Stock Market Phase Target Met

Stock-Markets / Stock Markets 2016 Jan 20, 2016 - 07:53 AM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

SPX: Long-term trend - Severe correction underway.

SPX: Intermediate trend - The index is completing a downtrend phase within a longer-term decline. This should be followed by a counter-trend rally before selling resumes.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discuss longer market trends.

PHASE TARGET MET

Market Overview

There is a good possibility that SPX has reached its first phase projection from 2116 at the 1858 level, although it could still go a few points lower as a base is created. A few weeks ago, I mentioned that the distribution pattern at the 2116 level (which was completed on 12/11) confirmed the count of the second phase produced by the top distribution tier that was created after the 2135 top.

The congestion level at the 2116 level has formed two distinct phases, and it is only the first phase which is at or near its low. After a rally, the second phase should begin and take the index quite a bit lower.

Assuming that a short-term low has been reached at 1858, the decline from 2081 measures 223 points. It would be normal for a rally which starts from the low to retrace .382 of that distance, which would take it to 1943. (50% to 1969).

Lately especially, every little move in oil has generated a move in the index. WTIC has not yet filled its potential downside count, but could make a short-term low before it does.

SPX Chart Analysis

Daily chart (This chart, and others below, are courtesy of QCharts.com)

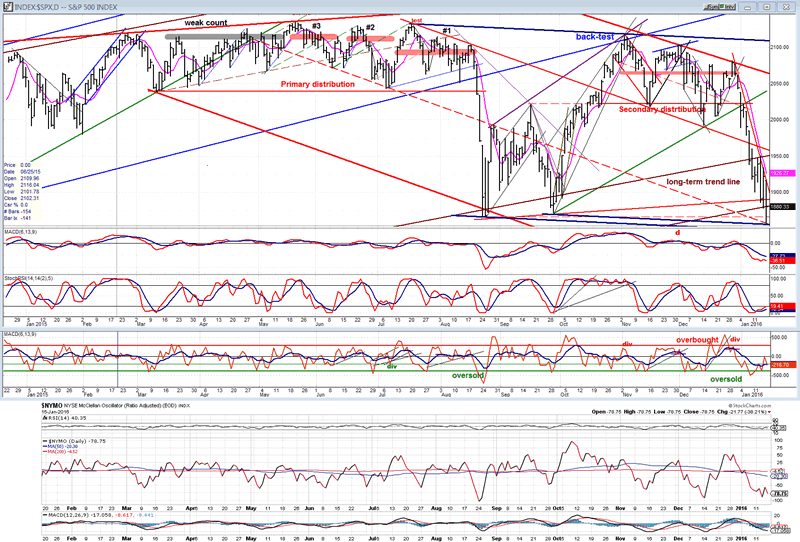

On the daily chart of the SPX, I have drawn a down slanting channel which is outlined by two heavy red lines.

I believe that this represents the current trend of this important correction, with prices expected to trade within the confines of this channel for some time to come. The channel is divided into three sections. After the August decline which broke out of the blue intermediate uptrend channel came to an end at 1867, we were able to determine the original channel by drawing a trend line across the tops of 7/20 and 8/18, and a parallel across the 3/11 low. A base was formed between the August and September lows, with the index trading mostly in the lower half of that original channel. When prices broke out into the upper half, the rally did not stop at the top channel line, but expanded the original channel by another 50% of its width before finding a top at 2116. At the same time, the bottom channel line of the blue intermediate channel was back-tested. This created a broader bearish market channel which divided itself in three nearly equal sections.

Between 11/08 and 12/29, SPX traded within the upper third of the broader channel, forming a secondary level of distribution which matched and confirmed the second phase of the distribution that took place after the market top. When that secondary distribution phase was completed, the index then started a steep decline all the way down to the bottom of the second third of the broad red channel (dashed line) which was reached on Friday, witht a low of 1858. Not only does that low fill a phase count from the 2116 top, but it should find support on that dashed line which already has provided several support and resistance points from its origination point. Support is also provided by the bottom line of a flatter, broad channel which is delineated by dark blue trend lines.

At the 2135 market top, I have marked in red three phases of the original distribution pattern. These should provide a reliable downside count for the ongoing correction, especially since the first phase called for a maximum decline to 1869 and the August low came in at 1867.01! Now, the second phase has been confirmed by the secondary distribution pattern which formed at the 2116 top. The three phases combined call for a correction of about 600 points. Because three separate phases have formed, it is highly likely that the correction will also proceed in three major phases (we should be approximately halfway through the second one). The phase of distribution to the left of the 2135 top is marked in grey. This provides a less reliable count than those marked in red, but still must not be totally ignored. Should the correction include this section, it would nearly double in size.

I mentioned above that the current phase of the correction may be coming to an end at last week's low. This is supported by the daily indicators. The most important one (which is always the early bird) is the A/D oscillator, the lowest of the three; it has already established a low and started an uptrend. This is matched by the McClellan Oscillator (Courtesy of StockCharts.com) which has been posted under the price chart and which is oversold and making essentially the same pattern. The SRSI has also started to turn and move up, another warning that the low may have been reached. The MACD (which is always the least responsive) has not yet turned. But by going flat while the index was still falling, it is exhibiting deceleration, which is a form of positive divergence to the price.

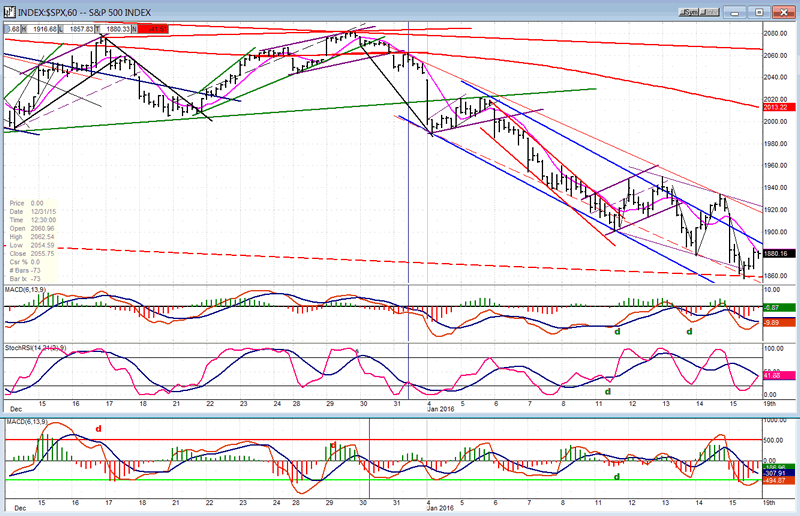

Hourly chart

The hourly chart shows the current downtrend phase as a five phase decline which is presently in its fifth phase and possibly making a wide ending diagonal. If that is correct and this pattern continues, it looks as if we could get another bounce followed by a final minor decline which would end the entire downtrend from 2082 and bring about a good rally.

The main body of the decline is the portion trading between the two blue trend lines. Deceleration is taking place with the lows pulling away from the bottom channel line, and there have been two attempts at breaking out of the top one. Both have failed, but a third one could be underway, although its start is more sluggish than the other two, so the pattern could be changing. With short-term cycles continuing to bottom into the end of the month, there could be one more test of the low.

On Friday, as the index was meeting its phase target, it also found support on the bottom of the two-thirds trend line of the major channel. The bounce from that low has lasted four hours -- enough to turn the indicators, but they will have to be more convincing to suggest that a final short-term low has been made.

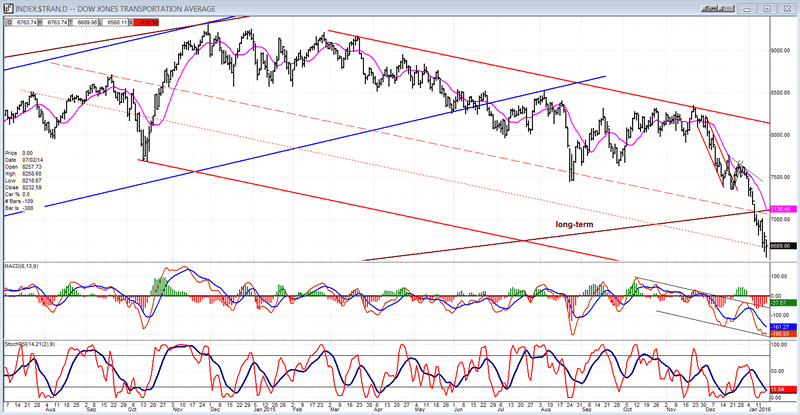

TRAN (Dow Jones Transportation Average)

The Transportation Average has a narrower bearish channel which only lends itself to be partitioned in two sections. Last week, the index dropped into the lower half, continuing its sharp decline from the 11/20 top. It may be finding temporary support on the dotted parallel which is drawn from a minor top.

The indicators do not look as advanced as those of the SPX, which means that a reversal may not yet be at hand for this index. I have looked at the P&F chart for projection targets, but was unable to arrive at a reliable count.

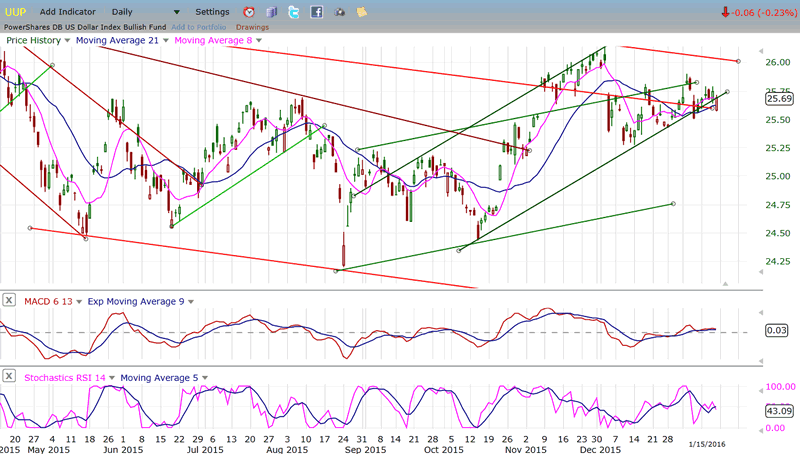

UUP (dollar ETF

UUP appears to be losing its upside momentum and getting ready to extend its consolidation. While it is not yet ready to reverse its long-term uptrend, continuing its sideways pattern is probably a pretty good bet.

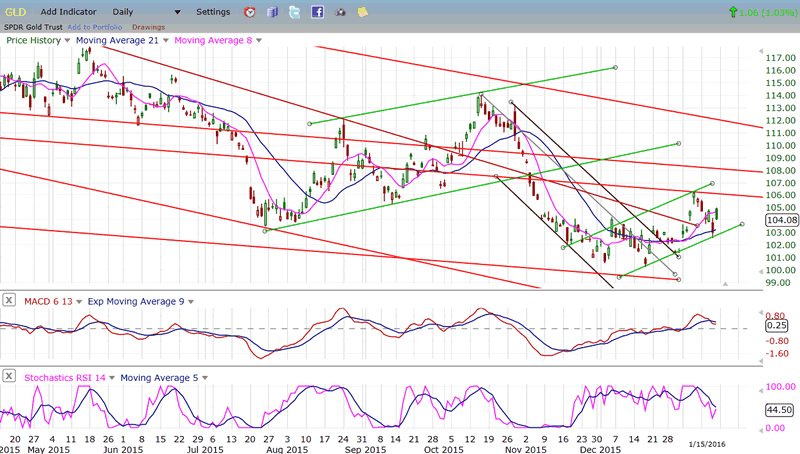

GLD (Gold trust)

GLD is holding on to its recent gains but does not seem very keen on extending them. It must do so soon or risk another retest of its low, or more. The current pattern looks like a smaller version of the one above which could not make any headway and finally rolled over and made a new low. The similarity also extends to the indicators which enhances the negative bias. A break of the green uptrend line would either lead to an expansion of the base, or to a new low, justifying the potential 97-98 target which is still in play.

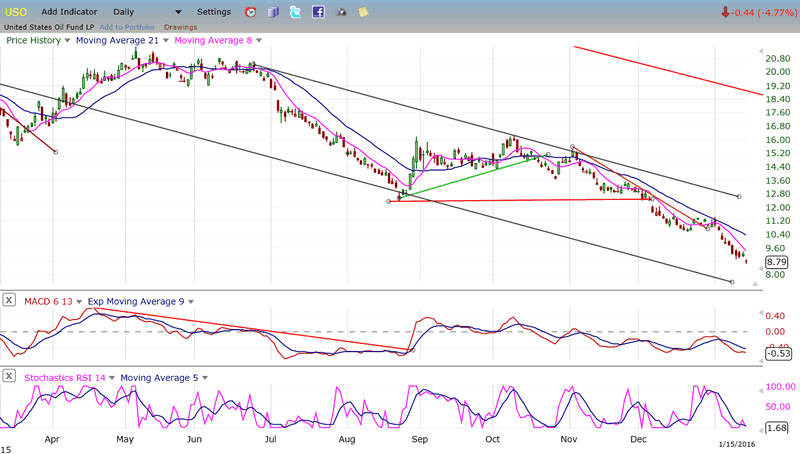

USO (United States Oil Fund)

USO has finally reached the projected "8" target, but in order to fill the count completely it must print 8 or less, not 8+. Since there is no sign of a decisive low, more downside is likely and this would continue to affect the market's performance.

WTIC had a 29/30 target which was reached on Tuesday, but it has not been able to rally. While they are often filled precisely, P&F counts of actively traded stocks and commodities can occasionally fail to reach their projections, or exceed them. Waiting for confirmation that a reversal is occurring is always a good idea!

Summary

Last week's stock market action brought more confirmation to the view that it had started a major correction which some will label a bear market. The name that one gives it is not as important as being able to forecast correctly what will take place next week or next month. While a near-term target for the decline has been reached and a countertrend rally is due, there is strong evidence that both in time and in price, this correction will continue for the foreseeable future.

Andre

FREE TRIAL SUBSCRIPTION

If precision in market timing for all time framesis something that you find important, you should

Consider taking a trial subscription to my service. It is free, and you will have four weeks to evaluate its worth. It embodies many years of research with the eventual goal of understanding as perfectly as possible how the market functions. I believe that I have achieved this goal.

For a FREE 4-week trial, Send an email to: info@marketurningpoints.com

For further subscription options, payment plans, and for important general information, I encourage

you to visit my website at www.marketurningpoints.com. It contains summaries of my background, my

investment and trading strategies, and my unique method of intra-day communication with

subscribers. I have also started an archive of former newsletters so that you can not only evaluate past performance, but also be aware of the increasing accuracy of forecasts.

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.