Stock Market Bend, Bend, Bend.... Break

Stock-Markets / Stock Markets 2016 Jan 07, 2016 - 12:49 PM GMTBy: Dan_Norcini

The S&P 500 has been bending over the last three trading sessions ( first three trading days of this New Year) but refused to break down. Overnight however, that has changed, at least during Asian trade and very early European trade.

The S&P 500 has been bending over the last three trading sessions ( first three trading days of this New Year) but refused to break down. Overnight however, that has changed, at least during Asian trade and very early European trade.

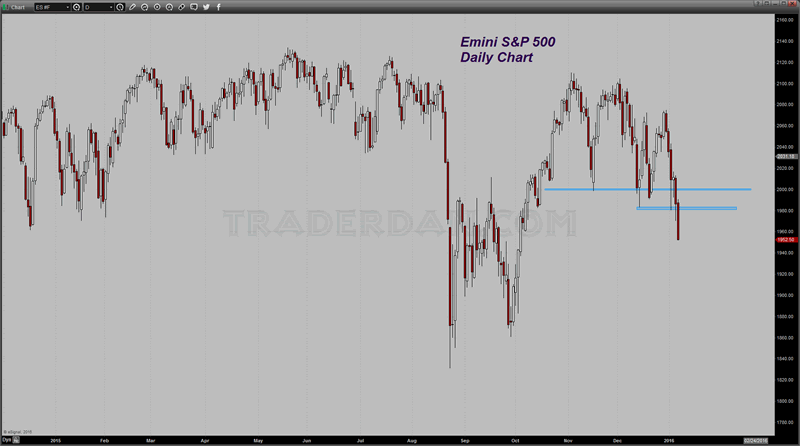

Notice how the index has dropped below the 2000 level twice to start the year but always managed to close back above that level. On Wednesday, the market broke down below that key 2000 level but rebounded heading into the closing bell to avoid managing to close below the spike lows in December and on Monday of this week.

Emini S&P500 Daily Chart 1

However, Chinese stock market woes this evening in Asia with first a 15 minute halt and then a complete cessation of trading after the halt ended and the market slid further, has sent the S&P 500 futures sharply lower and down through those spike lows near and just above the 1980 level.

In looking over the chart, unless this index can rebound sharply during the day today (Thursday) and claw its way back above 1980, we could very well see an acceleration of selling with the potential to drop down into the next chart support region clustered near the 1900 level.

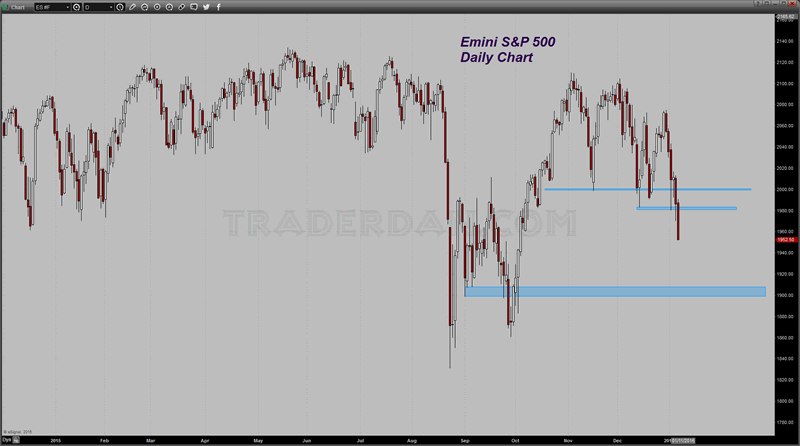

Emini S&P500 Daily Chart 2

What makes this time a bit different than other recoveries is that the market was always able to depend on ample amounts of liquidity being supplied from Central Banks. Draghi and company clearly disappointed the markets in early December when their announced supplemental monetary measures were deemed insufficient by the broad markets to mend what ails the European economies.

Now that the Fed has raised rates here in the US, the market understands that the odds of them actually reversing the rate hike and supplying additional liquidity into the US economy, are very, very remote. Thus, the markets are now adjusting to the fact that global growth is slowing and the Fed and the ECB both have already shown their cards. Something new and unexpected will need to take place from the Central Bankers or some sort of very good economic news from somewhere is going to be needed to shift the current psychology that seems to be setting in.

China's attempt to allow free market forces a greater set of reins clearly is giving them a rude but swift education to be careful for what they wish. When those free market forces were pushing Chinese stock prices inexorably higher attracting huge sums of capital INTO CHINA, they loved free markets. Now that that same capital is reversing and flowing out, suddenly the tiger can no longer be counted on to perform for the circus master as it is now devouring the handler.

Where all this shakes out is uncertain but one thing does seem clear to me, none of it is good for commodity prices in general. Crude oil and the energy complex is living proof of this. Overnight both Brent and WTI crude oil are falling apart even further. It now is looking increasingly likely that $30 is going to be tested, barring some sort of huge flare up in the middle East.

That is going to further pressure the stocks of energy companies and add more stress to the US shale industry. Many of us have been expecting that more pressure was needed before these guys will actually get serious about curtailing production but as we have seen from the recent EIA data, both US daily production and supplies at the key Cushing, Ok location, are increasing, not decreasingly. How in the world can the current supply glut be cleaned up if the total production keeps rising while supplies continue to build? Something will have to give. Perhaps the refiners will stop cranking out product and close refineries for "maintenance" or something but unless demand picks up in a big way, the supply side of things seems non-responsive even after a fall in price of this magnitude. That is why some of us believed and still do, that lower prices and even more pain are yet necessary before the worst will be over.

One last thing, copper continues to move lower and the platinum/gold spread continues to see platinum losing ground to gold. Both are signs of deflationary pressures/slow growth concerns building even further.

That flattening yield curve has once again been extremely prescient.

Dan Norcini

Dan Norcini is a professional off-the-floor commodities trader bringing more than 25 years experience in the markets to provide a trader's insight and commentary on the day's price action. His editorial contributions and supporting technical analysis charts cover a broad range of tradable entities including the precious metals and foreign exchange markets as well as the broader commodity world including the grain and livestock markets. He is a frequent contributor to both Reuters and Dow Jones as a market analyst for the livestock sector and can be on occasion be found as a source in the Wall Street Journal's commodities section. Trader Dan has also been a regular contributor in the past at Jim Sinclair's JS Mineset and King News World as well as may other Precious Metals oriented websites.

Copyright © 2016 Dan Norcini - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

Dan Norcini Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.