Steps from a Deep October Stock Market Selloff

Stock-Markets / Stock Markets 2015 Sep 22, 2015 - 01:33 PM GMTBy: Bob_Loukas

For some reason there was a late flurry of expectations that the FED was going to raise rates this past week. Many in the media would like us to believe that we've finally transitioned out of an economic intensive care and that the economy is ready to stand on its own two feet. Evidence to support the idea is the employment picture, which when taken on the surface provides the illusions that we're in a healthy and thriving economy.

For some reason there was a late flurry of expectations that the FED was going to raise rates this past week. Many in the media would like us to believe that we've finally transitioned out of an economic intensive care and that the economy is ready to stand on its own two feet. Evidence to support the idea is the employment picture, which when taken on the surface provides the illusions that we're in a healthy and thriving economy.

But the reality is very far from what those broad numbers represents. Sure certain pockets of the economy are doing well, namely the top 10%-20% of income earners. But for the majority of people, real incomes have been in a constant decline throughout this expansion period, while the quality of available employment has been subpar. The government and their talking heads want you to believe all is well, but what we have here is a highly stimulated economy (via low interest rates, easy money, high debt spending, and artificial asset appreciation) that is only muddling through a business Cycle expansion.

But if we stop and consider that the FED has not raised rates in over a decade now, has pumped trillions of dollars into the economy, and that this is month 78 since the last recession, we're being fooled into forgetting that the U.S (and the world) is currently experiencing an economic depression that is being tapered over with easy money. All of this economic stimulus should have seen inflation and the economy growing at over 5%, but both metrics are barely above the break-even point. And to make matters worse, we're forgetting that the standard economic business Cycle is typically just 80-90 months in duration. In short, we're now entering the timing band for the next economic recession.

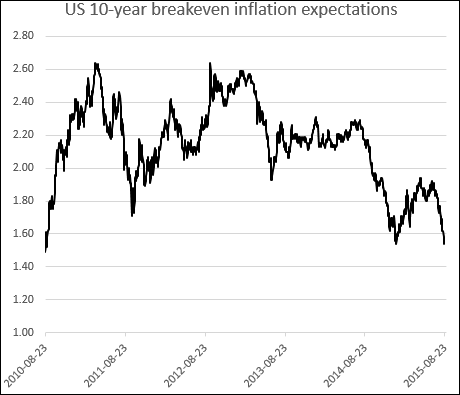

So when we hear about the FED possibly raising rates I find this almost ludicrous to even consider. The Dollar is at multi-year highs for a reason, because capital is fleeing from risk, especially from the emerging markets, for the safety of the reserve currency. The FED cannot move because global growth is slowing and market volatility is rising. Core retail sales are coming in at below expectations, as demand for goods remains weak. Take a look at inflation expectations, they're once more heading towards that deflationary line.

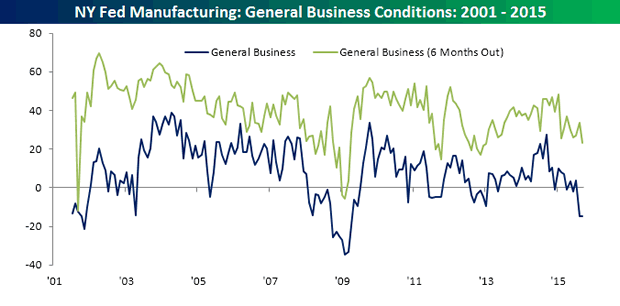

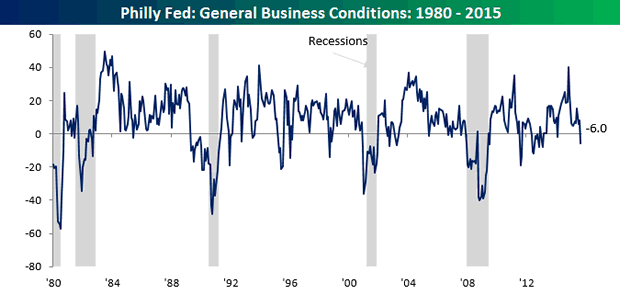

The media can focus on employment numbers all they like, but they're a lagging indicator, unlike manufacturing surveys which provide a better snapshot of economic activity. If we look at the recent NY and Philly FED surveys, both show a new developing downtrend that I know the FED is concerned about.

Source: Bespokeinvest.com

So what's the point I'm sure you're asking, because we have established in the past that economic performance does not correlate well with stock market performance, at least not in the short-term. And I would agree with that statement, with the caveat being that eventually fundamentals always matter, and that this might now be that time when it matters!

We had a massive and powerful bull market rally, but it has aged considerably and has left valuations at levels only eclipsed by that once in a century bull market of 1982-2,000. My point is that I sense that both the economy and the markets in general are approaching their climax. This is now a time to be both concerned and defensive.

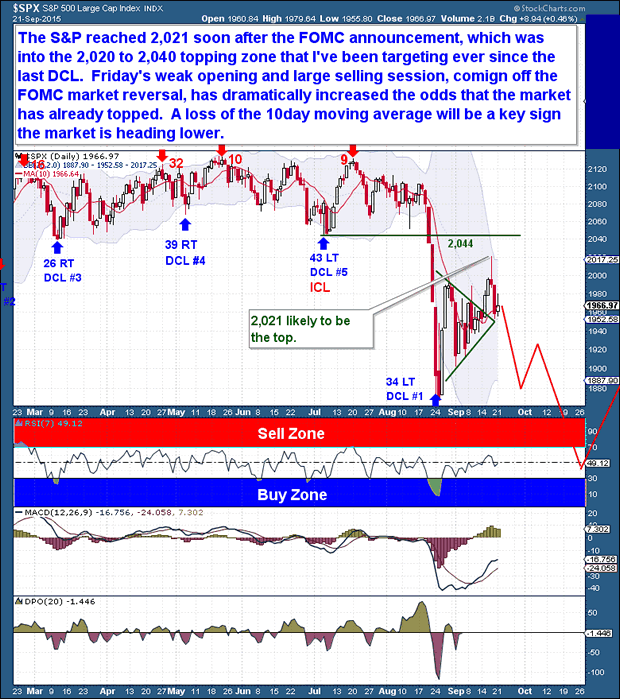

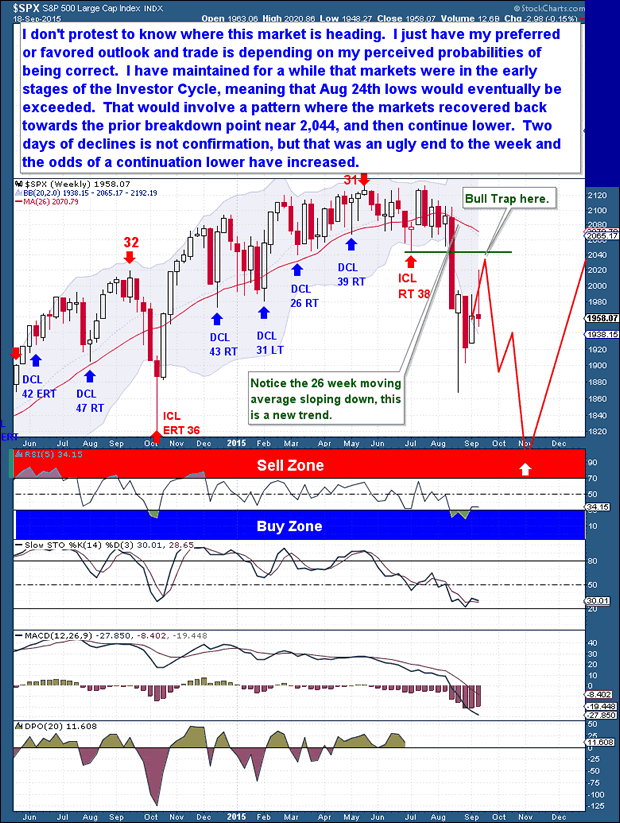

On the Daily Cycle, the S&P index reached 2,021 soon after the FOMC announcement, which was into the 2,020 to 2,040 topping zone that I've been reporting as my target ever since the last Daily Cycle Low (DCL). (See post back in Aug Post: Sound the Alarm - Aug 24th). This has been the type of move I expected ever since the deep August lows, with the action in this Daily Cycle constituting only a counter-trend reaction before a larger degree continuation of the Investor Cycle took control again.

When the market reversed sharply on Thursday, I thought it might be mainly an overbought drop, before one more rally towards a Cycle Top near 2,044. But when Friday opened sharply lower and significant selling was seen, it dramatically increased the odds that the market had already topped.

I don't protest to know where this market is heading, especially not in this type of conflicting environment. I only have my preferred outlook to present you each and every week and I'm also not afraid to change that viewpoint as the market Cycles dictates. My trades depend upon my perceived probabilities of the current outlook, which are of course greatly influenced by my degree of comfort in my outlook.

In this particular case, I have maintained for a number of weeks that the markets were in the earlier stages of the Investor Cycle, meaning that the Aug 24th lows would eventually be exceeded. That would involve a pattern where the markets recovered back towards the prior breakdown point near 2,044, and then continue lower. Two days of sharp declines are not confirmation, but that was an ugly end to the week and the odds of that expected pattern playing out, i.e. a continuation lower, have greatly increased.

The Financial Tap publishes two member reports per week, a weekly premium report and a midweek market update report. The reports cover the movements and trading opportunities of the Gold, S&P, Oil, $USD, US Bond’s, and Natural Gas Cycles. Along with these reports, members enjoy access to two different portfolios and trade alerts. Both portfolios trade on varying time-frames (from days, weeks, to months), there is a portfolio to suit all member preferences.

You’re just 1 minute away from profitable trades! please visit http://thefinancialtap.com/landing/try#

By Bob Loukas

© 2015 Copyright Bob Loukas - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.