World Recession 2009 as a Result of Peak Oil

Economics / Recession Jun 27, 2008 - 12:55 AM GMTBy: Brian_Bloom

Whilst most people are vaguely aware that oil is important to the world economy, few understand the true impact of the recent rise in the oil price.

Whilst most people are vaguely aware that oil is important to the world economy, few understand the true impact of the recent rise in the oil price.

In 1998 the heads of state of the USA and Australia failed to ratify the Kyoto protocols. They were trying to protect their country's economies. Ironically, they engineered a situation where not only is the US economy under greater threat than it would have been had our leaders ratified the protocols, the entire world economy is now seriously threatened.

It took a further nine years for the US government to finally understand how serious an error of judgement the failure to ratify Kyoto was. The issue had nothing to do with Carbon Dioxide emissions. It had to do with the fact that their failure to take action at that time blocked the march to market of alternative energy technologies. Finally, in June 2007, the Renewable Energy and Energy Conservation Tax Act (H.R. 2776) was passed. But the damage had been done. The sharp rise in the oil price – from around $65 a barrel in June 2007 to around $135 a barrel in June 2008 – has been a direct consequence of that original error of judgment.

H.R. 2776 put the following in place, and the associated costs over 10 years are highlighted:

| Tax concession (Alternative Energies) | Cost $billions |

| Renewable energy production tax credit | 6.580 |

| Solar Energy and Fuel Cell Investment tax credit | 0.563 |

| Renewable clean energy bonds for public providers and electric co-operatives | 0.550 |

| Sales of electric transmission property | 0.000 |

| Residential energy efficient equipment incentives | 0.089 |

| $4,000 tax credit for plug-in hybrids | 1.200 |

| 50 cents per gallon production tax credit for cellulose alcohol for fuel | .024 |

| Extension of biodiesel production tax credit | .279 |

| Tax credits for alternative fuel dispensing equipment | .184 |

| Fringe benefits for bicycle commuters | .010 |

| Modification of depreciation allowances on certain vehicles | .786 |

| Restructuring of New York Liberty Zone tax credits | 1.636 |

| Total cost of tax concessions for alternative energy and alternative energy infrastructure | $11.901 |

| Tax concession revoked (savings) | Income $billions |

| Denial of section 199 benefits for income attributable to domestic production(within the US ) of oil, natural gas or primary products thereof | (11.427) |

| Increased amortization period for geological and geophysical expenditures from 5 years to7 years | (0.103) |

| Limitations on the ability of oil and gas companies to claim foreign tax credits | (3.562) |

| Tightening of eligibility for renewable diesel credits | (0.085) |

| Total Income from elimination of oil and gas tax credits | ($15.177) |

The surplus of $3.276 billion ($15.177 - $11.901) will be allocated as follows to encourage energy efficiencies within buildings:

| Tax concession (to encourage energy savings and reduced CO 2 ) | Income $billions |

| Tax credit bonds for green community programs designed to reduce greenhouse gas emissions | 1.46 |

| Tax credit bonds to provide States with funds to encourage energy efficiency improvements to domestic property | 0.903 |

| Energy efficiency deductions for commercial buildings | .901 |

| Energy efficiency credits for appliances | .351 |

| Depreciation by utilities of smart electric meters over a five year period | 1.315 |

| Total cost of encouraging energy conservation in buildings | $4.93 |

Total apparent incremental cost of H.R. 2776: $1.654 billion

($15.177b – $11.901b – $4.93b)

Apart from the fact that the bill is responding to lobby group pressures in some areas – which may or may not solve the problems (and which responses glaringly do not promote R&D in other areas, in particular over-unity electromagnetic energy) – it is a sterling example of political sleight of hand and the disingenuousness that accompanies lack of ethics in politics. It “appears” that the US government has now put in place a series of measures which will encourage that which Kyoto would have required it to do 10 years ago, and that the net cost will be around $1.7 billion over 10 years.

But let's look at the additional cost of not ratifying the Kyoto protocols and of not passing H.R. 2776 (or something similar) ten years ago. Let's look at the impact of the recent oil price rises – which would likely not have occurred if the Kyoto protocols had been ratified.

Note: As an aside, there will be some critics who will argue that it's easy to talk like this in hindsight. The fact is that I started writing these articles on November 30 th , 1999. In that very first article the following statement appeared: “Perhaps [the] most serious [error of judgement] of all, the USA Government failed to ratify the Kyoto Protocols - thereby sabotaging any lingering possibility that natural market forces would ensure a timely emergence of the technological "drivers" of the next [economic] up-wave.” Source: http://www.gold-eagle.com/editorials_02/bloom080502.html . I ask the reader to bear this in mind when reading the balance of this forward looking article which is, ultimately, attempting to develop an approach to solutions.

For many years I have been trying to communicate that the people whom we have appointed to positions of political power are typically not suited to occupy those positions of trust. We cannot allow a situation to continue where our supposedly democratically elected political leaders are responsive to lobby groups which represent vested interests. We cannot continue to appoint charismatic, silver tongued, persuasive salesman to positions of political power. The issue does not devolve to which political system we use, or which political party the candidate represents. It devolves to “eligibility” of politicians to occupy positions of power. And eligibility goes beyond competence. It goes to wisdom and ethical values.

Below are two photographs. One is of the Democratic contender for the office of President of the United States ; and the other is his Republican counterpart. I make no partisan statement here, and I make no further comment other than to recommend to readers that you study these two photographs very carefully and consider the detail in both photographs. The next President of the United States of America will very likely be one of these two men.

Barack Obama |

John McCain |

Dear reader, it is a virtual certainty that, unless the oil price is “managed” downwards, 2009 will be a year of recession. Arguably, for the following reasons, the world economy is already in recession.

In 2004 I took a long term view of the world's oil (and related) markets and their impact on the world economy. This is what I found – in context that world GDP in 2003 was $42.3 Trillion:

Table 1: Summary oil related contributions to World GDP.

(2003 numbers)

| Oil | 2.84% |

| Motor Car Manufacture | 2.80% |

| Road Building | 0.50% |

| Value Add (Refineries, Pipelines, Service stations) | 2.00% |

| Aircraft Manufacture | 0.58% |

| Air Travel, Road, Rail, Sea Freight | 0.74% |

| Subtotal | 9.46% |

| Other assumed (Plastics, pharmaceuticals, textiles) | 1.00% |

| Total % of World GDP | 10.46% |

In 2003, the weighted average savings rate of the industrialised world was 4.39%.

The table below shows the impact on the economic multiplier of that savings rate

Table 2: Multiplier Effect after 12 cycles of spending

Savings rate |

4.39% |

|||

Time Period |

Income |

Save |

Spend |

|

1 |

$ 100.00 |

$ 4.39 |

$ 95.61 |

|

2 |

$ 95.61 |

$ 4.20 |

$ 91.41 |

|

3 |

$ 91.41 |

$ 4.01 |

$ 87.40 |

|

4 |

$ 87.40 |

$ 3.84 |

$ 83.56 |

|

5 |

$ 83.56 |

$ 3.67 |

$ 79.89 |

|

6 |

$ 79.89 |

$ 3.51 |

$ 76.39 |

|

7 |

$ 76.39 |

$ 3.35 |

$ 73.03 |

|

8 |

$ 73.03 |

$ 3.21 |

$ 69.83 |

|

9 |

$ 69.83 |

$ 3.07 |

$ 66.76 |

|

10 |

$ 66.76 |

$ 2.93 |

$ 63.83 |

|

11 |

$ 63.83 |

$ 2.80 |

$ 61.03 |

|

12 |

$ 61.03 |

$ 2.68 |

$ 58.35 |

|

Cumulative Income |

$ 948.75 |

$ 41.65 |

$ 907.10 |

|

Multiplier effect |

9.49 |

X |

||

Assuming one spending cycle occurs in one month ( not realistic, but done for the purposes of making the point in principle), then the cumulative impact of the income that originally flowed from oil and related industries – over 12 months – would be:

10.46% X 9.49 = 99.27%

Except for the items under “Other”, the numbers in Table 1 are accurate (in that the dollar values were sourced from the internet), as was the weighted average world savings rate used in Table 2. The only assumption that is “rubbery” is how long it takes a spending cycle to complete. To my knowledge it is impossible to measure this, but the point has been made in principle.

The reader should also be aware that this is a highly unorthodox way of looking at this particular subject. Most economists (and I am not an economist) talk in terms of Primary Industries (Farming, Fisheries, Forestry and Mining,) being the initial drivers of the economy. However, without “energy” (also sourced from coal) there would be no large scale Primary Industry activity. There would be no broad-acre farming, no deep sea fishing, no forestry and no deep level mining.

The bottom line is that oil is the ultimate driver of the world economy and will continue to be so until an appropriate alternative is found – which, in addition to providing a source of energy also needs to provide multiple millions of downstream employment opportunities.

This latter requirement will eliminate nuclear, wind, geothermal, hydro-electric and other similar ‘fixed' location technologies from contention – all of which will replace coal . It also brings into stark focus that ‘farming' for food will come into head-to-head competition with farming for biofuels (intended to replace oil) unless we find an alternative energy that is not dependant on food related agriculture. (Biofuels from cultivated algae seems to offer a possible solution in this area).

The two (apparent) alternatives – which potentially offer comprehensive solutions - are solar energy and environmental energy scavenging, because neither generates CO 2 . Conceivably, in time, it may be possible to introduce hydrogen into contention. Unfortunately, the minds of physicists are typically programmed to block out environmental energy scavenging on the grounds that this is a pipe dream which would defy the laws of thermodynamics. I happen to think they are making a serious error of judgment in closing their minds to this possibility; and I set out comprehensive reasons in my factional novel, Beyond Neanderthal – which can now be ordered over the internet from www.beyondneanderthal.com

So what do we do in the meantime? What do we do as oil supplies wane, and as coal is being blocked from being a fall-back position by the IPCC findings – because Carbon Dioxide is supposedly destroying our environment? (with which I happen to also disagree). Do we just ignore the fact that synthetic diesel can be made from coal at a cost of less than $50 a barrel, and embrace nuclear – which is what the politicians have been positioning to achieve ever since Margaret Thatcher's days? Take another look at the two photographs above. Do you see humility, compassion, Sage wisdom or Christian Love?

Well, even if you are prepared to accept nuclear (which won't address the Peak Oil problem) it will still take a few years to roll nuclear out. We therefore have to take it on the chin and accept that 2009 will likely bring a recession; and that the length and depth of that recession will depend on how quickly we can mobilise alternative energy technologies that can also generate downstream economic activity. As it happens, nuclear probably can't do that and neither can nuclear address the Peak Oil problem because cars can't be nuclear powered (yet). At present, nuclear is good for one thing only. It can generate electricity for distribution to remote locations via overhead wires in politically stable countries. Maybe, one day, it could be harnessed to produce hydrogen from seawater for use in hydrogen fuel cells.

But here's a thorny one: Who gets to decide which country will be allowed to have nuclear power and which country won't? Let's think about that for a while. Venezuela ? Haiti ? Zimbabwe ? Iran ? Syria ? How about Turkey ? Hmm. That's a really thorny one. Turkey will likely have 80 million inhabitants by the end of the decade and, if it gets accepted into the EU, it will have the largest population of any single member country of the EU. Oh, and by the way, Turkey 's population is largely Muslim. Does that matter? If so, why? Why should it matter? One of the issues in the modern day world is the divisive attitude of some of more our egocentric leaders.

Which brings us back to Peak Oil and the 2009 recession.

As an aside, are you starting to get an idea of just how much economic damage will be attributable to the IPCC's findings if it turns out the scientists are wrong about the role of CO 2 in climate change – which I happen to be convinced they are? (For the arguments, see my media release dated June 4 th , 2008, which can be accessed at http://www.beyondneanderthal.com/html/s01_home/home.asp?id=home ), and, while you're reading that media release, bear in mind that the ice caps on Mars are also melting. Are you starting to understand how much economic damage the politicians have caused by not ratifying the Kyoto protocols? Not yet? Well, then read on.

Table 3: Calculation of wholesale value of oil in 2004

as percentage of 2003 World GDP

2003 World GDP: $42.3 trillion

2003 World Oil Production Capacity: 74 million Barrels per day

2004 Price per barrel: +-$45

Value of world oil market: 74 X 365 X $45 = $1.2 Trillion p.a.

Conclusion

Oil alone contributed 1.2/42.3 = 2.84% of 2003 World GDP

Table 4: Calculation of wholesale value of oil in 2008

as percentage of 2008 World GDP (implied)

• Total 2006 GDP: $48.4 Trillion (Source: World Bank)

• Implied annual growth rate (3 yrs since 2003): 4.59% p.a.

• Implied 2008 GDP: $52.9 trillion (compounding at 4.59% p.a.)

• Current oil price (June 23rd, 2008): $137/bbl

• Current Oil Demand: 87.8 million bpd (Source: International Energy Agency)

• Value of Oil demand: $4.39 trillion

Conclusion:

Implied oil production has risen from 2.84% of world GDP in 2003/4 to 9.1% in 2008

Now, to understand what this means, we have to look at the part of the world economy which is not directly related to oil.

Table 5: Implied annual growth rate of the

non-oil element of the World Economy

- 2003: 97.16% (100% - 2.84%) of $42.3 Trillion = US$41.1 Trillion

- 2008: 91.9% (100% - 9.1%) of $52.9 trillion = US$48.6 trillion

- Implied Growth rate in current dollars: 3.4% p.a.

Overall Conclusion: Adjusting for price inflation, and assuming world inflation has been rising at more than 3.4% p.a., the world economy is very likely already in recession as at June 2008.

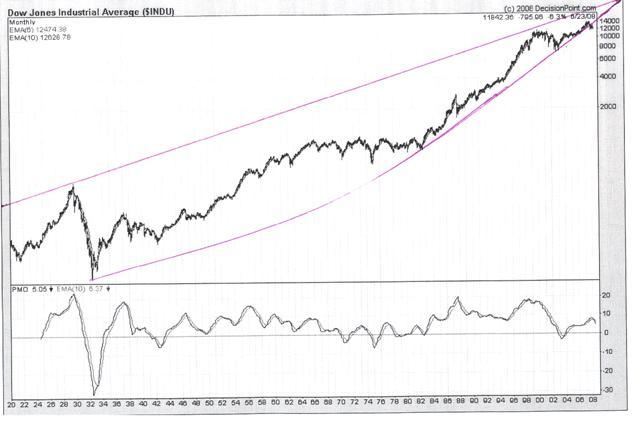

This observation is validated by the chart below – courtesy Decisionpoint.com, which recently gave a sell signal as the index penetrated its curved up-trend line on the downside.

Chart 1: 80 Year View of the Dow Jones Industrial Index

This sell signal can be interpreted as the market saying that there will not be a hyperinflationary blow-off in share prices, and that the Fed will curb its predilection to print its way out of economic problems

It should also be recognised that the very ability of the US Federal Reserve System to continue creating money out of thin air is waning in any event; because US Public Debt is now in excess of $9.4 trillion and the interest burden on that debt is in excess of the so-called budget deficit, the component numbers of which are probably not believable anyway because of likely bookkeeping sleight of hand. Ignore the bookkeeping. Follow the cash trail.

Finally, we should not forget that the Federal Reserve System operates in breach of Article 1, Section 8 of the United States Constitution. And we should also not lose sight of the fact that it is currently dysfunctional. The FOMC is supposed to have 13 members, 7 of whom are nominated by the US President and ratified by the Senate; and six of whom are Presidents of the regional Federal Reserve Banks – which are owned by Private Enterprise. At present, there are two nominated seats vacant – and so voting at FOMC meetings is weighted 6:5 in favour of Private Enterprise. The political system in the US has also become dysfunctional because the Senate has been sitting on the President's nominations for the 2 vacant seats for months and has failed to either ratify or reject them.

Way Forward

The time has come for us to face the future with a far more responsible and mature approach. Yes, even Blind Freddy can see that there is climate change. Its even happening on other planet/s as our sun has been moving to complete its 26,000 cycle through the galaxy – and to begin yet another cycle in its multi billion year life. We have to respect what the highly professional scientists are saying, but we also have to stop treating them as if they were omnipotent gods. We cannot allow them, with just a flick of the wrist, to dictate what we may or may not do in respect of Carbon Dioxide; or, with a flick of the other wrist, to accept or reject the possibility of over-unity electromagnetic energy generation when they don't even understand why the Universe is expanding at an accelerating rate. What the world desperately needs now is holistic thinking, calm discussion and sensible, non partisan decision making by men and women of wisdom and integrity.

Fischer Tropsch technology – for converting coal to synthetic diesel – has a place within the context of a much bigger strategic view of the future. One such view is set out within the 440 pages of Beyond Neanderthal , which took over 20 years to research. For various reasons, Nuclear Fission technology is philosophically flawed as a concept and should be treated with great circumspection. The possibility of Over-Unity electromagnetic energy production should be investigated by the best minds in the field of Physics. The circumstantial evidence suggests that there is more to this concept than meets the eye. It should not be dismissed without in-depth investigation.

Let's stop focussing on individual pieces of the jigsaw puzzle; and let's get some sensible Big Picture discussion going. You can purchase a copy of Beyond Neanderthal , which is a factional novel, over the internet at www.beyondneanderthal.com

By way of a tongue-in-cheek humorous ending: I hereby claim Senator McCain's proposed $300 million prize for the development of a more efficient battery that will “leapfrog” the abilities of current hybrid and electric cars. http://edition.cnn.com/2008/POLITICS/06/23/campaign.wrap/index.html?eref=rss_topstories

The extremely powerful, non-chemical electricity storage technology is described in my novel – which draws attention to two specific technologies, patented in the 1980s, and which the world appears to have forgotten. The $300 million will come in handy because, by my calculations, the other of these two technologies will require roughly that amount to be fully commercialised across the planet within 7 years. In so doing, we can save the US Government the $16.8 billion tax credits provided for by H.R. 2776. Oh, and I almost forgot. The $300 million can be repaid in full as part of the deal.

By Brian Bloom

The novel, Beyond Neanderthal , has arrived from the printers. Orders may be placed at www.beyondneanderthal.com and existing orders will be executed in the next few days.

Copyright © 2008 Brian Bloom - All Rights Reserved

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.