Europe in Deflation: Got (cheap) Milk?

Economics / Deflation Oct 30, 2015 - 10:35 AM GMTBy: EWI

Why falling food prices are not a boon for Europe's economy

Why falling food prices are not a boon for Europe's economy

In the early 1990s, two simple words from a genius ad campaign radically transformed the way the U.S. consumer saw it: "Got Milk?"

Suddenly, the narrative changed from an obligatory drink you had to finish as a kid, along with eating your vegetables -- into a sexy, funny, and above all desirable treat for all ages.

Until now.

In Europe, in 2015, famous celebrities donning milk mustaches no longer light the public's passion for lactose -- as prices for milk have spoiled. Here, a September 8, 2015 CNN Money article captures the curdled state of affairs:

"So much milk is sloshing around the European Union that milk is often cheaper than bottled water. In UK, a liter bottle of water costs around $1.50, a liter of milk $1... Wholesale milk prices have collapsed by 20% this year."

(Idea for a new campaign pitch: "Got (really, really, dirt cheap) Milk?")

Except that, it's not just the price of milk that's gone sour. According to data from April 2015, "supermarket prices in the UK have fallen at the steepest rate in eight years," including meat, milk, cheese, and vegetables. (The Telegraph)

There's no disputing the decline is a disaster for dairy farmers and the like. But cheaper food costs -- well, according to the mainstream financial experts -- that's a boon for consumers and commodity-dependent companies.

Affirms one October 12, 2015 USA Today article:

"The big drop in raw materials costs is going into somebody's pocket... proving a rare opportunity to pocket savings but maintain retail prices and strong demand."

This idea is nothing new. It gained mainstream traction back in 2014, when a 60% crash in crude oil prices inspired the "goodflation" movement. And in May 2015, when the UK's Consumer Price Index plunged into negative territory for the first time in 55 years, the move was hailed as good news:

"This looks like the mild and benign variety of deflation... Instead we should welcome the positive effects that lower food and energy prices bring for households at a time when wages are rising strongly, unemployment is falling, and the economy is growing." (May 19 Daily Mail)

But here's the thing; we've crunched the numbers. We've checked and rechecked all the inventory. And the results couldn't be clearer: Declining food and energy prices have not contributed to and/or secured rising wages, falling unemployment, or strong economic growth.

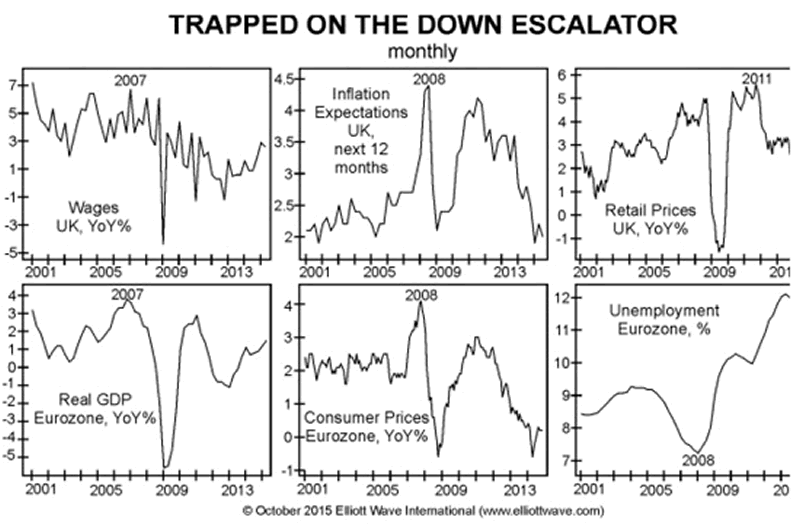

Here, the following chart from our September European Financial Forecast, puts this reality in stark focus:

"Play with the numbers however you like, but no amount of slicing and dicing can hide the fact that deflation has moved in, made itself comfortable and is now checking out what's free to eat."

With the eurozone's real GDP flat, unemployment rising, and wages in the UK at the same level where they were years ago, the evidence is clear: deflation has not been a "good thing" for Europe's economy. In fact, much of the world is under deflation's tightening grip. And judging by the magnitude of deflation spreading through Europe, and even the U.S., the vise will not rest on food and commodity prices alone.

The best part is, we've just compiled a special free three-part report on deflation including exclusive, subscriber-grade excerpts from our European Financial Forecast and Elliott Wave Financial Forecast -- that will equip you with a long-term picture of the global deflationary changes in store.

Get the full picture of what we see as a worldwide deflationary trend in our new report, Deflation and the Devaluation Derby.

Here's what you will learn:

- Currency devaluation's role in the developing global crisis

- How the self-reinforcing aspect of deflation is already apparent in commodities trading

- Why the top 1% of earners are in for a rude awakening

- How Europe's biggest economies are screeching to a halt

- The hair-raising future for U.S. stocks

Just recall how swiftly the 2007-2009 financial crisis unfolded. We anticipate that the next global financial crisis could be even more sudden and severe.

Prepare now with our new report, Deflation and the Devaluation Derby. CLICK TO CONTINUE READING >>

This article was syndicated by Elliott Wave International and was originally published under the headline Europe in Deflation: Got (cheap) Milk?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.