increase their allocation to bonds.

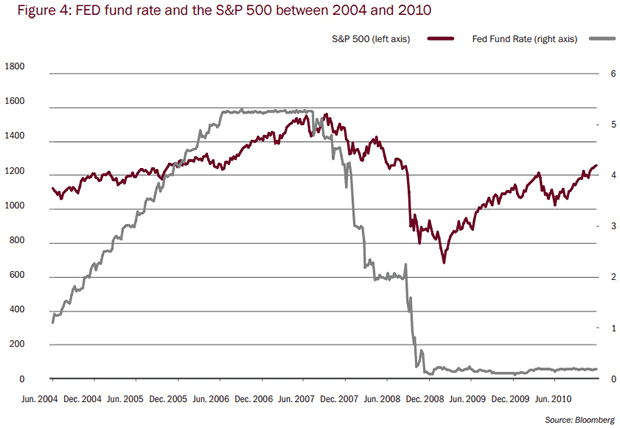

However, equities are much less sensitive and react less "mechanically" to interest rate changes than bonds. UBS recently came out with a study where they analyzed the 12 previous cycles of interest rate hikes by the FED. Their conclusion: on average, the S&P 500 increased roughly 10% in value in the 12 months after an initial rate hike. This also holds true when we look at the rate hike prior to the financial crisis, depicted in Figure 4. Although the FED started to hike rates in 2004, stocks continued to perform well, i.e. generating returns of nearly 40% since the start of the hike until the highs in 2007. The substantial increase in the FED fund rate did not negatively impact stocks for several years. This is not to say the general rule of interest rates hurting equities is not true. Our point is rather that even if an imminent rate hike would be at hand, there would be no immediate reason to reduce equity exposure.

And the impact of interest rates on gold? In general there is a negative correlation between gold and real interest rates. When real interest rates rise, gold becomes less sought after, as investors search for investments with higher yields. However, according to the World Gold Council, the negative effect of real interest rates on gold is only triggered when real interest rates rise above 4%.

Conclusion for investors

We don't know where and when an interest rate hike will take place. Nevertheless, monitoring the development of yields should be part of any risk management approach, because as we have shown in this article, yield normalization can have a substantial impact on the portfolio.

Subscribe for BFI Insights at MountainVision.com

Source - http://goldsilverworlds.com/

© 2015 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.