Silver Rides a Runaway Expense Train

Commodities / Gold and Silver 2016 Jan 05, 2016 - 05:36 PM GMTBy: DeviantInvestor

The US government will spend nearly $4 Trillion this fiscal year – starting last October 1. Of course it projects a massive deficit, increasing national debt, uses “funny” accounting, and does not address unfunded liabilities.

The US government will spend nearly $4 Trillion this fiscal year – starting last October 1. Of course it projects a massive deficit, increasing national debt, uses “funny” accounting, and does not address unfunded liabilities.

Business as usual…

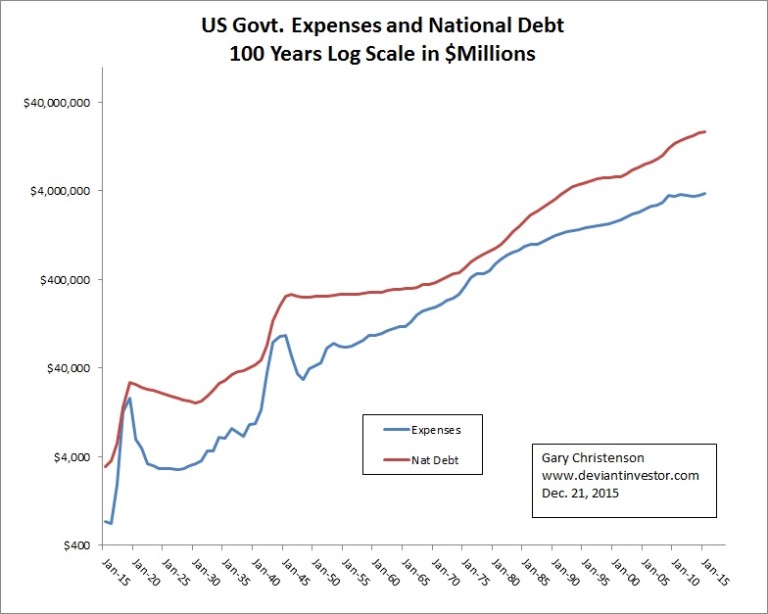

Examine the last 100 years of US government expenditures and national debt – on a log scale in $ millions. Note that official government expenses have increased from about $750 million to about $4 Trillion, an increase by a factor of over 5,000.

National Debt (official – not including unfunded liabilities) has increased from about $3 billion to nearly $19 Trillion in 100 years, an increase by a factor of about 6,000.

Expenses increase, national debt increases more rapidly and … based on 100+ years of history, both will continue their exponential increases for a long time. The 100 year exponential increase in government expenses has averaged about 8.9% per year.

The Excel calculated statistical correlation between US government expenses and official national debt for 100 years from 1915 – 2015 is 0.97. No surprise here.

What about silver prices?

Silver in 1915 averaged about $0.56 cents per ounce, per Kitco.com. Since then national debt increased, the dollar was continuously devalued, and silver prices increased. Business as usual … the train runs down the track.

The Excel calculated statistical correlation between US government expenses and silver prices for 100 years is 0.82. The government spends more, goes deeper into debt, the dollar devalues, and silver prices rise. Business as usual … train running down those tracks …

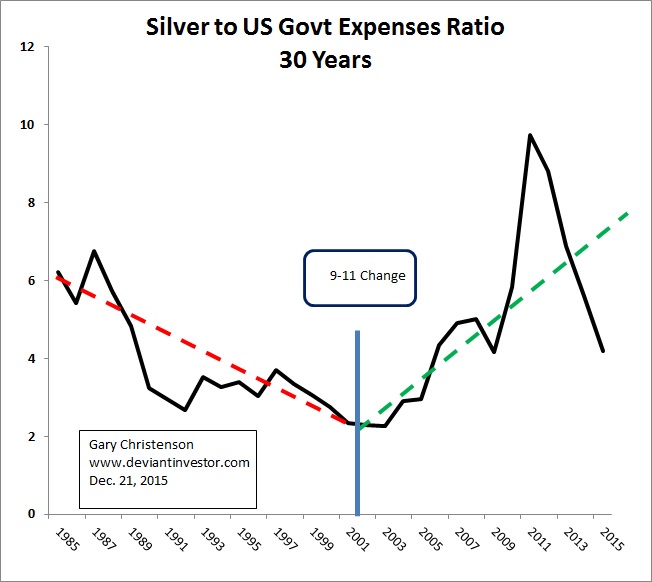

But if we look at the ratio of silver prices to the official expenses of the US government over the past 30 years, we see a reversal in the years around 2000 – 2003. Call the turning point September 11, 2001.

From 1985 to 2001 the (1 trillion times) silver/expenses ratio declined as the paper (stocks, bonds and debt) economy boomed, commodity prices, including silver and gold, languished, and the ratio dropped from about six to two. But after 2001 the ratio climbed to a high of nearly 10 in 2011, and has since dropped to about four.

IT IS CLEAR THAT:

- Expenses and national debt are exponentially increasing with no end in sight.

- Both expenses and national debt resemble a runaway train without the oversight of adult management.

- Silver is used and needed in more industrial applications every day.

- Investor demand for silver is much larger than in previous years and increasing.

- Supply appears to have peaked. Read Steve St. Angelo’s

- Silver prices, even as erratic as they are, correlate with US government expenses over 100 years at better than 0.80. Expenses will increase and so will silver prices. Silver prices are riding that accelerating expense train.

- Silver prices have corrected about 70% from their 2011 high and, based on history, will “regress to the mean,” which means their next big move should be much higher.

- War, further dollar devaluation, an increase in monetary or fiscal stupidity, a financial crash, or a weakening of US international prestige will accelerate the decline of the dollar and the rise of silver prices. All of the above seem likely. Read Bill Holter.

I think it is clear that silver prices will rise considerably. The expense train is accelerating and the consequences will push silver prices higher.

Assume US government expenses increase by a typical 40% – 50% in five to seven years and the silver to government expenses ratio increases from the current 4 to about 12 or considerably higher. That puts silver prices in the range of $50 to $100 around 2020 – 2022.

Is $100 silver improbable? Consider for comparison:

- Silver prices rose from under $2 in 1973 to about $50 in January of 1980.

- Apple computer stock rose from under $0.50 (split adjusted) in 1997 to over $125 in 2015.

- Argentina has devalued the peso in the last 40 years by a factor of about 1,000,000,000. Inflation (excessive central bank “printing”) is aggressively destroying currencies in many countries throughout the world.

- The Federal Reserve was “printing” about $85 Billion per month to buy dodgy paper to bail out banks. Approximately two months of such QE was enough to purchase all the gold that supposedly is stored in Fort Knox. It is easy to “print” currency but it is difficult to create wealth. Yes, gold is wealth! If not, why does Fort Knox exist and why are China and Russia aggressively selling paper and importing gold?

I think $50 – $100 silver is not only possible but quite probable within a few years. It certainly seems likely by comparison to the above four actual events. Yes, silver prices are riding the runaway expense train.

Silver thrives, paper dies!

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.