Gold and Silver Risk On

Commodities / Gold and Silver 2015 Aug 24, 2015 - 01:59 PM GMTBy: Alasdair_Macleod

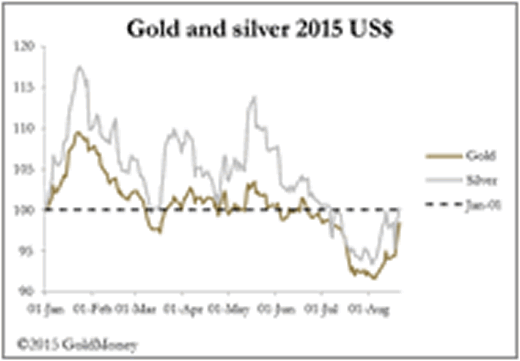

This week market relationships underwent a sea-change, with a sudden realisation that the global economy is in a deepening crisis. Equity valuations in the developed nations are falling sharply and corporate bond spreads are widening, triggering a flight to the relative safety of government bonds. Gold and silver prices have recovered somewhat this week, with gold now 9% up from its lows of six weeks ago, and silver 8%.

This week market relationships underwent a sea-change, with a sudden realisation that the global economy is in a deepening crisis. Equity valuations in the developed nations are falling sharply and corporate bond spreads are widening, triggering a flight to the relative safety of government bonds. Gold and silver prices have recovered somewhat this week, with gold now 9% up from its lows of six weeks ago, and silver 8%.

While this has been encouraging for followers of precious metals, it is probably realistic to describe their performance so far as evidence of a developing bear squeeze and not yet a sign of something more material. Bears being closed out should be evident from a fall in open interest on the futures market, and this may be true in silver, which is our next chart.

Note how open interest continued to fall after early August, despite the price recovery. Another reason for OI to drop off is the September contract is winding down, so spread positions were being reduced accounting for much of the fall. If this is so, then short positions in the managed money category will still be uncomfortably high.

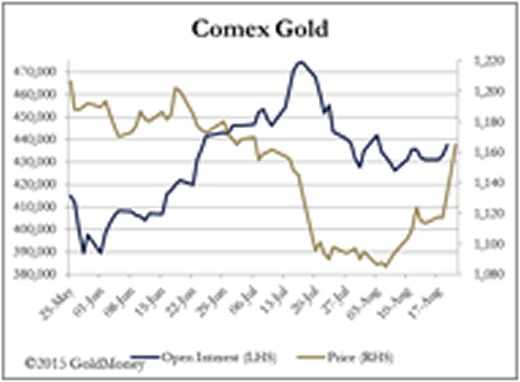

This is not so evident in gold, which is next.

In this case, open interest has steadied since early August, only picking up slightly in the last few days. It could be that new spreads are being opened, rather than new bull positions, but we shall only know for certain when the Commitment of Traders Report is published this evening.

China’s series of minor changes to the yuan/dollar rate has triggered, or at least coincided with weaknesses in emerging market currencies, verging on a crash in some instances. The Khazak tenge lost 23% in one day as oil prices slid lower, and the Turkish lira, which has a poor history, has also fallen sharply on political turmoil. Other weakening EM currencies range from Brazil to South Korea, and Thailand to South Africa. Old hands are reminded of the Asian crisis in 1997, which started in a minor way with the Thai baht coming under pressure, spreading to other South East Asian currencies and becoming a full blown regional crisis.

Many of the factors that drove these currencies into a sharp devaluation are present today on a wider and larger scale, with nearly all equity indices firmly entrenched in bear markets. Investors are shifting their perceptions from chasing equity uptrends to protecting themselves, aware that if emerging markets sink further there is a risk of a full-scale rout developing. That being the case, gold prices should benefit considerably from accelerated buying of physical metal throughout Asia.

It seems improbable that the Fed and the Bank of England will persist in their desire to raise interest rates, particularly since the S&P500 and the FTSE are reflecting growing investor panic. Instead, unless equities stabilise of their own accord, there will be a growing likelihood of a new round of quantitative easing aimed at supporting the markets.

To summarise, precious metals prices are rapidly switching from an entrenched bear market to conditions that could drive prices significantly higher over the medium term.

Next week

Monday. Japan: Leading Indicator (Final). US: Flash Manufacturing PMI.

Tuesday. UK: BBA Mortgage Approvals. US: S&P Case Shiller Home Price, FHFA House Price Index, New Home Sales. Japan: PPI Services.

Wednesday. UK: CBI Distributive Trades. US: Durable Goods Orders.

Thursday. Eurozone: M3 Money Supply. US: Core PCE Price Index, GDP Annualised (2nd Est.), Initial Claims. Japan: CPI, Real Household Spending, Unemployment.

Friday. UK: Nationwide House Prices, GDP (2nd Est.). Eurozone: Business Climate Index, Consumer Sentiment, Economic Sentiment. US: Core PCE Price Index, Personal Income, Personal Spending, University of Michigan Sentiment. Japan: Large Retailers Sales, Retail Sales.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2015 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.