Stock Market Faulty Recession Barometer

Economics / Recession 2016 Mar 03, 2016 - 05:22 PM GMTBy: The_Gold_Report

A cacophony of recession chatter is filling the airwaves. Some experts are already declaring we are in one while others are raising warning flags. Their message has not been lost on the masses: Google searches for the word "recession" have risen to the highest level since 2012. Interestingly, many commentators cite the 20% decline in global stock prices as the warning signal, if not the cause. But veteran investor Joe McAlinden believes the U.S. economy will continue to expand in the year ahead.

A cacophony of recession chatter is filling the airwaves. Some experts are already declaring we are in one while others are raising warning flags. Their message has not been lost on the masses: Google searches for the word "recession" have risen to the highest level since 2012. Interestingly, many commentators cite the 20% decline in global stock prices as the warning signal, if not the cause. But veteran investor Joe McAlinden believes the U.S. economy will continue to expand in the year ahead.

Recognition that the U.S. economy is not falling into recession, however, may not be a market panacea, as good news on the economy could be bad news for stocks. Investors who have completely priced out Federal Reserve rate hikes for this year will soon refocus on the next potential market disrupter: Those Fed hikes may get priced back in.

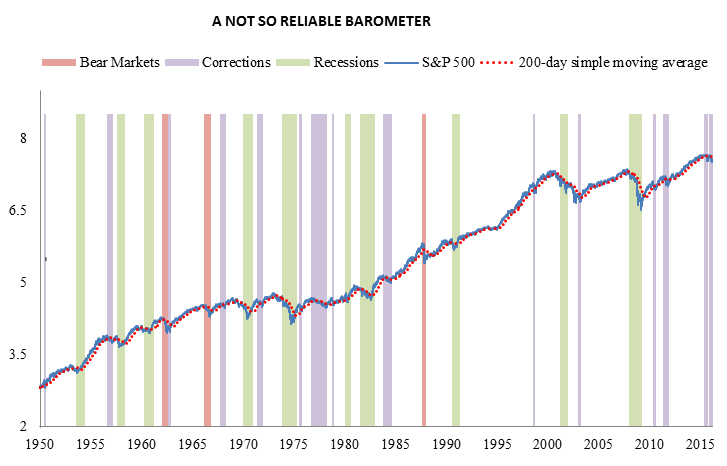

Over the decades, I have seen investors mistakenly look at the stock market as a foolproof barometer of overall economic health. To be fair, share prices do typically fall preceding a recession and rise prior to an expansion. But the stock market as an economic barometer has given almost as many false signals as right ones. Nobel Prize-winning economist Paul Samuelson sardonically sniped in 1966 that market indexes had "predicted nine out of the last five recessions! And its mistakes were beauties." Samuelson points out a rather obvious notion: though market indices can often retreat significantly, such declines don't necessarily signal an economic recession—a fact exemplified in the 1987 market crash.

At MRP, we believe we are right in the midst of one of those "real beauties"—a big drop, NOT followed by a recession. There is no denying that the world has been in a dramatic flux since commodities have plummeted, particularly in critical emerging economies, like China, which has experienced big contractions in growth rates, and Brazil which is falling into a depression. The pain is felt sharpest in commodity exporting countries. Also, business investment (capex and inventories) has been cut back throughout the world—including the U.S., although the latest durable goods orders suggest a firming may be underway.

The oil supply/demand imbalance played a large role in the latest stock market slump. Recent crude oil/stock price correlations have been over 0.9 in the past 10 weeks. At times in the past, they have been near zero, if not negative. Oil prices have plunged as advances in production technology have contributed to a supply glut. The negative fallout of production becoming "too efficient" is widespread and economically destructive. In response to sub-breakeven prices, oil producers, at least in the U.S., are shutting down rigs by the hundreds, capping marginal oil wells, laying off workers, cutting dividend payouts and slashing capital expenditures. Financially unstable energy companies with high extraction cost and sensitive to oil prices have gone bankrupt. Last year, bankruptcies jumped 379% and even more are expected this year. Still, oil continues to fill up storage facilities and push them to capacity levels not seen for 80 years. Financial companies with exposure to the energy industry have been pummeled.

But this too will pass. The "it's all about crude" mentality displayed in the market these past few months will soon fade away. Moreover, the underlying U.S. economy has some significant bright spots. Household consumer expenditure, which makes up nearly 70% of total GDP in the U.S and over 10% of world GDP, remains healthy. Retail sales, which have done well year-over-year, support the fact that consumers, with additional disposable income due to low energy prices, haven't stopped spending. The stock market, relative to the 2009 low, is still up almost threefold, and housing prices have been steadily rising. Together, they induce an exceptionally positive wealth effect that should encourage U.S. consumers to spend, especially when energy costs are so low.

New data points in the U.S. labor market signal increasing demand for workers and rising wages —evident in the most recent payroll data with average hourly earnings continuing its uptrend that began a year ago. The rise in wages is a double-edged sword, however. On one hand, you have extra disposable income bolstering consumer spending but the rising trend of AHE suggests wage-push inflation will soon send overall inflation higher. This wage acceleration is coming at a time when inflation for "core" services is already running at 3.0% year-over-year. Even the Fed's favorite inflation measure, the core PCE deflator, at 1.7% now sits just below the Fed's target. In our view, the central bank will soon have to stop worrying about hitting its inflation target and start worrying about overshooting it.

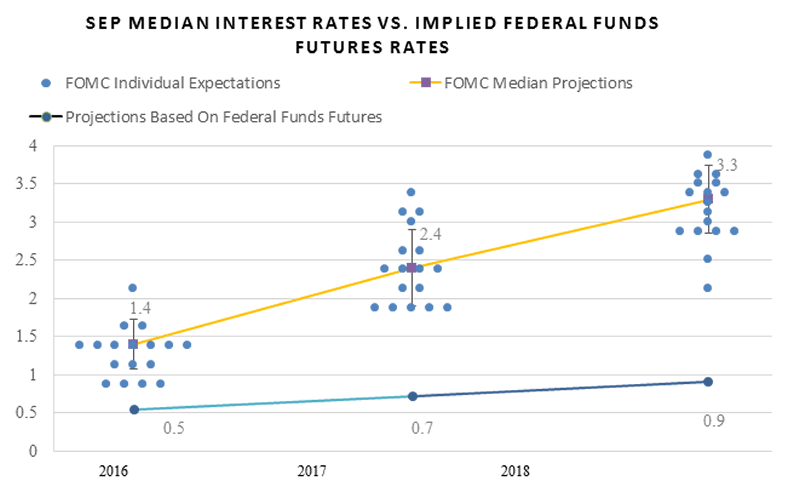

The most recent labor market data on top of favorable retail sales numbers should have been a turning point for market expectations about the near-term path of monetary policy normalization. Instead, market participants have gone the other way: Ongoing concerns about global growth have led investors to decide the Fed will virtually abandon the planned path toward interest rate normalization that was suggested in the December Survey of Economic Projections (SEP). At MRP, we have argued that the greatest risk facing the market is not cheap oil or a global slowdown, but the need for market expectations to move toward the median FOMC projections presented in that December 2015 SEP.

So who is right, the market or the Fed? Investors have focused on the dramatic decline in markets across the world and the plunge in commodity prices as reason to disregard the Fed's projections and begin to price in a recession. However, incoming data that pertains to the central bank's "Dual Mandate" now, more than ever since the Great Recession, supports further rate increases. Yet, investors believe the Fed will continue its extraordinarily accommodative policy. On Tuesday, the hawkish Kansas City Fed President Esther Dudley, in opposition to market sentiments and dismissive of Fed consensus, remarked that "Waiting until I see actual inflation at the Fed's target may be waiting too long" and that the FOMC members should "absolutely" keep a March rate hike on the table.

Bottom line: Although we do NOT see an imminent RECESSION, we do expect to see more volatility and downside risk, eventually knocking the DOW and S&P 500 down close to what has already occurred in small cap U.S. stock prices and many international markets.

Joe McAlinden has over 50 years of investment experience. He is the founder of McAlinden Research Partners and its parent company, Catalpa Capital Advisors. Previously, McAlinden spent more than 12 years with Morgan Stanley Investment Management, first as chief investment officer and then as chief global strategist, where he articulated the firm's investment policy and outlook. He received a bachelor's degree ***** laude in economics from Rutgers University and holds the Chartered Financial Analyst designation. McAlinden has served on the board of the New York Society of Security Analysts.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment.

From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Charts provided by Joe McAlinden.

Streetwise - The Gold Report is Copyright © 2014 by Streetwise Reports LLC. All rights are reserved. Streetwise Reports LLC hereby grants an unrestricted license to use or disseminate this copyrighted material (i) only in whole (and always including this disclaimer), but (ii) never in part.

Streetwise Reports LLC does not guarantee the accuracy or thoroughness of the information reported.

Streetwise Reports LLC receives a fee from companies that are listed on the home page in the In This Issue section. Their sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

Participating companies provide the logos used in The Gold Report. These logos are trademarks and are the property of the individual companies.

101 Second St., Suite 110

Petaluma, CA 94952

Tel.: (707) 981-8999

Fax: (707) 981-8998

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.