Gold's Underlying Truth and Dow Jones Potential to Fall by 75%

Commodities / Gold & Silver Jul 10, 2008 - 07:45 AM GMTBy: Brian_Bloom

As a reasonably intelligent man of 61 years of age, this analyst is not unmindful of the fact that his recent preoccupation with the wisdom of the Ancients has been raising eyebrows – if not questions as to his sanity – amongst regular and (previously?) loyal readers. What possible linkage could an understanding of the Ancients have with investment and making money?

As a reasonably intelligent man of 61 years of age, this analyst is not unmindful of the fact that his recent preoccupation with the wisdom of the Ancients has been raising eyebrows – if not questions as to his sanity – amongst regular and (previously?) loyal readers. What possible linkage could an understanding of the Ancients have with investment and making money?

Those who have been puzzled may rest assured. I have not been going off with the pixies. There are solid reasons; and one of these reasons flows from the fact that, in today's markets, everyone and his brother is a technical analyst.

I well remember how, in 1968, I was giving guidance to some of the leading stockbrokers in South Africa on how to interpret share price charts. I worked for a firm, Performance Charts, which had just launched that country's first commercial charting service. The daily and weekly bar charts were plotted by hand on semi-log paper; and we also offered hand drawn Point & Figure charts. The Personal Computer hadn't arrived yet, but we were using time on an IBM 360 mainframe to calculate a form of numerically based oscillator on selected shares and indices.

In those days hardly anyone in that country had heard of technical analysis and of those who had, the majority thought it was mumbo jumbo. Today, everyone who trades the markets is a technical analyst and it is this very fact that renders daily charts and oscillators potentially dangerous when the Primary direction of the market is in doubt.

One way of ameliorating this danger is to take a step back and look at the longer term charts which do not whipsaw around so much. Below is an example of one such chart.

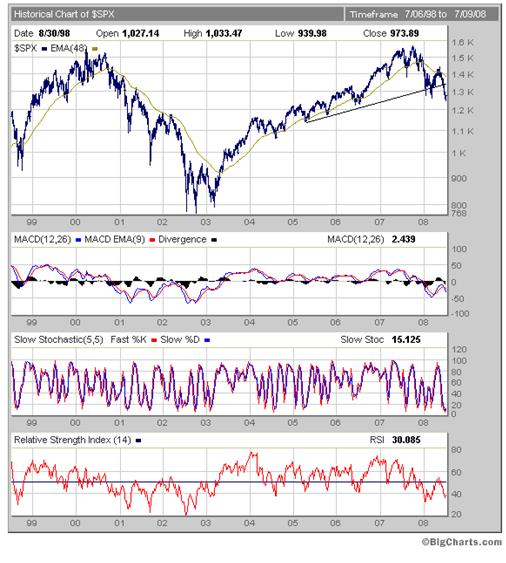

Chart 1

This is a weekly chart of the Standard and Poor 500 Index dating back to 1999 (courtesy Bigcharts.com). It shows the following:

- a “Double Top” formation (2000 and 2007),

- a breakdown in January 2008 below the support of its 48 week moving average,

- a pullback up to the (now) resistance of the 48 week moving average, followed by

- a resumption of the downtrend as the index pulled away from its now downward pointing moving average.

- In addition, the MACD oscillator recently gave a sell signal as the blue line crossed below the red line.

- Arguably, the chart also shows a complex Head and Shoulders formation and a downside penetration of the neckline at around 1300.

In summary, with six bearish signals, this chart cannot be reasonably argued by anyone to be “bullish”. However, technically, there “should” be a pullback up towards the neckline before the Primary Down-Trend begins to manifest in earnest. The distance between the neckline and the chart's peak is about 250 points. This implies that the next “support” level (after the chart starts to fall again – whenever that may be) will be around 1050 to 1100

Now let's take a step further back and look at a “Mega Sized” chart.

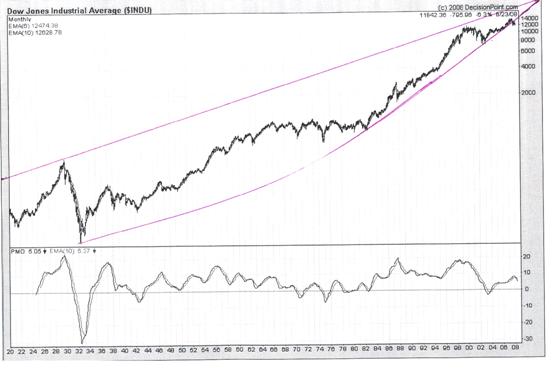

Chart 2

This chart, courtesy Decisionpoint.com, dates all the way back to 1920. It is current to June 23 rd 2008. We can argue until we are blue in the face about how the lower curved trend line should/could/might have been drawn in – but it is an unarguable fact that if a lower channel line had been drawn in that was parallel to the top trend line, then the “theoretical” potential culmination of a downside move in the Dow Jones Industrial Index would be somewhere between the 3000 and 4000 levels. This represents a “potential” fall of up to 75% from the current level and this assumes that the Dow Jones will still remain within the upward pointing channel and won't penetrate below it.

The “theoretical potential” for a 75% fall! Do I have your attention yet?

This scenario is not coming as a surprise to this analyst. In context of Peak Oil, and the US Federal Reserve's predisposition to ramp the markets by throwing freshly printed paper dollars at them, the question that I have been asking myself for some years now is: “What is going to happen when the equity markets eventually become unmanageable?”

I could conceive of only four logical possibilities, none of which could be anticipated with any degree of certainty. They manifested as a subset of the above question as follows:

- Will the markets (and let's use the Dow Jones Industrial Index as a proxy) enter a hyperinflationary exponential blow-off phase?

- Will the DJIA churn sideways to downwards for anything between 10 to 20 years as the excesses unwind and as new wealth-creating activities emerge to drive the world economy forward once again?

- Will the DJIA pull back by up to 75% as a precursor to the world economy entering a “Depression” state?

- Will the lower trend-line of the DJIA at 3000 be penetrated on the downside, thus presaging a total (and terminal) collapse of the world economy?

Clearly, question 2 above is the most desirable outcome and, at least, we can be thankful for small mercies. What the sell signals on the second chart above imply is that the Fed is no longer expected to try and print its way out of this morass. The markets are no longer expecting hyperinflation of the nature that is currently prevailing in Zimbabwe, for example – where a loaf of bread costs Z$250 million.

Given the (now) $9.4 trillion US Public Debt, and the various crises that have emerged since LTCM went belly up, the remaining three questions above did not seem to this analyst to be merely academic. Conceivably, depending on the wisdom or lack thereof of our leaders, any of the three would be possible. The ultimate question was: “Is the world economy going to survive the fallout of what those testosterone addled egomaniacs in political and financial power have been doing for the past 30 years whilst they should have been acting as the caretakers of society?”

To answer this latter question, I decided (some years ago) to dig down to bedrock in my research. If I was going to step back far enough to get the ultimate “Big Picture” view, then the best place to start would be at ground zero – the year modern society began to emerge. It took some digging, but I finally discovered that ground zero was around 3,113 BCE. Something extraordinary happened across the face of the planet around that time. (You can get a better handle on what I discovered about the Ancients by buying my factional novel, Beyond Neanderthal , which is available from www.beyondneanderthal.com .The storyline is fictional but the themes are based on carefully researched fact)

To give the reader some background as to where I was coming from, I had already discovered, in 1985, that the world was heading for Peak Oil. In that same year I also began to focus on the fact that fossil fuels in general provided the energy that powered the world economy. In that context, and in context of the fact that, by 2000, it had become blindingly obvious to me that the politicians were positioning to soften antagonistic public opinion and to nudge it into submissive acceptance of Nuclear Fission as the “most sensible” alternative energy option.

I finally decided to look back into history to see if our modern day scientists might have missed something with regard to other alternative energy possibilities, because Nuclear Fission is anything but sensible. For one thing, it will probably be withheld from third world countries, and where will that leave them? “I'm alright Jack, screw you?” Do the world's leaders not even think in terms of ethics and morality anymore?

To be honest, in my open minded search, I had been given a clue. In 2005 I had read a book by Sir Lawrence Gardner, entitled “The Shadow of Solomon” – wherein he had made some rather startling observations about gold in biblical times.

Let's cut to the chase. Here's the bottom line of what I found in respect of gold:

If you go to the website at http://www.rexresearch.com/ ormes/ormes.htm you will see details of British Patent # GB 2,219,995 A , which was registered in the name of David Radius Hudson on December 28, 1989.

Here are two quotations from that document:

- “ This invention relates to the monoatomic forms of certain transition and noble metal elements, namely, gold, silver, copper, cobalt, nickel and the six platinum group elements. More particularly, this invention relates to the separation of the aforesaid transition and noble metal elements from naturally occurring materials in their orbitally rearranged monoatomic forms, and to the preparation of the aforesaid transition and noble metal elements in their orbitally rearranged monoatomic forms from their commercial metallic forms. The materials of this invention are stable, substantially pure, non-metallic-like forms of the aforesaid transition and noble metal elements, and have a hereto unknown electron orbital rearrangement in the "d", "s", and vacant "p" orbitals. The electron rearrangement bestows upon the monoatomic elements unique electronic, chemical, magnetic, and physical properties which have commercial application.”

- “The ORMEs [orbitally rearranged monoatomic elements] of this invention can be used for a wide range of purposes due to their unique electrical, physical, magnetic, and chemical properties. The present disclosure only highlights superconductivity and catalysis, but much wider potential uses exist, including energy production .”

The potential for technological innovation that is implicit in this last sentence is examined in Beyond Neanderthal , the storyline of which connects all the visible gold related dots – which date back to the time of the Ancient Egyptians, then through the period when Sir Isaac Newton began to understand Gold's true underlying value, to, finally, the present day.

The above patent registration document names “energy production” as one application of this astoundingly versatile material. Another will be in the field of agricultural yields; as is also explained in the novel.

To get a feel for the potential of gold in agricultural technologies, the reader might refer to the news article published in January 2008 at http://www.news.com.au/story/ 0,23599,23136588-23109,00.html . If the connection is not immediately apparent to you then I commend you to order a copy of my novel at www.beyondneanderthal.com . All is revealed.

To get a feel for the energy technology potential of gold, the following quote from a lecture given by Mr Hudson might get your juices going:

“This [gold derived, electrically superconductive] material [when charged with electrical energy] is so sensitive to magnetic fields that when it goes to the white powder form and loses 4/9ths of its weight, what it is doing is flowing light within it, in response to the earth's magnetic field. There is so much current flowing in it that it levitates 4/9ths of its weight ON THE EARTH'S MAGNETIC FIELD. Your hand has sufficient amperage that if passed under this tube [in which the powder is contained], the material floats, it is that sensitive to magnetic fields .”

It took me a couple of years of thinking about this information and of digging into the original Old Testament scripture references to gold – as Sir Isaac Newton had apparently done – before I finally approached a Rabbi and asked him the following question. “Tell me Rabbi, what was it about gold that gave it such a high profile importance in the Torah?”

That question led to a series of one-on-one lectures that were so complicated that the Rabbi himself had difficulty in interpreting the original Kabbalah references. In summary, from Kabbalist and other sources, the following emerged:

There are ten levels in all of creation. The top three are “not of this world” and the bottom seven are “of this world”. Further, as the quantum physicists are beginning to understand, the Universe is not only infinitely large it also infinitely small. There are wheels within wheels within wheels. Within each discrete wheel, these same ten levels exist. Gold, it appears, is “not of this world”. It is in the second highest level of all that exists. Silver, on the other hand, is in the top level of the bottom seven levels. Energetically speaking, it is at the highest level that is “of this world”. Remember that it was the shekel (made from silver) that was used as money in the days of the bible. Gold, it turns out, was never money. It had a far more important role – which was why it was so prized, and which was also why there was so much emphasis placed on gold in the Holy Temple.

This latter fact was also why Sir Isaac Newton was so interested in gold. Newton was possessed of one of the finest minds in all of human history. Given the limitations of the scientific knowledge of the day, he could only go so far before he finally hit a dead end, but he came to understand that there was more to gold than met the eye. And, with the light of understanding having dawned in his mind, Newton did the only practical thing he could: He resigned his position as a University professor, positioned himself to be appointed Master of the Royal Mint and, finally, he put Great Britain on a Gold Standard. This ensured that Britain's gold would be stored all in one place, under lock and key and within easy reach.

Conclusion

We now have a direction: Based on the above evidence, which modern science is only now beginning to validate, gold is without doubt the most valuable substance on the planet – if not in all existence. It appears to have the power to lift humanity to a new level in its evolutionary journey. Its linkage with tangible “money” was merely facile – to sow the seed of understanding that it had a value that was beyond comprehension in days gone by.

But this was not the only discovery that emerged from my investigations. By comparing the Kabbalist explanation of the origins of the Universe with the Chinese I-Ching explanation (they confirm one another), it became apparent that the Ancients probably knew more about energy than we do today. And the deeper I dug the more convinced I became that they were probably in possession of other energy technologies that we are only now beginning to understand.

Again, connecting the dots, there appears to be a direct linkage between what was known by some in 3,113 BCE and what we are beginning to discover about Zero Point energy and so-called “Dark” Energy. Over-Unity energy production may, after all, turn out to be feasible, despite modern day physicists' conviction to the contrary when they cite the laws of thermodynamics. One relevant connecting dot is another modern day patent for another technology (unrelated to gold), which lies at the end of a series that joins the Kabbalah and the I-Ching dots with other dots uncovered by Rene Descartes (1596 -1650); James Clerk-Maxwell (1831 – 1879), Nikola Tesla (1856 – 1943) and, very likely, Nils Bohr, (1885 – 1962). This one, Sir Isaac appears to have missed.

Finally, if you look at the 80 year chart 2 above, you will note that the lower curved trend line and the upper trend line intersect – you guessed it – in the year 2012. This is the same year that both the Mayan Calendar and the Chinese I-Ching forecast will be the culminating year of the current epoch. As my late father might have put it: “Some of the people who lived in those days must have been really smart cookies”.

The Challenge

Whilst the above may or may not be very interesting, the reality is that, at present, it can only be categorised as “pseudo science”. The technical risks are too high for Private Enterprise to pursue these avenues of investigation. Private Enterprise is driven by Return on Investment – end of discussion.

So, how do we deliver these nascent energy technologies from the womb? More importantly, given the macro sell signals on the markets and the possible economic implications of these sell signals, what the hell do we do? What we do – as is explained in Beyond Neanderthal – is we shift the paradigm of our thinking to embrace ideas that might have seemed impractical in days gone by. We stop worrying about ROI and we start worrying about survival. When the ship springs a leak, you don't shop around for the best price. You get off your backside and you fix it, regardless of financial cost!! We have a direction.

Overall Conclusion

You should order a copy of Beyond Neanderthal . It is no ordinary novel. Via its light-hearted and entertaining storyline, it lays out the entire mind-blowing jigsaw puzzle that took the author over 40 years to assemble. Yes, humanity is approaching the end of an old epoch, but the evidence suggest that we can also look forward to the dawning of a magnificent future – provided the politicians are brought to heel. They need to be reminded that they are society's servants, not its masters. For example, they need our permission to take decisions which may threaten our future existence – like encouraging, via tax breaks, the turning of food into biofuels; and like moving to embrace Nuclear Fission.

Primum Non Nocere . “First, do no harm.” ( Hippocrates (ca. 460-ca.377 B.C.).

Orders can be placed at www.beyondneanderthal.com . It has been crafted so that most men and women possessed of school level science will both understand it and be entertained by it.

By Brian Bloom

My novel, Beyond Neanderthal, is now available to be ordered via www.beyondneanderthal.com and will soon be available via Amazon. Via its entertaining storyline, it attempts to inject some sanity and level headedness into what is emerging as a hysterically fearful environment. Things are not as bad as they seem. There are practical solutions as well as theoretical solutions.

Copyright © 2008 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.