Gold the Ultimate Financial Crisis Insurance

Commodities / Gold and Silver 2015 Aug 25, 2015 - 03:23 AM GMTBy: Casey_Research

By Brian Hunt

By Brian Hunt

You wake up in the morning, turn on the news, and get a sick feeling in your stomach…

The stock market is crashing again.

Another big Wall Street bank has failed.

Your 401(k) has lost another 25%. It’s bleeding value every week.

Your dream of early retirement is history. You’ve lost so much money in stocks that even a "regular" retirement is in jeopardy. If you live a long life, there’s no way you’ll have enough money.

This is the financial-disaster scenario that terrifies a lot of investors.

It’s what kept people up at night during the 2008 credit crisis.

These days, everyone likes to read and talk about the dangers of another financial crisis.

Could something like 2008 happen again? Could another crisis cause the value of the U.S. dollar to collapse? Could the banking system seize up overnight?

Many brilliant people say the answer to these questions is "yes."

Fortunately, I don’t need to know the answer to these questions…and neither do you.

The good news is that it’s very easy to buy insurance against financial disasters like these. I personally own this insurance.

Many of the smartest, wealthiest people I know own it, too. It could mean the difference between a comfortable, early retirement…and just barely getting by. And part of owning this insurance - and potentially making millions of dollars in the next crisis - involves owning one of the market’s riskiest investments.

It’s a strange turn of events that I’ll explain shortly…

The Ultimate Insurance Against Financial Disaster

• First, let’s agree on what “insurance” is…

In my book, buying insurance comes down to spending a little bit of money to hedge yourself against a disaster.

Throughout our lives, we spend a little bit of money on insurance and hope we never have to use it.

For example, home insurance costs a small fraction of your home’s value. You buy it and hope you never have to use it.

The same goes for car insurance. It costs a fraction of your car’s value, so you buy it and hope you never have to use it.

It’s the same with “wealth insurance.”

You can buy wealth insurance and hope you never have to use it.

There are hundreds of wealth-insurance policies out there. They involve intricate details, lots of forms to sign, and payments of big fees to advisors and salesmen (which are often the same thing).

But I’d rather keep things simple and keep money in my pocket instead of putting it in a salesman’s pocket. You might be in the same boat.

Here’s how we can do it…

Put a small portion of our wealth in gold bullion.

That’s it.

That’s all it takes to get wealth insurance…and protect your family against a financial disaster.

You don’t need complicated insurance products. You don’t need to pay big fees to a salesman. Just pay a small commission to a gold seller, store the gold in a safe place, and you’re done.

• Here’s why this "insurance" is important…

Some very smart people are predicting a global depression, a collapse in the dollar, and a huge increase in the price of gold.

For example, Seth Klarman is a legendary investor. He’s probably the smartest financial mind you’ve never heard of. Klarman is warning that the Federal Reserve’s low-interest-rate policy has distorted the financial markets…and is setting us up for disaster.

Klarman and others bring up good points. The U.S. government is spending way too much money on wars, Obamacare, welfare, and other programs. Europe’s and China’s economies could decline and trigger a global recession. These are all real risks to your retirement account.

Even if you’re more optimistic and think things will be fine, I think you’ll agree that it makes sense to own some insurance in case a financial disaster strikes.

People would likely flock to gold in a global financial disaster…and cause its price to soar. For example, the decade from 1970 to 1980 was marked by war, recession, and very high inflation. This made the 1970s a terrible decade for stocks and bonds. But it was terrific for gold owners. As people fled stocks for precious metals, gold gained more than 2,000% during decade.

That’s why it makes sense to buy gold as a form of insurance.

The good news is that you don’t have to buy a huge amount of gold to have a good insurance policy. You can place just 5% of your portfolio into gold.

Its place in your portfolio could mean a huge difference in your family struggling to get by…or doing well.

How a Gold Position Could Make You Wealthy During a Crisis

• Let’s say you have a $100,000 portfolio with 95% of it in blue-chip stocks and income-paying bonds.

You place the remaining 5% of your portfolio into gold. This gives you $95,000 in stocks and bonds, and $5,000 in gold.

If the predicted financial disaster doesn’t strike, your stocks and bonds will increase in value.

Your gold will probably hold steady in price or decline a little. Since the bulk of your portfolio is in stocks and bonds, you’ll do just fine.

But what if the financial disaster strikes? I’ve heard some top analysts say gold could climb to $7,000 an ounce in a financial disaster scenario.

Let’s say a financial disaster sends the value of your stocks and bonds down 50%. That would be a massive decline. Throughout history, only the worst, most severe bear markets sent stocks down this much.

This epic financial disaster would cut your $95,000 position in stocks and bonds by 50%, leaving you with $47,500. But let’s say this disaster also causes gold to rise to $7,000 an ounce. Right now, gold is $1,150 per ounce. A rise to $7,000 would produce a more-than-sixfold increase in the value of your gold. It would cause the value of your $5,000 gold stake to rise to about $30,435.

Post-financial disaster, you’d be left with $77,935 ($47,500 from stocks and bonds + $30,435 from gold).

The disaster still would hit you, but not nearly as hard. Your insurance would play a big role in limiting the damage.

But what if you think the chances of financial disaster are higher than “unlikely”?

What if you’re more worried than the average Joe?

If you are, simply increase the "insurance" portion of your portfolio. Instead of a 5% position in gold, you could increase it to 20%.

If the previously mentioned financial disaster were to strike your $100,000 portfolio weighted 80% in stocks/bonds and 20% in gold, the math work out like this:

The 50% decline in your $80,000 stocks/bonds position would leave you with $40,000. Gold’s increase to $7,000 an ounce would increase your $20,000 gold position to $121,739

Your large gold-insurance position actually would produce a net gain in this scenario. You’d be left with $161,739…an increase of over 60%.

• As you can see, the larger your gold-insurance policy, the better you would do in a financial-disaster scenario.

But if the financial disaster doesn’t strike, you won’t benefit as much, because you hold less money in stocks and bonds, which do well if the economy carries on.

And keep in mind…it would take a serious financial disaster to send stocks down by 50% and gold up to $7,000.

Depending on what you think the chances of a financial disaster are, you can adjust your gold-insurance policy. It all depends on your goals and beliefs.

Think the chances of disaster are slim? Consider a gold-insurance policy equivalent to 1%-5% of your portfolio. Think the chances of disaster are high? Consider a gold-insurance policy equivalent to 20% of your portfolio.

Is financial disaster around the corner? I don’t know the answer.

Nobody does.

But if you buy some "wealth insurance" in the form of gold, you don’t need to know the answer. It’s simple. It’s easy. It’s low-cost.

You buy gold and hope you never have to use it. You’ll do fine if things carry on. You’ll do fine if the crap hits the fan.

And the peace of mind you get from owning gold "insurance" is worth even more than the money it could save you.

How to Amplify Gold’s Power to Create Wealth

You might have heard some advisors say that if gold soars in value during a crisis, the companies that mine gold could soar even more.

That’s because when the price of a natural resource doubles, triples, or quadruples in price, the profit margins of the companies that produce the natural resource can skyrocket.

For example, let’s say you own a gold-mining company. Your company can produce gold for $800 per ounce. Let’s also say the current selling price for gold is $1,000 per ounce. This means your profit margin is $200 per ounce.

Now let’s say the price of gold rises from $1,000 per ounce to $2,000 per ounce. This is a 100% increase in the price of gold. But your company’s profit margin just soared from $200 per ounce to $1,200 per ounce…a 500% increase.

This kind of financial magic is called leverage…and it can produce incredible stock market gains.

For example, from 2002 to 2008, the price of gold climbed from $300 per ounce to $1,000 per ounce.

During this time, leading gold company Kinross Gold climbed from $2.25 per share to nearly $27 per share (a 1,093% gain). Another gold company, Yamana Gold, climbed from around $1.53 a share to more than $19 per share (a 1,165% gain). The gains were so great in this market that a simple gold stock index gained 692%!

These types of gains are impressive. But please keep in mind that these companies are also very risky. They are some of the riskiest stocks in the entire market. That’s because mining is a capital-intensive business. The firms have no control over their product. When gold falls in price, these companies can fall more than 80% in a short time.

But if a financial crisis forces the value of gold much higher, and paper currencies much lower, these companies could rise 500%…1,000%…or more.

That’s why it can make sense to make them part of your "wealth insurance" position.

Stock Options that Will Pay Off Big if the Dollar Crashes

• Around the office, we often say these firms are like stock options that will pay off big in a financial crisis. And they are stock options that don’t expire.

As you may know, a stock option is a type of security that offers massive upside. And we’re not talking about “only 100%” upside.

Stock options can return 10, 20, even 50 times your original investment.

It’s not uncommon for traders to turn $10,000 into $250,000 with well-placed option trades.

• But while buying options gives you the potential to make giant gains, they come with some negatives, too.

The biggest one is that options have finite life spans. For example, you might buy an option contract in January that expires in June. If the outcome you expect doesn’t happen by June (known as the “expiration date”), the value of your option will be worthless, and you’ll lose 100% of the capital you place in the trade.

The best mining stocks have the same upside as stock options. It’s not uncommon for professional mining-stock investors to turn $10,000 into $250,000 by buying the right stock at the right time.

However, these miners are actual businesses. They don’t "expire" like option contracts do. The right miners have plenty of cash on hand to fund their operations…which allows you to hold these stocks for years and get exposure to their incredible upside potential. (It’s worth mentioning that Seth Klarman - the legendary investor I mentioned earlier - owns a large amount of small-cap gold firm NovaGold.)

Because the upside of these stock options that never expire is so great, placing just a small amount of your portfolio in them can produce incredible gains if gold increases in price.

Placing just 1% or 2% of your portfolio in these stocks can result in a huge positive change to your overall net worth.

The Right Time to Buy Insurance Is When It’s Dirt-Cheap

• Finally, we come to the ideal time to buy these stocks.

Buying at the right time is how you set yourself up for 500%…1,000%…even 2,000% returns.

The ideal time to buy these stocks is after huge busts.

Gold-mining stocks are cyclical. This means they go through huge booms and busts.

One year, they will advance by 50%. The next year, they will advance another 50%. The year after that, they will plummet by 60%.

This boom and bust price action is in stark contrast with the steadier price action of "non-cyclical" stocks like fast-food chain McDonald’s…or health care giant Johnson & Johnson.

• The only way to make money in the sector is to buy near the bottoms…and sell near the tops.

You must buy these assets when prices are so low that the public can’t stand the thought of owning them (when they are cheap).

As my friend and legendary natural resource investor Rick Rule often says, “You’re either a contrarian or a victim.”

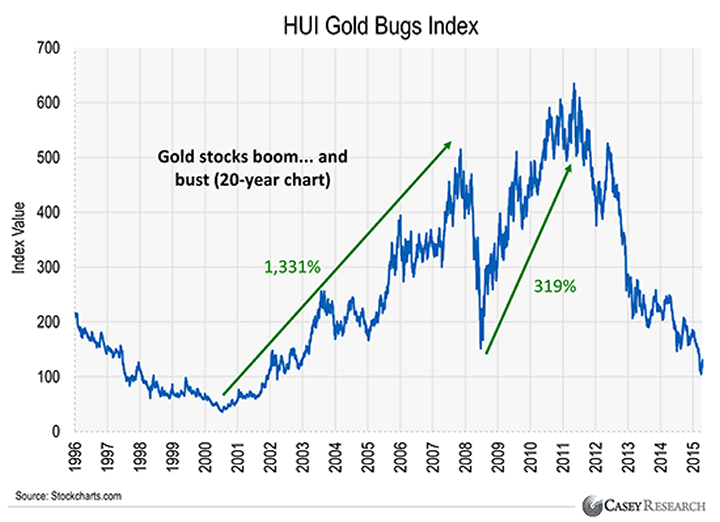

The chart below shows how powerful this idea can be. It displays the past 20 years of the most widely used gold-stock index (the "HUI").

You can see how it goes through huge booms and busts. The booms are good for hundreds-of-percent gains. The busts result in huge losses…

If you look at the right side of this chart, you can see that there has been a giant bust in gold stocks. Global central banks have been able to make it seem like all is well with the global financial system…and the HUI has lost 79% of its value since its 2011 peak.

Most investors see this and turn away in disgust. But many sophisticated investors see it as a "fire sale" for these assets that could soar during a currency crisis.

If the global central bank experiment ends badly, the value of paper currencies will continue to plummet. The value of "real money" (gold) will soar. And buying these "stock options that never expire" now, while they are dirt-cheap, could end up looking like a genius move.

• In summary, gold is the ultimate form of wealth insurance. I buy it and hope to never have to use it. It’s a vital part of my overall wealth plan. I hope it’s part of yours.

And a basket of carefully selected gold-mining stocks could pay off in a big way if world governments continue to devalue our money.

International Speculator is our advisory focused on the best small gold stocks with huge upside potential. Editor Louis James has extraordinary amounts of experience, know how, and industry contacts. Most importantly, Louis personally investigates the most important projects...and meets face-to-face with management teams.

Right now, you can gain access to a list of the top junior mining stocks to buy today with a subscription to International Speculator. If you’re interested, you’ll need to act quickly… We’re doubling the price of a subscription soon. Click here for more details.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.