Everything’s Deflating And Nobody Seems To Notice

Economics / Deflation Oct 22, 2015 - 12:07 PM GMTBy: Raul_I_Meijer

Whenever we at the Automatic Earth explain, as we must have done at least a hundred times in our existence, that, and why, we refuse to define inflation and deflation as rising or falling prices (only), we always get a lot of comments and reactions implying that people either don’t understand why, or they think it’s silly to use a definition that nobody else seems to use.

Whenever we at the Automatic Earth explain, as we must have done at least a hundred times in our existence, that, and why, we refuse to define inflation and deflation as rising or falling prices (only), we always get a lot of comments and reactions implying that people either don’t understand why, or they think it’s silly to use a definition that nobody else seems to use.

-More or less- recent events, though, show us once more why we’re right to insist on inflation being defined in terms of the interaction of money-plus-credit supply with money velocity (aka spending). We’re right because the price rises/falls we see today are but a delayed, lagging, consequence of what deflation truly is, they are not deflation itself. Deflation itself has long begun, but because of confusing -if not conflicting- definitions, hardly a soul recognizes it for what it is.

Moreover, the role the money supply plays in that interaction gets smaller, fast, as debt, in the guise of overindebtedness, forces various players in the global economy, from consumers to companies to governments, to cut down on spending, and heavily. We are as we speak witnessing a momentous debt deleveraging, or debt deflation, in real time, even if prices don’t yet reflect that. Consumer prices truly are but lagging indicators.

The overarching problem with all this is that if you look just at -consumer- price movements to define inflation or deflation, you will find it impossible to understand what goes on. First, if you wait until prices fall to recognize deflation, you will tend to ignore the deflationary moves that are already underway but have not yet caused prices to drop. Second, when prices finally start falling, you will have missed out on the reason why they do, because that reason has started to build way before a price fall.

A different, but useful, way to define -debt- deflation comes from Andrew Sheng and Xiao Geng in a September 24 piece at Project Syndicate, China in the Debt-Deflation Trap:

The debt-deflation cycle begins with an imbalance or displacement, which fuels excessive exuberance, over-borrowing, and speculative trading, and ends in bust, with procyclical liquidation of excess capacity and debt causing price deflation, unemployment, and economic stagnation.

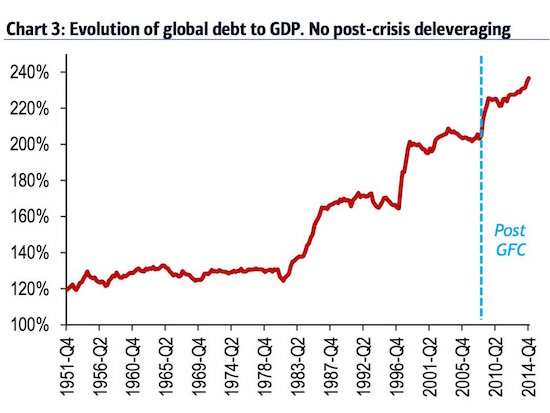

That’s of course just an expensive way of saying that after a debt bubble must come a hangover. And how anyone can even attempt to deny we’re in a gigantic debt bubble is hard to understand. Our entire economic system is propped up, if not built up, by debt.

The mention of the excess capacity that has been constructed is useful, but we’re not happy with ‘price deflation’, since that threatens to confuse people’s understanding, the same way terms like ‘consumer deflation’ or ‘wage inflation’ do.

Central banks can postpone the deflation of a gigantic debt bubble like the one we’re in, but only temporarily and at a huge cost. And it looks like we’ve now reached the point where they’re essentially powerless to do anything more, or else. We are inclined to point to August 24 as a pivotal point in this, the China crash where people lost faith in the Chinese central bank, but it doesn’t really matter, it would have happened anyway.

And today we’re up to our necks in deflation, and nobody seems to notice, or call it that. Likely because they’re all waiting for CPI consumer prices to fall.

But when you see that Chinese producer prices are down 5.9%, in the 43rd straight month of declines, and Chinese imports are down 20% (with Japan imports off 11%), don’t you hear a bell ringing? What does it take? If the dramatic fall in oil prices hasn’t done it either, how about steel? How about the tragedy British steel has been thrown in, how about the demise of Sinosteel even as China is dumping steel on world markets like there’s no tomorrow?

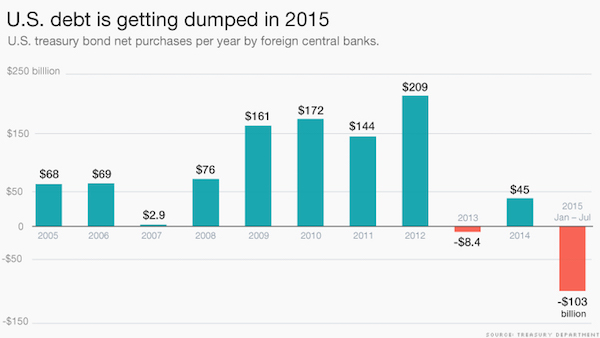

How about the reversal of funds that once flowed into emerging markets and are now flowing right back out?

Or how about major global banks, all of whom see their profits and earnings deplete, and many of whom are laying off staff by the thousands?

Wait, how about global wealth down by 5% since 2008 despite all the QE and ZIRP policies? And global trade off by -8.4% YoY?!

Here’s from Tyler Durden last week:

Credit Suisse’s latest global wealth outlook shows that dollar strength led to the first decline in total global wealth (which fell by $12.4 trillion to $250.1 trillion) since 2007-2008.

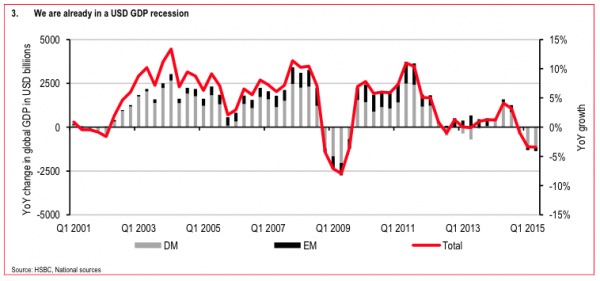

[..] from HSBC: “We are already in a global USD recession. Global trade is also declining at an alarming pace. According to the latest data available in June the year on year change is -8.4%. To find periods of equivalent declines we only really find recessionary periods. This is an interesting point. On one metric we are already in a recession. [..] global GDP expressed in US dollars is already negative to the tune of $1,37 trillion or -3.4%.

How about companies like Walmart and Glencore, just two of the many large entities that have large troubles? These are not individual cases, they are part of a global trend: deflation. As evidence also by the increase in US corporate downgrades and defaults:

Moody’s issued 108 credit-rating downgrades for U.S. nonfinancial companies, compared with just 40 upgrades. That’s the most downgrades in a two-month period since May and June 2009, the tail end of the last U.S. recession. Standard & Poor’s downgraded U.S. companies 297 times in the first nine months of the year…

Everything and everyone is overindebted. All of the above stats, and a million more, point to the beginning of a deleveraging of that debt, something that curiously enough hasn’t happened at all since the 2007/8 crisis. On the contrary, a massive amount of additional debt has been added to a global system already drowning in it. China alone added $20-15 trillion, and that kept up appearances.

But now China’s slowing down everywhere but in its official GDP numbers. And unless we build a base on the moon, there is no other country or region left that can take the place of China in propping up western debt extravaganza. This will come down.

The only way a system that looks like this could be kept running is by issuing more debt. But even that couldn’t keep it going forever. We all understand this. We just don’t know the correct terminology for what’s happening. Which is that debt that has been inflated to such extreme proportions, must lead to deflation, and do so in spectacular fashion.

As long as politicians and media keep talking about disinflation and central bank inflation targets, and all they talk actually about is consumer prices, we will all fail to acknowledge what’s happening right before our very eyes. That is, the system is imploding. Deflating. Deleveraging. And before that is done, there can and will be no recovery. Indeed, this current trend has a very long way to go down.

So far down that you will have a very hard time recognizing the world, and its economic system, on the other side of the process. But then again, you have a hard time recognizing the world for what it is on this side as well.

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)© 2015 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.