Gold and Silver End-Quarter Influences

Commodities / Gold and Silver 2015 Oct 02, 2015 - 04:27 PM GMTBy: Alasdair_Macleod

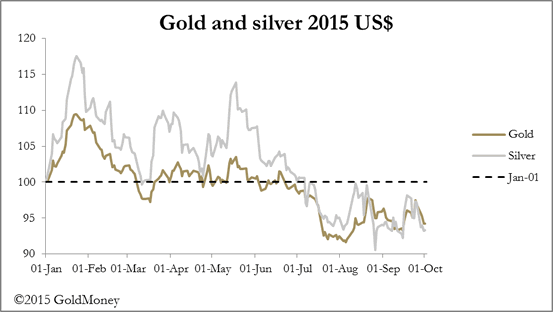

In a generally quiet week, gold and silver prices were marked down in thin trade towards the quarter-end, when traders make up their books, with gold falling $32 to $1114.5, and silver by 58 cents by the close on Thursday night. Prices opened lower in early European trade, with gold less than $10 from the $1100 level.

In a generally quiet week, gold and silver prices were marked down in thin trade towards the quarter-end, when traders make up their books, with gold falling $32 to $1114.5, and silver by 58 cents by the close on Thursday night. Prices opened lower in early European trade, with gold less than $10 from the $1100 level.

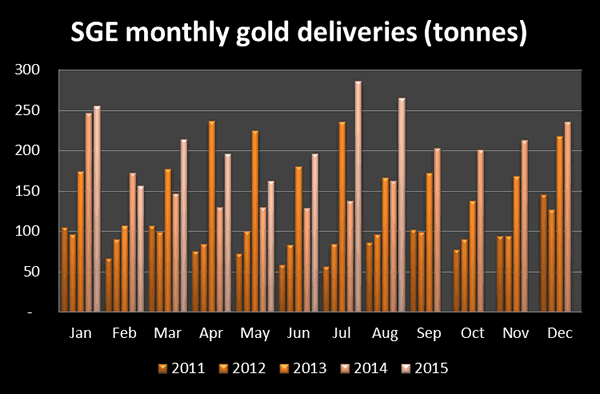

Open interest in both metals on Comex barely changed, yet anecdotal reports of continuing demand for physical gold from all over Asia persists. Chinese demand, measured by deliveries to the public through the Shanghai Gold Exchange is up over 35% so far this year compared with the same period last year. The annual progression on a monthly basis is shown in the next chart.

The final number for September will not be available for another week or so, but it is likely to be nearly 250 tonnes. So since January 2011, total gold delivered is nearly 8,500 tonnes, a staggering amount.

This is despite a continuing weakness in some Asian currencies, such as the Turkish lira, which makes gold more expensive in local terms for much of Asia Minor. Separately the Peoples Bank of China announced an addition to its gold reserves of 16.17 tonnes in August. In silver, according to a report filed with Reuters, coin demand "is absolutely through the roof", a manager at Perth Mint was quoted as saying. In this case it is manufacturing capacity that is to blame for delays in supply, and at the US mint at Westpoint, the plant is working three shifts and paying staff overtime to keep up with demand for Silver Eagles.

While the ordinary person shows a growing uneasiness over the financial outlook, there is still confusion over US interest rate policy, with some mainstream investment banks still expecting the Fed to raise the Fed Funds Rate in December. Hard evidence of both disappointing US economic performance and the destruction a strong dollar has wreaked on commodities and emerging market economies suggests the future offers deflation, and not inflation. It is therefore a mystery why views that US rates will rise persist.

The lack of cogent thinking (or is it deliberate disinformation?) is never a good sign for a stable market outlook. It suggests that multiple markets are mispriced, a situation that is always corrected. Nor is this something under the control of central banks, other government agencies, or those who deal on their coat-tails. Mr Market always wins in the end. Therefore, if what is going on in precious metals markets, equity and bond markets, as well as currencies are at odds with financial reality, they are likely to adjust suddenly and together.

The persistent distortion whereby gold is being cleaned out of western vaults while futures traders depress the price even further is symptomatic with this loss of reality. This is not to say a rise in the gold price is immenent, only the bears are on borrowed time.

Next week

Monday. Eurozone: Markit Composite PMI (Final). UK: Market/CIPS UK Services PMI. US: Markit Composite PMI (Final), Labour Market Conditions, Non-Manufacturing Business Activity, Non-Manufacturing Prices.

Tuesday. US: Balance of Trade

Wednesday. Japan: Interest Rate Decision, Leading Index. UK: Manufacturing Production, Industrial Production. US: Mortgage Applications, Consumer Credit

Thursday. Japan: Machinery Orders, Current Account. UK: Halifax House Price Index, BoE Interest Rate Decision. US: Initial Jobless Claims.

Friday. UK: Construction Output, Trade Balance. US: Import Prices, Export Prices, Wholesale Inventories.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2015 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.