Can Gold Price Climb to $1400/oz?

Commodities / Gold and Silver 2016 Mar 12, 2016 - 04:06 PM GMTBy: Jordan_Roy_Byrne

At the start of 2016, renowned fund manager and bond king Jeff Gundlach predicted Gold would surge to $1400/oz. That was quite the call considering Gold was still in a bear market. He reiterated his target a few days ago in a webcast. Gold closed the week below $1260/oz after reaching as high as $1287/oz following the ECB decision. Corrections in both Gold and gold stocks have been limited to swift declines lasting no more than two days. While we cannot predict the future, we think there is some chance that Gold could reach Gundlach's target before a sustained correction.

At the start of 2016, renowned fund manager and bond king Jeff Gundlach predicted Gold would surge to $1400/oz. That was quite the call considering Gold was still in a bear market. He reiterated his target a few days ago in a webcast. Gold closed the week below $1260/oz after reaching as high as $1287/oz following the ECB decision. Corrections in both Gold and gold stocks have been limited to swift declines lasting no more than two days. While we cannot predict the future, we think there is some chance that Gold could reach Gundlach's target before a sustained correction.

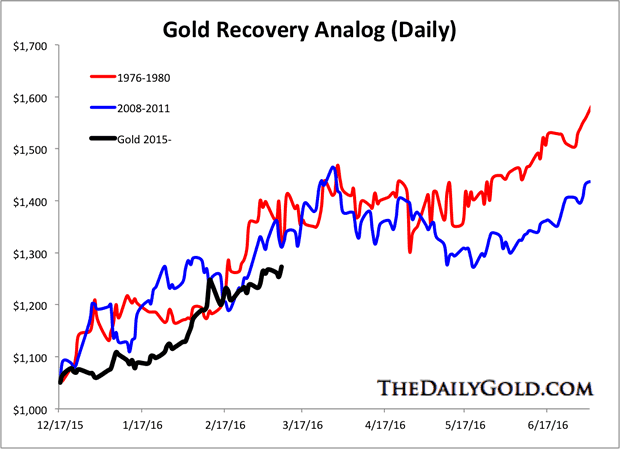

Below is the Gold recovery analog chart or bull analog chart. We compare the current rebound to those from major lows seen in 1976 and 2008. By the way, it is great to be constructing bullish analogs rather than bearish analogs. As we can see, if this recovery in Gold continues to follow the path of those two recoveries then Gold could reach $1400/oz before correcting. The analog hints that if Gold reached $1400/oz then it could correct $100-$120/oz.

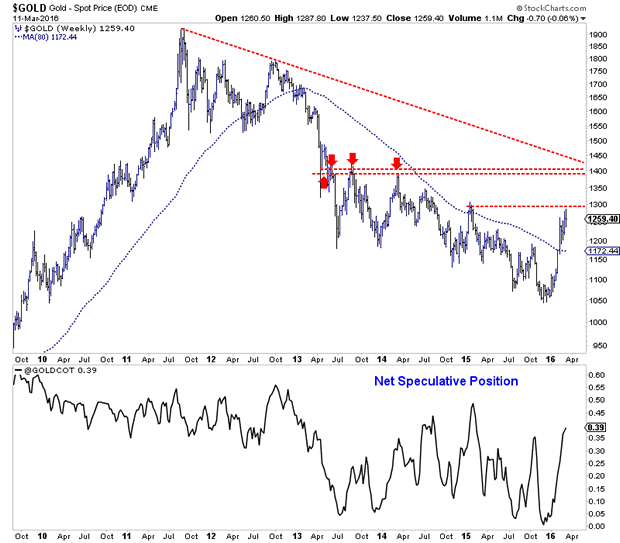

While Gold's monthly and quarterly charts show very strong resistance around $1330/oz, its weekly chart argues that $1400/oz is the next major target after $1300/oz. In other words, if Gold can make a weekly close above $1300/oz, then it has a chance to run to $1375 to $1400/oz. Note that $1375 is the 38% retracement of the entire bear market. Initial resistance is $1300, which is the measured upside target from Gold's recent, small breakout.

Note that Gold's current net speculative position is 39% of open interest. While this appears bearish in the recent context of a bear market, Gold is now in a bull market. From 2001 to 2012, Gold's net speculative position, when high, ranged from 50% to 60%. Moreover, the current net speculative position remains below 2014 to 2015 highs of 44% and 49%. If Gold wants to move above $1330/oz and towards $1400/oz, the current setup of the commitment of traders report won't stop it.

Furthermore, open interest in Gold surged to 499K contracts. That is the strongest open interest in more than 4 years! Rising open interest usually confirms an uptrend. Note that from December 2001 to May 2002 open interest increased 90%. From December 2008 through March 2009, open interest increased 50%. Over the past five weeks open interest has increased by 30%.

When a market makes a strong rebound following a difficult bear market, investors and pundits suddenly become cautious due to the subconscious fear that the bear will reassert itself. We have even made the same mistake in recent weeks, thinking Gold and gold stocks would correct before another strong leg higher. While the possibility remains, there is equally as much evidence that Jeff Gundlach is right and Gold will reach $1400/oz before any setback. Gold and gold stocks have refused to correct for more than a few days at a time. Do not be surprised and unprepared if this run continues. Also, any extended weakness in Gold or gold stocks is a buying opportunity.

Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.